World markets are becoming more open to non-conventional solar panels as ‘special modules’ made up 5% of the exports from China last year.

Analysts at Taiwan’s PV Info Link referred to Chinese customs data to demonstrate exports of products including half-cut, shingled and multi-busbar modules – for mono and polycrystalline products – reached 1,120 MW in September, October and November – around 10% of that quarter’s module exports.

That 1.1 GW represented more than the half the cumulative capacity of exported special modules, which according to PV Info Link reached 2 GW at the end of November, indicating a rapidly accelerating trend.

“Australia, Japan, Spain, the UAE and Brazil are the major export destination countries for Chinese special modules,” PV Info Link analysts wrote. At the beginning of last year, only Brazil and Australia were likely to buy that kind of product.

The analysts said in the first half of last year, the only Chinese manufacturer exporting special modules was Canadian Solar – it was only in the second half that other big producers such as Jinko, Trina, DZS Solar, Risen and Suntech joined the race.

Becoming mainstream

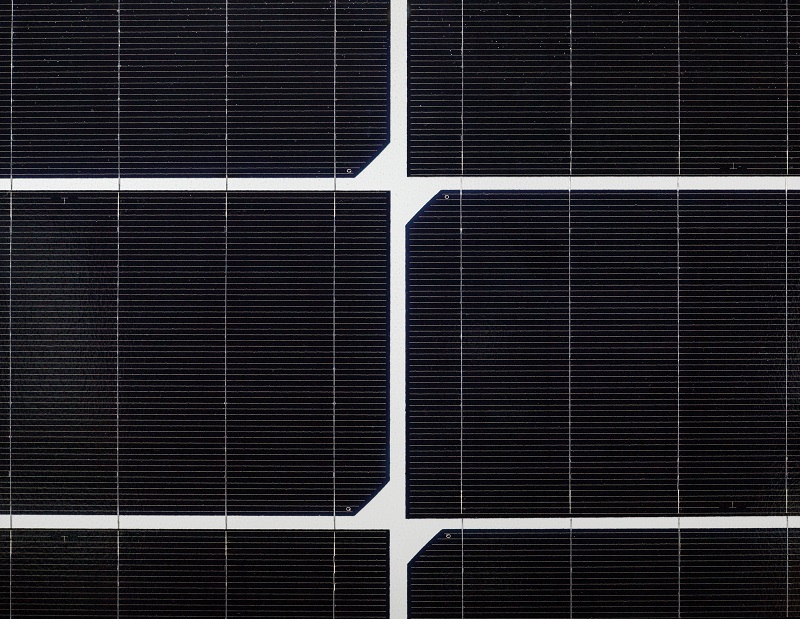

“[Regarding] the types of export product, most of the major suppliers’ special modules went with the half-cut technology, of which, Suntech, JA Solar and Risen Energy applied more mono PERC cells with half-cut technology,” the analysts said. “The rest applied more half-cut with multi-Si cell. For the shingled technology, DZS Solar and Seraphim had more shingled module exports, of which, DZS Solar’s shingled module exports were all applied with mono PERC cells.”

Half-cut technology is enabling production of polycrystalline modules with the same power output as conventional, monocrystalline panels after going through the slice and string processes, added PV Info Link. As for shingled technology, analysts said it is mainly being applied to mono PERC cell manufacturing. “However, the maturity and yield rate for the shingled modules are not as high as [for] half-cut,” added the analysts. “The market also has doubts [over] shingled modules patent issues.”

PV Info Link’s analysts concluded half-cut panels are relying on more mature technologies, and total annual production in China for that kind of panel should reach around 20 GW. “Half-cut module shipments will account for 15% of the world’s module shipment, becoming one of the mainstream products,” they predicted.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.