The weekend read: EV charging meets Blockchain

There are a number of reasons to be bullish on electric vehicles. Government support is growing, battery prices are falling, and the technology is constantly developing. But, for the prospect of owning an electric car to become even more attractive, existing EV charging infrastructure needs to be enhanced. This is where blockchain comes in.

EU PVSEC: “Multicrystalline silicon will not die”

At first glance, the European PV conference this week has confirmed the widespread view that the upswing of monocrystalline technology will accelerate. But a closer look reveals that multicrystalline solar cells are still in the game.

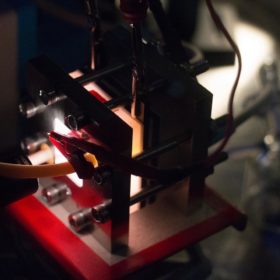

International research group develops solar cell with storage properties

Although the “solar flow battery” is currently considered too expensive by its own creators, a further improvement of its design and the use of emerging solar materials and new electrochemistry may open new opportunities for this kind of technology.

Declining prices forces SMA to lower 2018 forecasts, announce structural changes

Citing the market downturn in China, which has resulted in “enormous excess capacity”, rapidly declining prices and postponed projects, SMA Technology AG has lowered its 2018 sales and earning guidance, and expects a break-even or negative EBITDA. It has also announced structural changes.

New records and results abound at EU PVSEC

The EU PVSEC conference, held this week in Brussels, was filled with bold announcements regarding solar’s trajectory in the coming years; and is backed up by a few announcements of new world records and impressive results from industry players and leading research institutes.

Solar PV to grow 65-fold by 2050, 2°C target will be missed by a long shot – report

DNV GL has issued its annual Energy Transition Outlook. It reports that global electricity demand is set to grow by a factor of 2.5. Over half of this demand is expected to be met with renewable energy by 2050, while storage will play a key role. It adds that grid infrastructure expenditures are less related to variable renewable energy assets than to increasing energy demand. In the current scenario, meanwhile, global warming is likely to reach 2.6°C.

Banks turn their back on coal amid emissions concerns

While global coal mining companies are enjoying the highest prices in years on the back of boosted Asian demand, banks and financiers are increasingly ending their support for coal power. London-based Standard Chartered the latest to stop financing new coal-fired stations.

pv magazine Quality Roundtable, Taiwan: Carrier-induced solar cell degradation: Solved (sort of)

Solar cell manufacturers are always on an R&D race to improve efficiency. But even with their efforts, today you can still expect up to about a 3.5% loss from carrier- or light-induced degradation, industry insiders claimed last Thursday at pv magazine’s Quality Roundtable, held at Energy Taiwan 2018 in Taipei.

Renewables 2.0: Preparing for the new complexity of renewable energy in a post-subsidy world

As the deployment of renewable energy continues to expand around the world, driven by various inputs, such as capital allocation and investment, falling capital costs, competitive LCOE and various policy mechanisms, we are now moving towards a new era for renewable energy. ‘Renewables 2.0’ will have significant, wide-ranging consequences for all market players, as regulators reduce their support and power producers seek new revenue models. In this article, Duncan Ritchie, partner at Apricum – The Cleantech Advisory, will look at the key market developments for renewables, explode the myth of grid parity, highlight the need for flexibility and explain the importance of new financing solutions that are capable of meeting the new complexities brought about by ‘Renewables 2.0’.

Video: Quality Roundtable at Intersolar SA

At pv magazine’s first Latin American Quality Roundtable, held at Intersolar South America in Sao Paulo, we were joined by international players, like JinkoSolar and DuPont, as well as public and private Latin American entities, all of which are striving to bring more quality to the solar PV supply chain, from the U.S.-Mexico border to Tierra del Fuego.