The weekend read: Circular innovations

Slowly but surely, environmental concerns are making their way into mainstream thought throughout the PV industry. A look at recycling offers an example of this, with stakeholders trying to get ahead of the high volumes of end-of-life modules already on the horizon. pv magazine examines the technologies that will be needed, alongside policy and economic support, to keep the bulk of these modules out of landfill and ultimately to establish a circular economy for PV materials.

Reshuffle at the top, as new markets arise

A new wave of consolidation and some reshuffling is underway among market leaders in the solar EPC space, writes IHS Markit’s Josefin Berg. In 2019, the 30 largest EPC providers globally installed 28 GW of non-residential PV, representing 26% of the total market. This increase from 21% in 2018 stems mainly from a growing concentration in the Chinese PV market, as well as integrator concentration in rapidly growing markets like Spain and Vietnam.

How high-powered modules enhance your solar investment

As the next generation of high-powered PV technology begins to roll off production lines, how these modules will fare in the field is a question on the lips of many. And it is a question we will look to address in this pv magazine Webinar, hosted in partnership with Canadian Solar.

We’ll take a closer look at the new technologies that are wrapped up in Canadian Solar’s new HiKu7 and BiHiKu7 modules, designed to reduce the LCOE for solar plants and set the stage for global grid parity. With power ratings up to 665 W, HiKu7 and BiHiKu7 open the door to further optimizations at several levels, promising lower LCOE and a higher return on investment, without creating additional challenges for installers or components suppliers.

Nobel Prize-winning auction geniuses want to apply their findings to renewables

Stanford professors Paul R. Milgrom and Robert B. Wilson were awarded the 2020 Nobel Prize in economics for developing a new auction theory and new auction formats for goods and services. Their findings were already successfully used in the electricity energy sector and may now meet the challenge on how to better shape clean energy procurements.

Swinerton was the largest solar EPC contractor outside China in 2019

Although the Wiki-Solar website ranking only provides a snapshot of PV project engineering, procurement and construction contracts outside of China, it is nevertheless a useful indicator of the changing global solar market landscape. Of the top 11 companies, three are based in India, three in the United States, another three in Spain and two in the United States.

‘Solar is the new king of energy markets’

The advance of PV has been lauded by the International Energy Agency as it launched the latest edition of a flagship World Energy Outlook 2020 report overshadowed by the Covid-19 crisis and uncertainty over how long the economic recovery could take.

Q3 solar investment figures hint at recovery

After a weak second quarter, financial activity is back at full steam in the PV sector, says Mercom, noting strong performance across a range of metrics.

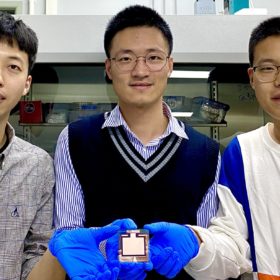

Additive allows all-perovskite tandems to hit 24.2% efficiency

Scientists led by China’s Nanjing University discovered that a chemical commonly used for bleaching in the textile industry can also serve as a performance-boosting additive to mixed lead/tin perovskite thin films. Using this additive, they were ultimately able to fabricate a two perovskite tandem cell measuring 1.05cm² that achieved 24.2% efficiency.

Investigating bifacial for floating PV

Scientists led by the University of Ontario modeled the performance of bifacial modules in floating PV applications, finding that in a north/south orientation at a 30 degree angle, the modules could receive as much as 55% more sunlight than a monofacial module in the same setup.

Another bumper year sees green bonds push through $1tn mark

Sustainability-linked debt financing is experiencing ever increasing popularity and the success of green bonds has driven other products linked to social performance and other sustainability criteria. The total volume of such investments to date passed the $2 trillion point this year.