The increasing number of exhibitors and visitors to Intersolar South America, held in Sao Paulo, Brazil, between August 28-30, combined with an overall higher quality of participants, has confirmed that expectations on the Brazilian market – and those of neighboring countries, like Argentina and Chile – remain high, and that more growth may come over the next months and years.

Below are the four key takeaway from this year’s event:

- DG as a market driver

The Brazilian solar market has grown predominantly due to the addition of large-scale projects – and auctions – over the past years. Indeed, of the 1.6 GW of installed capacity reported by energy regulator, ANEEL, at the end of June, around 1.3 GW of installed capacity are represented by solar parks selected in auctions, while more GWs will come online through this mechanism over the next two to three years.

Despite these numbers, large-scale solar does not currently appear to be the market’s main driver. The Brazilian government, in fact, has not yet said when, and under which auctions, solar may participate.

“We are asking the Brazilian authorities to include solar in all energy auctions,” said Rodrigo Sauaia, president of Brazilian solar association ABSolar. The association is calling on the government to allocate around 2 GW of PV every year in auctions. In the meantime, developers have started to look with interest into the private PPA segment.

According to Sauaia, there are currently nine large-scale solar projects being developed for this segment. It remains unclear, however, what the short-term prospects really are.

What has really attracted the attention of many of the fair’s participants, including solar park developers, is the distributed generation (DG) segment, which in Brazil, relates to every PV installation not exceeding 5 MW and, as such, is also aimed at middle-sized ground-mounted solar parks.

The current regulation, which grants access to net metering and to several fiscal incentives, has been well designed and is ensuring unexpected levels of development. According to a recent report from local consultancy, Greener, in the first half of this year, newly installed capacity in this segment was around 126 MW – more than the country installed across of all of last year.

Lower PV system prices and installation costs are obviously contributing considerably to this growth, although the continuous drop of Brazil’s currency may represent an obstacle in the upcoming months, if the real does not stabilize.

The presence at Intersolar South America of the three market leaders in the DG segment – Cises Solar, Renovigi and Aldo (all of them with big, shiny, and very crowded, booths) – as well as that of many Brazilian PV product providers, shows that interest in both the small and big power consumers in Brazil is growing tremendously, especially in regions with high electricity prices, such as Sao Paulo, Rio de Janeiro and Minas Gerais.

“We are totally impressed by the fair this year,” Lucas Troia, general manager at Sices told pv magazine. “The distributed generation market in Brazil is growing year after year, as well as the number of jobs it is generating; we are now working with around 6,000 companies, and each one has around five employees, so we are creating around 30,000 direct jobs in the sector, and this is just the beginning,” he said, adding, “If the economy starts to grow again, we may have even more.”

Indeed, it must be remembered that solar DG saw its first and strong development in Brazil between 2015 and 2016, during a very strong recession, and that instead of being one its victims, it emerged as an antidote against it.

- Political uncertainty is not an issue, but challenges remain

Enthusiasm and euphoria may be good for the economy or the growth of a specific sector, but they can also be a danger if all possible challenges and issues are not taken into account.

“This enthusiasm makes sense, as we have now the right conditions for a fantastic growth,” said Greener’s CEO, Marcio Takata. “The sector, however, has still to deal with several challenges. The regulatory framework for DG will be changed in 2019, and we should be sure that the tariff model will take into account the evolution of the solar technology,” he said.

He added that PV technology, and the corresponding supply chain, are becoming increasingly efficient. However, more time could be needed to ensure this technology is accessible to the majority of Brazil’s population

Takata also said difficult financing conditions are one of the hardest challenges to face. “We have now to work together with banks and financial services providers to better understand PV, and the first response seems to be positive, as new specific credit lines are being created and launched,” he said.

Furthermore, he believes that another issue is represented by the learning curve of the solar entrepreneurs in Brazil. “Several installers and PV systems providers have just started their business and are not efficient enough, and more quality is required,” he said.

Popular content

Despite all these issues, and the political uncertainty, the sector seems to have no particular fears now. “Brazil is always challenging, because the political environment is never smooth. But you cannot stop doing things because of this. We are running and accelerating…” Surya Mendonça, the CEO of Brazilian developer, Origo Energia told pv magazine.

- Larger in size

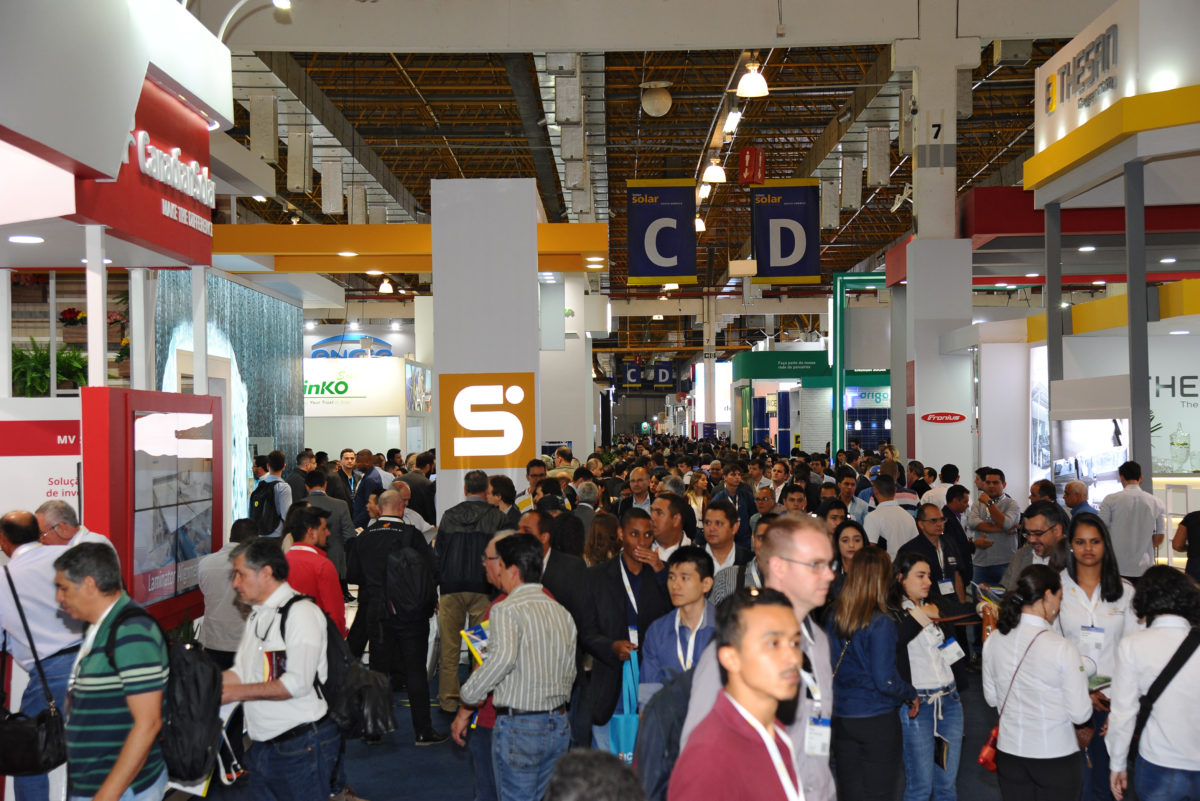

Arriving at the White Pavilion of the Expo Centro Norte, the first impression was that this year Intersolar SA is bigger than ever: Significant traffic jams at the main entrance; long queues for accreditations of any kind to enter the fair; and crowded booths and corridors from the very beginning.

This impression did not vanish for the duration of the event, and has also been confirmed by the provisional numbers provided to pv magazine by the exhibition’s organizer, Solar Promotion International. “We are having this year 263 exhibitors, which compares to 220 in 2017, and 180 in 2016,” said Gioia Müller-Russo, the company’s project manager. She added that around 55% of exhibitors comprised Brazilian companies.

According to her, the total booth surface has grown by around 1,000 square meters. As for visitors, Müller Russo specified that on the first day, according to preliminary estimates, their number has nearly doubled, compared to last year.

When asked if the event, which is aimed at embracing more Latin American solar markets than just Brazil, attracted more visitors and exhibitors from neighboring countries, managing director of Solar Promotion, Florian Wessendorf said that, although it remains primarily focused on Brazil, there has been an increase in the amount of people coming from Argentina, Chile and Uruguay for both the exhibition and conferences.

Inaki Legard, commercial director of Spanish PV production equipment Mondragón confirmed this trend. “We have had talks mostly with Brazilian companies, but actually one of the most interesting visits to our booth came from Argentineans. We have also had good contacts with Chilean companies,” he said.

Looking forward, Solar Promotion expects to have an even bigger and more crowded event in 2019. “We have already booked two thirds of the surfaces for next year,” Müller-Russo said.

- More quality

That the fair has now reached the dimension of a regional event with an international and highly qualified presence, was clearly seen in the attendance of all major Chinese module manufacturers, Brazil-based panel makers, inverter and storage manufacturers of all kinds and sizes, distributed generation specialists, and also in the presence of newcomers including, among others, providers of measurement tools, frames, solar glass, connectors and cables, and software.

“It is interesting for us, because there are also a lot of people who want to start a new business and join the industry,” Julian Rau, responsible for Global Sales Photovoltaic at Swiss cable and connector provider, Stäubli told pv magazine. “Compared to last year, there are more people, and the stands and the companies are more professional,” he said.

Álvaro García-Maltrás, General Director Latin America & Caribbean at Trina Solar, also confirmed that the fair has grown in terms of quality and presence. “This our second year here, and compared to last year, we have seen significant progress. I see much more professionals, as well as much quality from exhibitors and visitors,” he said.

He is convinced that, particularly in the distributed generation segment in Brazil, the potential for more growth remains strong. “For many years, we have talked about the potential of solar in this region, but now it has become a reality,” he said, adding, “We are seeing a market that, although not really mature yet, is in a clear stage of expansion, and believe me, this is much better than a mature market.”

Keunhyung Lee, Deputy General Manager at Korea-based Hanwha Q Cells said that the company is also placing more focus on the growing Latin American solar markets. “… we are here to show we want to expand our presence,” he told pv magazine. Among the Latin American countries, he continued, Brazil currently holds the strongest attraction.

According to Alberto Cutler, General Manager for Latam and Italy at JinkoSolar, growth of the exhibition in terms of quality and numbers was unexpected. “In the second day, we have finished all of the datasheets that we brought here. This shows that the Brazilian market is now seeing a real and strong growth,” he said. “Now we are really talking about business in most of our meetings.”

Quality was also brought to this year’s fair by pv magazine, which held its first Latin American Quality Roundtable. The event brought together big international players with Brazilian private and public entities, which are striving to provide more quality to the PV supply chain in both Brazil and other Latin American countries.

You can read more about the roundtable on pv magazine next week.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.