A gigawatt solar factory in Europe? Why it must be in France

With Swiss solar equipment company Meyer Burger laying plans for a module fab in North Rhine-Westphalia and Norwegian panel maker REC Group mulling a fab in Sarreguemines, northeastern France, Xavier Daval – from French renewables association the SER – says it is time Europe resumes its path to a stable solar manufacturing industry, not least because of the rising proportion of solar module costs accounted for by shipping.

Chinese PV Industry Brief: Financials, a new GW-scale factory, and big hydrogen

Longi and Sungrow both announced solid financial results last week. Module maker China Solar delayed the resumption of trading on the Hong Kong stock exchange, and polysilicon producer GCL-Poly unveiled plans to raise up to US$16.8 million by issuing shares. Coal miner Baofeng Energy, meanwhile, announced the construction of what it claims will be the world’s largest PV-powered hydrogen plant, and Seraphim and Lu’An Solar revealed that they will open a 5 GW PV panel factory in China’s Jiangsu province.

Meyer Burger mulls gigawatt-scale German solar fab

Chief executive Gunter Erfurt told a German radio station a solar factory in North Rhine-Westphalia could supply high-efficiency panels for a 10 GW floating solar project on the vast Hambach open-cast coal mine.

Covid-19 and dependence on China’s PV supply chain

The Asian Development Bank says developing countries in Asia and the Pacific should consider developing their own solar industry supply chains as the Covid-19 pandemic has exposed their over-reliance on China to carry through the energy transition.

A new module factory in Bahrain

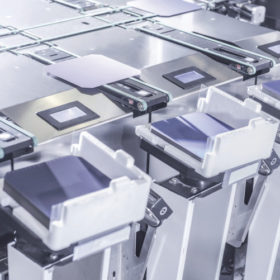

Italian company Ecoprogetti will supply the production equipment to Bahrain-based module producer Solartecc. Output is set to begin in the third quarter.

Kenyan utility launches tender for PV panel factory

The electricity company wants a solar module fab at its Tana Power Station in Murang’a county. The factory would have an initial annual production capacity of 10 MW.

German solar glass maker acquired by timber company and start-up innovator

Interfloat Corporation, a European market leader for solar glass, has been bought by Holzverarbeiter HS Timber Group and Blue Minds.

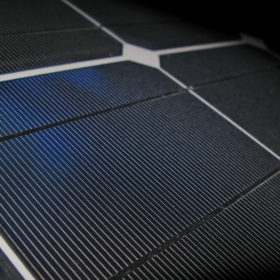

Indian tender for supply of 12 million solar cells

State-owned engineer and manufacturer Bharat Heavy Electricals Limited has invited bids for the supply of cells with five busbars and a minimum efficiency of 18.8%. Bidding closes on Friday.

Coronavirus to have limited impact on Chinese polysilicon industry

Analyst Johannes Bernreuter says most of China’s polysilicon production capacity is in regions away from the center of the coronavirus outbreak. He added, however, 27% of the nation’s 510,000-ton annual polysilicon capacity could be affected.

Coronavirus could cause solar panel price spike

The coronavirus outbreak in China could raise solar module prices in the near term as manufacturers have already begun experiencing wafer and solar glass shortages. Production rates are also being affected by an extended new year holiday introduced by the authorities as a measure to deal with the virus, and the requirement workers from infected areas quarantine themselves for two weeks.