PV InfoLink forecasts polysilicon prices to be halved by end of 2023

The consulting firm expects prices to decline gradually through the first semester of 2023, followed by an accelerated decline in the second half of the year, with prices falling from the current CNY 300 ($36.64)/kg to below CNY 150/kg by the end of 2023. Polysilicon production capacity may increase from 500 GW in 2022 to 975 GW next year.

Chinese Industry Brief: Surging solar exports, wafer supply deals

PV module exports surged in the first quarter, according to research firm PV InfoLink. Risen Energy, meanwhile, has just signed a $2.16 billion, long-term wafer supply deal with Shuangliang Eco-Energy.

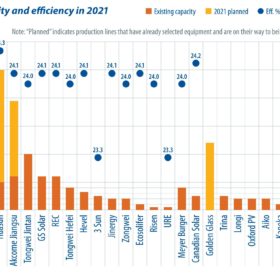

Looking past PERC solar cells

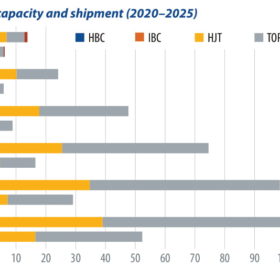

While the adoption of large-format wafers has driven a wave of capacity expansion for PERC, existing manufacturers and new entrants continue to evaluate TOPCon and HJT. An increasing number of HJT pilot lines and gigawatt-scale capacity expansion projects are appearing, as manufacturers see the advantages of fewer process steps, higher efficiency ratings, and better yield rates. The localization of equipment is also a driving factor. PV InfoLink’s Derek Zhao offers an update on the latest developments and process routes for HJT.

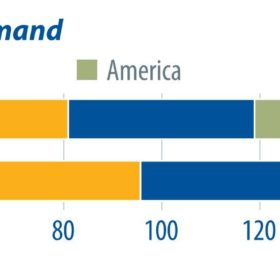

Solar supply, demand, and a foreign policy shakeup

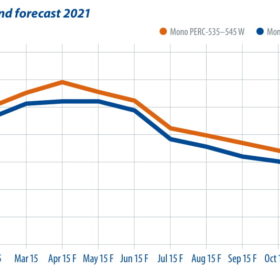

As the solar market enters the busy season in September and October, module utilization rates are reaching 70% to 85%. However, structural shortages remain in the supply chain, with polysilicon supply running short in the face of high demand, writes PV InfoLink analyst Amy Fang. Prices, which were expected to stabilize, rose again in the second half. High module prices will cast a shadow on demand in the fourth quarter, prompting module manufacturers to postpone delivery for some orders from the second half into next year.

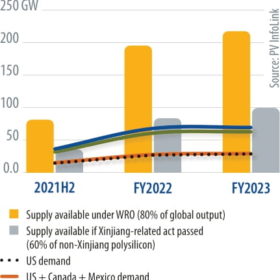

Polysilicon amid international trade disputes

Polysilicon capacity is unable to catch up with rapid capacity expansion in the mid and downstream segments, writes Corrine Lin, chief analyst for PV InfoLink. New polysilicon capacity requires big capex investment and a lead time of more than two years to complete construction and reach full operation. With unbalanced capacity between the upstream and downstream segments, polysilicon prices have been rising since the second half of 2020, with prices for mono-grade polysilicon surpassing CNY 200/kg ($27.40) in June 2021, up more than 250% year on year.

Chinese PV Industry Brief: Longi leapfrogs Jinko for first-half module shipments

There is also news of a 1.1 GW central inverter procurement contract, a pending IPO for solar cell player Runergy, and a $700 million-plus solar glass supply contract.

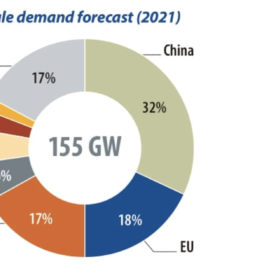

Post SNEC: Market demand and technology trends

Every year, the SNEC PV Power Expo marks a turning point in the direction of solar market trends, and 2021 was no exception. Corrine Lin, chief analyst at PV InfoLink, was at the show to soak up the latest trends at one of the first big events to go ahead since early 2020.

N-type solar development

This year, PV cell manufacturers will face the challenge of transformation. Apart from adjusting the ratio of production for different-sized cells, some manufacturers are turning to next-generation opportunities, shifting investment from p-PERC to n-type technology. PV InfoLink Analyst Amy Fang discusses the issues facing n-type cell development this year.

Price trends amid polysilicon shortage

Recent financial statements from the big module manufacturers indicate that higher prices for polysilicon and PV glass since the third quarter of 2020 have dealt a severe blow to profits in the module business. Module manufacturers have gradually scaled down capacity utilization since the Lunar New Year, as demand has been weaker than expected, given the absence of China’s usual June 30 installation rush, as in past years. In April, Tier-1 module makers further cut utilization rates to 55-70%. PV InfoLink’s Corrine Lin examines the price trends that are developing in 2021.

Solar and silver price hikes

The PV industry has experienced several rounds of price increases since the second half of 2020, from polysilicon to materials such as PV glass and films. Between July 2020 and February 2021, prices quoted for 3.2 mm and 2 mm glass surged by more than 60% per square meter. Prices for EVA and POE encapsulant films skyrocketed by more than 40% and 10%, respectively. Prices for silver paste also rose 7%, and have since remained stubbornly high. PV InfoLink Chief Analyst Corrine Lin examines the impact of silver’s recent price turbulence on PV cell manufacturing.