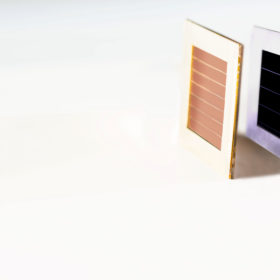

Imec claims 24.6% efficiency for tandem CIGS cell based on perovskite

The Belgian research institute developed its cell in partnership with EnergyVille, Solliance and German research center, ZSW.

Solar PV to grow 65-fold by 2050, 2°C target will be missed by a long shot – report

DNV GL has issued its annual Energy Transition Outlook. It reports that global electricity demand is set to grow by a factor of 2.5. Over half of this demand is expected to be met with renewable energy by 2050, while storage will play a key role. It adds that grid infrastructure expenditures are less related to variable renewable energy assets than to increasing energy demand. In the current scenario, meanwhile, global warming is likely to reach 2.6°C.

Oxford PV, Oxford University target 37% efficient perovskite solar cells

The solar company has launched a five-year research project with the British scientists, which has been funded with £2.5 million from the U.K. Government. The goal is to develop a thin film multi-junction perovskite solar cell with a 37% efficiency and long-term stability.

US members of congress warn of REC Silicon plant closure

A group of U.S. senators and representatives from Washington and Montana led by the top democrat on the U.S. Senate Energy and Natural Resources committee are calling on President Trump to negotiate with China and save REC’s Moses Lake facility.

AlsoEnergy merges with Locus Energy

AlsoEnergy has acquired/merged with its third energy monitoring and asset management company this summer. This most recent move brings 25 GW and 190,000 projects under AlsoEnergy’s responsibility.

Norway’s Statkraft aims for 2 GW of solar by 2025

Norway’s state-owned hydropower and wind company plans to invest around NOK 10 billion (US$1.23 billion) in wind and solar between 2019 and 2025.

Netherlands to test viability of solar roads

Although solar energy roads are still considered economically unviable, the Dutch water management agency, Rijkswaterstaat announced it will investigate their potential as an alternative to the lack of surfaces for PV deployment in the Netherlands.

German equipment suppliers take lead in European storage market, report says

German suppliers may still play a central role in providing residential storage systems, however the increasing number of Asian manufacturers on the European market is undeniable. Particularly in the U.K. and Italy, they have captured the lion’s share of sales.

Banks turn their back on coal amid emissions concerns

While global coal mining companies are enjoying the highest prices in years on the back of boosted Asian demand, banks and financiers are increasingly ending their support for coal power. London-based Standard Chartered the latest to stop financing new coal-fired stations.

Eni joins race for Africa’s clean energy market

Via an agreement with the United Nations Development Programme (UNDP), the Italian oil company aims to increase its presence in Africa’s renewable energy markets. It already invests more than half of its budget in the region.