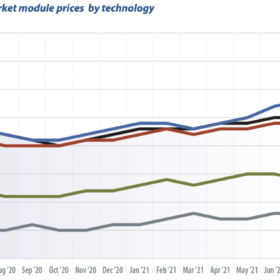

EU spot market module prices: Declines witnessed

The sky is the limit. Fortunately, this expression does not apply to current prices for PV panels, which have recently declined, following a continuous rise since the beginning of the year. Whether this situation holds, or whether prices drop further in the coming months is hard to say at the moment, writes Martin Schachinger of pvXchange. Polysilicon prices and thus wafer and cell prices could be in for a slight decline. However, a decisive movement in module prices in general is unlikely before the fourth quarter.

Chinese PV Industry Brief: Trina, Longi and Guangdong Electric Power all have reason to celebrate

…but cell manufacturer Aikosolar is expecting a reversal in fortune for the first half of the year and has blamed rising solar panel material costs.

Polysilicon price rally may have reached its peak

Market analyst Bernreuter Research reports that the price of the raw material rose by around 160% from US$11/kg at the beginning of the year to $28.50/kg currently. However, following the SNEC trade show in Shanghai last week, the price rose by only 1%, which suggests a turnaround or a price stabilization may be expected.

Chinese PV Industry Brief: Polysilicon prices keep rising

This week, the price of polysilicon reached RMB 124 ($18.9)/kg. All major categories of polysilicon products have seen their price increase by around 45% so far this year. Meanwhile, Tongwei has lowered the prices of its solar cells for April.

Korean poly maker’s figures dragged down by idled production lines

The Covid-19 pandemic helped ensure chemicals business OCI could not put its idled polysilicon lines in Gunsan back into use last year, as had been hoped, prompting another hefty assets impairment which weighed on the group even as it expects supply of the raw material to be kept tight by rising demand.

Chinese PV Industry Brief: Polysilicon, module prices continue to rise

Polysilicon prices continued to soar this week. Prices have been rising across the PV supply chain since mid-July due to recent accidents at two Chinese polysilicon factories, according to EnergyTrend.

The weekend read: Out with the old…

PV demand started weakly this year but will show an upward trend in the second half. Corrine Lin, chief analyst at PV InfoLink, examines supply and demand for polysilicon and predicts huge new capacities will come online in the west of China and shake up the market, spelling bad news for some international players.

Poly maker Daqo presents a blockbusting set of figures

Profits and revenues were down in a year which saw average selling prices slump – especially after the turbulence in the Chinese market – but the company’s hell-for-leather dash for production capacity expansion and aggressive cost cutting mitigated the ill effects. And there is more to come in the year ahead.

Solar cell prices decline in reaction to safeguard duties, impending MIP decision

“Significant” price movements in solar PV cells has been observed this week, in reaction to India’s safeguard duties, and the impending MIP decision, says EnergyTrend. Module, wafer and polysilicon prices, however, remain stable. In contrast, prices for li-ion batteries are set to increase by as much as 15% in Q3.

JinkoSolar posts lower shipment volumes, revenues for Q1, remains optimistic despite policy change

As forecast in its 2017 financial report, JinkoSolar shipped around 2 GW of modules in the first quarter of this year. Meanwhile, it did not adjust its forecast for 2018 shipments, in the range of 11.5 GW to 12 GW, despite the Chinese government’s cuts to installations.