Some 80,000 people living on a cluster of islands on Lake Victoria have reason to rejoice. Renewable energy developer RP Global has started work on 11 solar hybrid mini-grids on their islands, promising energy access to 20 villages on the Tanzanian side of the lake.

The company said a second stage of the project would see a further 11 mini-grids installed to power 23 more villages and bring the total number of people to benefit from the EU-backed project to 160,000.

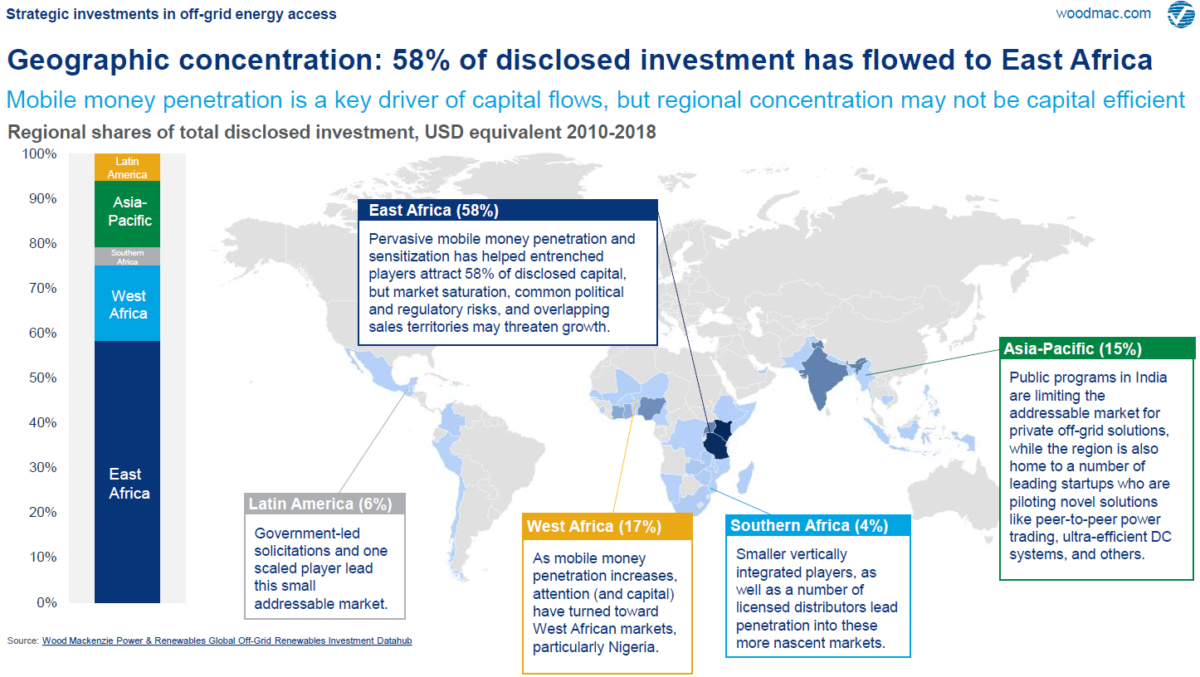

Meanwhile, the Strategic investments in off-grid energy access: Scaling the utility of the future for the last mile report by analyst Wood Mackenzie Power & Renewables spells out how investment in off-grid solar, mini-grids and universal energy access projects is continuing to climb steeply. Commitments to the sector reportedly experienced a 37% year on year increase from 2016 to 2017. Between 2017 and last year, investment climbed 22%. Last year’s investment volume was clocked at $511 million and almost $1.7 billion has been poured into the sector to date.

Still behind the curve

Despite the increased capital available, however, universal energy access is still a faraway ambition. The analysts wrote, there are around 1 billion people without access to electricity and 2 billion without reliable access. Around 400 million people have gained electricity access through off-grid solar between 2010 and 2017, by 2022, 740 million are expected to have joined that group.

Despite that rapid pick up, population growth in many parts of the world is outpacing electrification. At the current rate, 95% of the world’s population without access to electricity will soon live in sub-Saharan Africa. According to Wood Mackenzie, investment of $52 billion per year is needed to provide universal electricity access by 2030.

The RP Global project in Tanzania was co-financed by the European Union, through its ACP-EU energy facility, with Tanzania the main destination for funds earmarked for universal electricity supply. Around 58% of such investments are flowing towards East Africa, according to Wood Mackenzie.

“Besides the existing legal framework and the favorable solar resources, our decision to invest in Tanzania is a direct consequence of the low electrification rate in the country,” said Leo Schiefermüller, director of RP Global Africa. “Solar hybrid mini-grids are the least-cost electrification option, especially in rural areas, and the pay-as-you-go business model of Jumeme makes electricity consumption for the customer affordable,” he added, referring to the Tanzanian mini-grid operator co-financed by the EU.

Schiefermüller said the region of Tanzania his company operates in has some of the lowest electrification rates – just 3-5% of the population – because residents are dispersed among distant villages.

Popular content

The numbers are adding up

The Wood Mackenzie report states a utility grid connection for rural villages would cost around $500-$2,200, on average, per connection. By contrast, small-scale PV systems with a 5-250 Wdc capacity, operated on a pay-as-you-go basis, would cost around $80-$550, on average. While DC mini-grids with 25-500 kW capacities are more expensive, and prices per connection vary greatly, they are still cheaper than a utility connection.

Wood Mackenzie notes the universal energy access sector – especially the off-grid solar segment – and solar mini-grids are experiencing a steep uptick in strategic investment and partnerships from oil and gas majors, European utilities and independent power producers, clean energy original equipment makers, and the technology sector. Partners such as those see new business opportunities in fast-growing emerging markets.

“As the off-grid energy access sector begins to mature, strategic investors will deeply shape the market’s trajectory and redefine the customer-centric utility business model yet again by expanding service offerings beyond a basic electricity connection,” said Wood Mackenzie analyst and report lead author Benjamin Attia. “Ultimately, the energy access opportunity represents the prospect of ‘owning’ the next billion customers, their evolving needs and their data.”

Corporate money flows

Almost 75% of activity in the universal electricity supply segment is reportedly of commercial nature. Corporate investors have formed more than 30 joint ventures with off-grid energy access concerns. According to Wood Mackenzie, such activities leverage research and development as marketing resources. Corporate investors have provided, directly or indirectly, more than $461 million.

According to Wood Mackenzie’s report, utility-minded strategic investors including Engie, Shell, EDF and Total especially, are developing a strong interest in evolving the utility business model beyond electricity service provision. “Leading distributed energy service companies and their strategic partners are experimenting with ‘value-stacking’ add-on services like internet, water, productive appliances, financial products and services, and other retail goods,” the report added.

Making projections for the running year, however, the report suggests investment may fall because macro-level risks have grown as a result of capital concentration by company, technology, geography and business models, in conjunction with aggressive growth expectations by venture capital funds.

“More broadly, in the face of the risk and reward of unbundling, the energy access sector in general, and the SHS [solar home system] sector in particular, may face a slight identity crisis in the near-term,” Attia added. “Are they ultimately energy service providers or utilities? Are they ultimately consumer finance institutions? Retail product sales? Or all of the above?”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.