Erdogan opens ingot-to-module solar factory in Ankara

The $1.4 billion cost includes a 1 GW solar field 260km away in Konya. The factory was developed solely by Kalyon Solar Technologies after development partner Hanwha Q-Cells walked away from the project.

New alliance aims to break 600 W threshold

Chinese manufacturers including Trina Solar, Risen Energy and JA Solar have established a group to design and produce bigger PV modules. The 39-member alliance also includes inverter suppliers including Huawei, Sungrow and SMA.

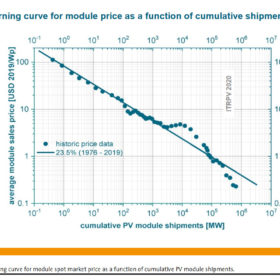

Solar costs set to continue falling according to ITRPV roadmap

The 11th edition of the German document which tracks solar price falls and efficiency improvements has considered the role bigger wafers are playing in cost reduction.

Wafer size transition in the midst of Covid-19

As the Covid-19 pandemic takes the world by storm, global supply chain operations remain disrupted, and solar exhibitions that were held in the first quarter of the year saw fewer manufacturers displaying their latest products.

MIT researchers put slimmer silicon back on the table

With solar grade polysilicon prices having plummeted in recent years, cutting down on consumption of the material has not been a priority. But strategies exist and significant savings can be made through deploying thinner wafers that use less silicon, insists a new paper published by MIT and NREL. And as manufacturers are increasingly hitting dead ends on other routes to cost reduction, this option could be back on the table for many.

Transitioning to larger wafers

Since 2017, 156.75 mm M2 wafers have been the standard. However, improvements in cell efficiency appear to have hit a bottleneck, making wafer size a hot topic among manufacturers once again. In the second half of 2018, 158.75 mm G1 mono wafers were introduced to the market. Corrine Lin of PVInfoLink argues that while G1 will likely become the mainstream format over the next two years, 166 mm M6 wafers and 210 mm M12 wafers are presenting new options for manufacturers.

UK researchers confirm correlation between micro-cracks and hot spots in polycrystalline cells

A research team from the University of Huddersfield used electron microscopy to analyze micro-cracks in 4,000 polycrystalline silicon solar cell samples. The results showed power losses may vary from 0.9-42.8%, and increased temperatures due to micro-cracking may favor the formation of permanent hot spots in the cells.

Cell prices have tumbled again since early June

The latest figures show the solar policy vacuum, and related dearth of demand in China earlier this year accelerated price reductions for cell makers. Although prices are expected to rebound in line with renewed thirst for solar in China, cell makers such as Tongwei are feeling the pain.

GCL-Poly posts $141m loss in H1

The Chinese PV group recorded a loss attributable to owners of the company of roughly $141.1 million, as its solar materials division posted a loss of approximately $185.5 million.

Looking ahead, post SNEC

In the wake of the 2019 SNEC trade show in Shanghai, PV InfoLink chief analyst Corrine Lin delves into the new cell and module technologies that were exhibited at the show.