Sentis Capital PCC is the largest single shareholder of Meyer Burger Technology AG, holding some 6% of the company's stock. It is now demanding that the Swiss technology group consistently work on the commercialization of its high-efficiency technology portfolio, in particular in the production of heterojunction (HJT) and tandem solar cells.

Sentis Capital welcomed reports that a proposal to establish HJT and tandem solar cell production is currently being evaluated by Meyer Burger – with the support of a Swiss Investment Bank. The shareholder is also convinced that Meyer Burger has “a significant competitive edge” with these technologies.

At the same time, Sentis Capital has demanded Meyer Burger's board take a number of crucial decisions. “The difficult market environment is currently preventing leading solar module manufacturers from relying on HJT despite [its] clear benefits,” it said in a statement.

The conversion of existing production lines to HJT is associated with high investment for the customer, notes Sentis. At the same time, customers run the risk of quickly losing their competitive edge if they do not sign an exclusive contract with Meyer Burger. “The competitive advantage at the level of the gross profit for the producer is around seven US dollar cents per watt peak,” the company stated in a press release.

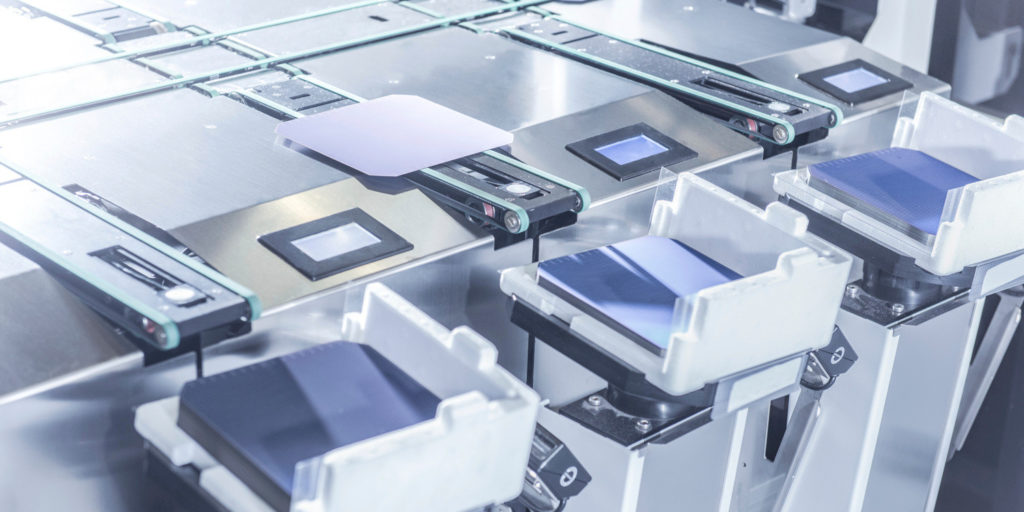

Sentis Capital finds Meyer Burger could, as a viable alternative, establish its own mass production facility for HJT solar cells. The company has the required experience, due to its existing pilot production facility at its site in Saxon Hohenstein-Ernstthal, Germany.

“This raises the question, why Meyer Burger does not complement its business model and uses the competitive advantage of net seven US dollar cent per watt peak for itself? Meyer Burger would be able to protect its own technology and directly benefit from future improvements in the efficiency and throughput of the equipment itself,” argued Sentis Capital. As an example of a successful implementation of this strategy, the company cites the US thin-film manufacturer First Solar.

Since Meyer Burger is currently unable to finance manufacturing with an annual capacity of 5 GW to 10 GW with its own resources, Sentis Capital proposes a capital increase or a strategic partnership. The shareholder asked the Meyer Burger Board of Directors to consider all options and select and present the best option to shareholders.

Popular content

However, Sentis Capital already seems to have a clear preference. “There are indications that the Board of Directors is reluctant to present to the capital market what may be the best option for financing its own production via the capital market,” it stated. Sentis went on to add: “Due to the extreme implications of this decision for Meyer Burger, the Board of Directors should not decide on a strategic partnership before informing its shareholders about the attractiveness and opportunities of investments,” it further explained. Through pursuing such a partnership, Sentis Capital sees a risk in that existing shareholders could stand to lose out.

In mid-October, Meyer Burger announced a new transformation program, with which the Swiss group looking to improve long term profitability. Among other things, it plans to relocate a significant portion of its worldwide sales and service functions for standard photovoltaic solutions to Asia. In addition, 100 full-time jobs in Switzerland are to be cut. An adjustment to the numbers of the Executive Board and the Board of Directors is also planned.

Measures such as these, have been welcomed by Sentis Capital. “We expect these adjustments to be made as soon as possible, so that the new management team can credibly present this strategic change to the capital market.”

Responding to pv magazine‘s request for more details, Meyer Burger stated that since mid-October, “the strategic focus is on heterojunction, SmartWire Connection Technology (SWCT), and next-generation cell and module technologies.

“The demands that the single shareholder now makes in his own media release through the media – including capital increase – reflect its own views,” said a Meyer Burger spokesperson.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.