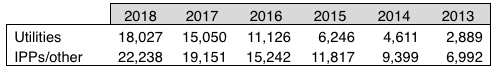

A rising number of energy utilities are turning to solar, increasing the scale of their aggregate PV portfolios more than sixfold in five years, according to figures released by Wiki-Solar, a U.K.-based compiler of utility-scale solar deployment data.

Listing projects with capacities of 4 MW or more that were commissioned by the end of 2018, Wiki-Solar identified more than 18 GW of PV capacity under the ownership of big power companies.

However, the figures should be taken with a pinch of salt. First of all, Wiki-Solar is tracking only around 150 GW of the world’s capacity of operating and under development utility-scale solar projects. Secondly, the compiler itself describes its data as an understatement, and notes some participants in its survey do not publicize all their projects.

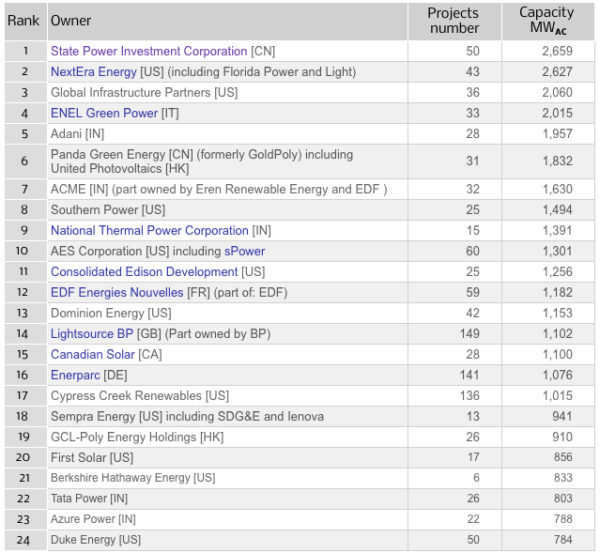

According to Wiki-Solar figures, as recently as five years ago only six utilities figured among the top 30 solar portfolio owners. That situation has changed markedly, with the latest figures showing Chinese, U.S. and Indian power companies leading the charge to solar.

“Leading Chinese and U.S. utilities like SPIC and NextEra have been prominent for some years, while dynamic growth in India has brought utilities like Adani and NTPC into the list,” said Wiki-Solar founder Philip Wolfe. “The top European utilities have held position by investing overseas; notably for ENEL, in South and Central America, and for EDF in Asia and America.”

China’s State Power Investment Corp (SPIC), one of the nation’s top five state-owned electricity producers, owns huge solar projects including a 500 MW installation in Golmud, in Qinghai province. A quick look at the utility’s website shows that by the end of 2016, however, SPIC owned solar capacity of 7,118.4 MW, far exceeding Wiki-Solar’s latest figures.

“The figures on SPIC’s website may well include smaller projects too, and cannot be traced back to individual solar power plants,” added Wolfe. “Some companies also quote peak power [rather than AC] figures, some include capacity in development, and some may ‘overclaim’ for other reasons.”

Blockbusting deals

Only last year, U.S. power giant NextEra revealed a massive solar panel deal with China’s Jinko Solar, for the supply of 2.75 GW of modules over four years – almost 700 MW annually – while India’s Adani came up with gigawatt-scale renewables plans. Italy’s Enel has unveiled its 2019-2021 strategy – a plan which envisages the deployment of an additional 11.4 GW of renewable energy capacity.

According to Wiki-Solar, independent power producers now hold a relatively lower share than they once did, as utilities become more active. But independent generators are still building significant portfolios at a steady pace, with infrastructure funds such as Global Infrastructure Partners and Warren Buffett’s Berkshire Hathaway in the U.S. owning more than 2 GW and 833 MW of PV capacity, respectively. Leading specialist solar investors include the heavily indebted Panda Green Energy, Acme – which has made headlines for offering to generate solar power at record low prices in India – Enerparc and Cypress Creek Renewables, according to Wiki-Solar.

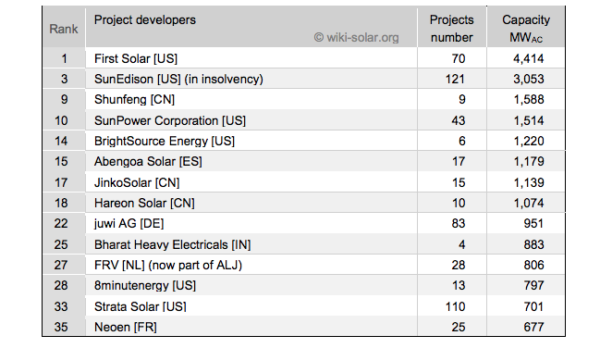

Some leading PV project owners develop their own plants but many buy projects from specialist developers. Wiki-Solar also aims to track the top PV project developers not listed as major plant owners, including specialist developers such as FRV, juwi, 8minutenergy and the late SunEdison, as well as leading solar equipment producers:

As pointed out, though, Wiki-Solar’s datasets should be treated with reserve as the organization holds full participant data for only around 30% of projects.

“Several leading players keep us informed about their contributions but the involvement of others may be substantially understated,” admitted Wolfe.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.