China polysilicon price increases amid regulatory signals

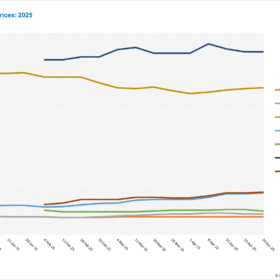

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Wafer producers scramble to stay afloat despite hydropower advantage

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that FOB China wafer prices remained stable this week amid weak demand and low production. It says manufacturers continue to face margin pressure despite seasonal hydropower cost relief and traceability documentation premiums.

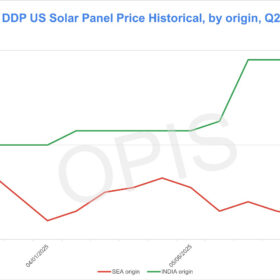

US panel price spread widens between India and Indonesia/Laos origin

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that US-assembled modules with imported cells continue to be heard between $0.26/W and $0.33/W, while modules with domestic content – which are still limited to just a handful of producers – are generally quoted between $0.4/W and $0.5/W.

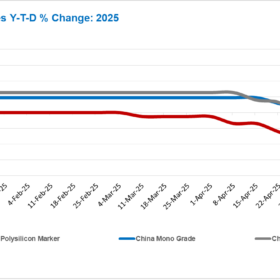

China polysilicon prices fall 11.76% since early April peak

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports thatglobal polysilicon negotiations remain challenging, as buyers and sellers continue to struggle to reach agreements on pricing amid a persistent supply-demand imbalance. Furthermore, it reveals that China’s polysilicon futures market could imply a further 13% drop for Nov 2025 delivery contracts.

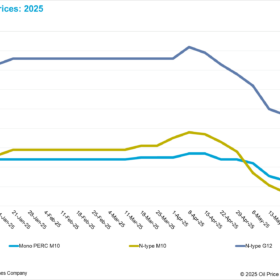

Solar wafer prices decline 22.78% since April peak

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Polysilicon market seeks strategic solutions amid persistent pessimism

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that pessimism in the global polysilicon market has deepened, driven by a persistent oversupply that exceeds buyers’ total monthly purchasing volumes. Several global polysilicon buyers have confirmed maintaining substantial inventories, which has contributed to the current subdued trading activity.

Chinese PV Industry Brief: CATL surges in Hong Kong trading debut

Chinese battery giant CATL surged 12.55% on its Hong Kong trading debut after raising HKD 35.6 billion ($4.6 billion), marking the world’s largest listing in 2025. The offering drew strong demand from strategic and cornerstone investors, boosting CATL’s market capitalization to HKD 1.34 trillion.

Chinese PV Industry Brief: Tongwei, GoodWe post 2024 losses

Tongwei says it recorded a $969 million net loss for fiscal 2024, while GoodWe posted an $85 million loss and Ginlong’s net profit fell 11.3% to $95 million.

China module prices bearish, U.S. prices rise on tariff policies

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that TOPCon modules from China held steady at between $0.085-0.090/W. It also reveals that Europe prices for TOPCon modules of over 450 W rose by 0.96%, assessed at €0.105/W.

Chinese PV Industry Brief: Polysilicon, solar module prices continue to slide

Polysilicon prices fell again this week amid weak market activity and elevated inventories, according to industry sources. Downstream wafer, cell, and module prices also continued to slide, with modules now trading as low as CNY 0.68 ($0.09)/W.