Stable GPM polysilicon prices post-antidumping duty rates, optimism on firm demand

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

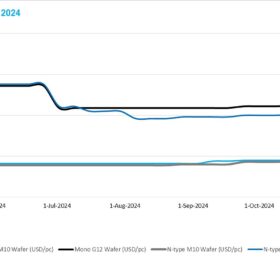

Solar wafer prices stable, potential price hikes loom amid trade policy changes

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Chinese PV Industry Brief: January-October solar additions hit 181.3 GW

China’s National Energy Administration (NEA) says developers installed 181.3 GW of new PV capacity from January to October 2024, including 20.42 GW in October alone.

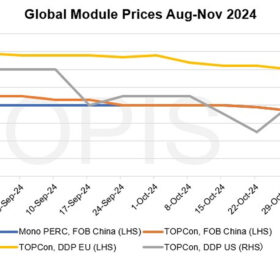

Global solar module prices stable-to-soft as markets absorb news of U.S. election, policy changes

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

China issues stricter investments rules for PV manufacturing

China has tightened investment rules for PV manufacturing, raising the minimum capital ratio for starting projects from 20% to 30%, according to new standardized guidelines announced by the government.

Polysilicon prices decline amid rising inventories, weak demand

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Chinese PV Industry Brief: JA Solar, Longi, Jinko, Trina report Q3 results

The Big FOUR released Q3 reports last week. JinkoSolar sees a steep drop in Q3 profit amid industry challenges. JA Solar experienced a revenue decline but recovered profit. LONGi narrows losses as revenue slips.

Chinese PV Industry Brief: Polysilicon prices steady amid demand issues

The China Nonferrous Metals Industry Association (CNMIA) says that prices for solar-grade polysilicon remain stable this week despite strong producer pricing intentions, as unresolved downstream demand issues are holding back sales potential.

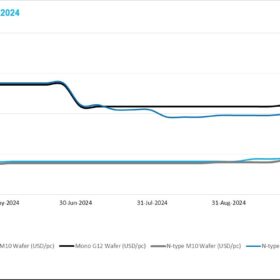

Wafer prices drop, inventory levels rebound despite operating rate cuts

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

PV panel, battery production up to 45% more expensive in EU than in China, IEA finds

Despite the ongoing implementation of industrial strategies in other countries, the value of China’s exports will exceed $340 billion by 2035, according to the International Energy Agency.