The European solar industry association, SolarPower Europe has released its outlook for the 2018 global PV market. As the association told pv magazine in early June, new PV additions for this year are expected to reach 102.6 GW, thus enabling the Europan solar market as a whole to improve on last year's figure of 99.1 GW.

Furthermore, in its Global Market Outlook for Solar Power 2018-2022, the association forecasts that China will not account for more than half of global demand this year, as it did in 2017, and will “only” add 39 GW, as a consequence of the recent changes in policy (read feed-in tariff cut and a quota for DG). Yet, according to the report, 14 countries are on track to install more than 1 GW of new PV capacity this year – a group that in 2017 was limited to just seven countries.

This clashes with the recent figures released by Taiwan-based TrendForce, which expects global PV demand to contract this year – around 5-8% – to 92 to 95 GW, with China accounting for 31.6 GW; but is more in line with IHS Markit – which revised its expectations down from 113 GW to 105 GW.

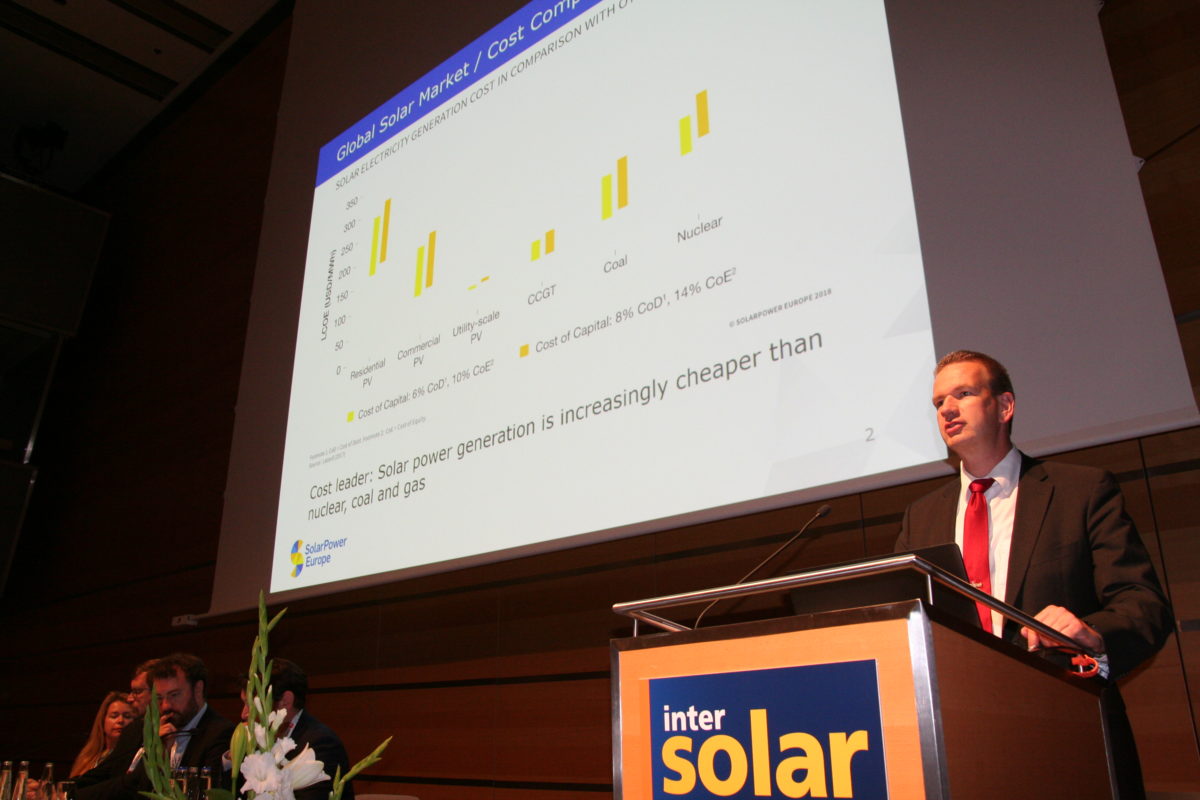

Speaking during the presentation of the Global Market Outlook at the Intersolar Europe conference today in Munich, Germany, president of SolarPower Europe, Christian Westermeier, said it would take one to two years until China had solved the issues with its new PV subsidy regime, leading to modest global PV growth rates of 3% and 5% in 2018 and 2019, respectively, before market growth would accelerate to 17% in 2020.

Average growth

Moreover, SolarPower Europe forecasts that global newly installed PV capacity for the period 2018-2022 will reach around 621.7 GW, which translates to an average growth of around 124 GW per year.

Popular content

Commenting on how Europe has grown over the past two years, Head of Market Intelligence at SolarPower Europe, Michael Schmela said that the EU is still lagging behind its potential with only 5.91 GW in 2017 and 5.89 GW in 2016.

This, according to him, is hinged on two factors: The large growth of Turkey; and U.K.’s ‘solar exit’ in 2016. “However, 21 of the 28 EU markets added more solar than the year before,” he said. In 2018 and 2019, EU solar markets are expected to record growth of 45% and 58%, respectively.

The association stressed that all of its Global Market Outlook 2018 scenarios have showed stronger growth than it previously predicted. “In 2017, SolarPower Europe assumed a cumulative installed capacity of 471 GW for the Medium Scenario in 2018, this year it forecasts 505 GW, which is about 7% higher,” it noted. Under the most lilkely scenario by 2021, provided by the association, global cumulative installed PV capacity will reach 871 GW, an amount which would be 13% higher than last year’s forecast.

“While in our Medium Scenario we expect the world’s solar power generation capacity will reach the terawatt era in 2022, according to our High Scenario this level could already be reached a year earlier,” Schema said.

The article was amended on June 19 at 14.00 to include comment from Christian Westermeier.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.