From pv magazine Spain

The value of the global market for six key mass-produced clean energy technologies – solar PV, wind, electric vehicles (EVs), batteries, electrolysers and heat pumps – increased almost fourfold between 2015 and 2023, exceeding $700 billion, or roughly half the value of all natural gas produced in the world that year.

According to the latest Energy Technology Perspectives 2024 (ETP-2024) report, published on Wednesday by the International Energy Agency (IEA), under current policies, the market for these clean technologies will almost triple by 2035 and exceed $2 trillion.

pv magazine

Global investment in clean technology manufacturing increased by 50% in 2023, reaching $235 billion. This increase is equivalent to almost 10% of the growth in investment in the entire global economy. Four-fifths of clean technology manufacturing investment in 2023 – some $188 billion – was spent on solar PV and battery manufacturing, with electric vehicle plants accounting for another 15%. Moreover, investment is set to remain close to its recent record levels, at around $200 billion in 2024.

Despite the ongoing implementation of industrial strategies in other countries, the value of China’s clean technology exports will exceed $340 billion in 2035 under current policy settings.

China is currently the country with the lowest costs to manufacture the key clean energy technologies considered in the report, not taking into account explicit financial support from governments. Producing solar PV modules, wind turbines and battery technologies costs on average up to 40% more in the United States, up to 45% more in the European Union and up to 25% more in India.

Under current policies, net imports of fossil fuels and clean energy technologies will reach $400 billion in 2035 in Europe.

Installation Outlook

The report uses scenarios such as the Stated Policies (STEPS) scenario, which reflects the current policy landscape, and the Announced Commitments (APS) scenario, which assumes governments meet their climate targets, to project the potential growth of these technologies.

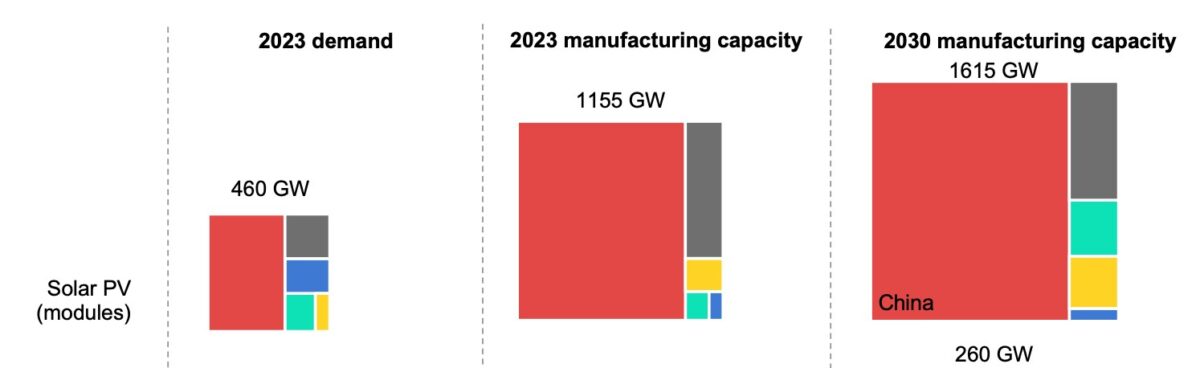

According to the IEA, global solar module manufacturing capacity could reach 1,546 GW in 2035 under the STEPS scenario, and increase to 1,695 GW under the APS scenario. In 2023, global capacity was 1,115 GW.

The report projects that global demand for solar modules will increase from 460 GW in 2023 to 674 GW in 2035, at an average growth rate of 3% per year, and to 724 GW in 2050 under STEPS. Under APS, global demand for solar modules will reach 860 GW in 2035 and 894 GW in 2050.

Europe

The European Union is currently the world's largest importer of solar PV modules, with domestic production covering just under 15% of demand in 2023. Instead, imports – mainly from China and South-East Asia – were enough to cover more of the demand, leading to a significant increase in stocks, which stood at about three times the level of annual installations in that year.

The EU's share of global solar PV manufacturing capacity has fallen to less than 1%. The only exception to this trend is polysilicon, of which the European Union holds 3% of the world's supply thanks to the high purity of polysilicon produced in Germany, which is still exported to China.

According to the IEA, the EU will remain the world's largest importer of modules in 2035, the main change being that some imports are coming from the US. Domestic production is around 7 GW, as there are currently no significant announcements of production expansion; on the contrary, there are indications that existing module manufacturing capacity could be reduced.

Policies and Support

A survey of more than 50 major clean technology manufacturers and materials supply chains conducted by the IEA reveals factors other than cost that influence investment decisions. These include various forms of policy support, market access, industrial base capabilities and expertise, and infrastructure.

The IEA notes that “governments must reconcile their commitment to well-functioning markets and cost-effective clean energy transitions on the one hand with the need to establish safe and resilient clean technology supply chains on the other. This means making difficult choices about which industries to support, how to structure trade relationships, and where to prioritize innovation efforts.”

The report concludes that beyond the extraction and processing of critical minerals, emerging and developing economies could leverage their competitive advantages to move up the value chain. For example, Southeast Asia could become one of the cheapest places to produce polysilicon and wafers for solar panels in the next 10 years, while Latin America – Brazil in particular – has the potential to expand its manufacturing of wind turbines for export to other markets in the Americas. North Africa has the resources to become a manufacturing hub for electric vehicles in the next decade, while several countries in sub-Saharan Africa could produce iron with low-emission hydrogen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.