Having ground to a halt in early February, PV manufacturing operations in China began to return to normal from the beginning of March, according to reports from PV InfoLink.

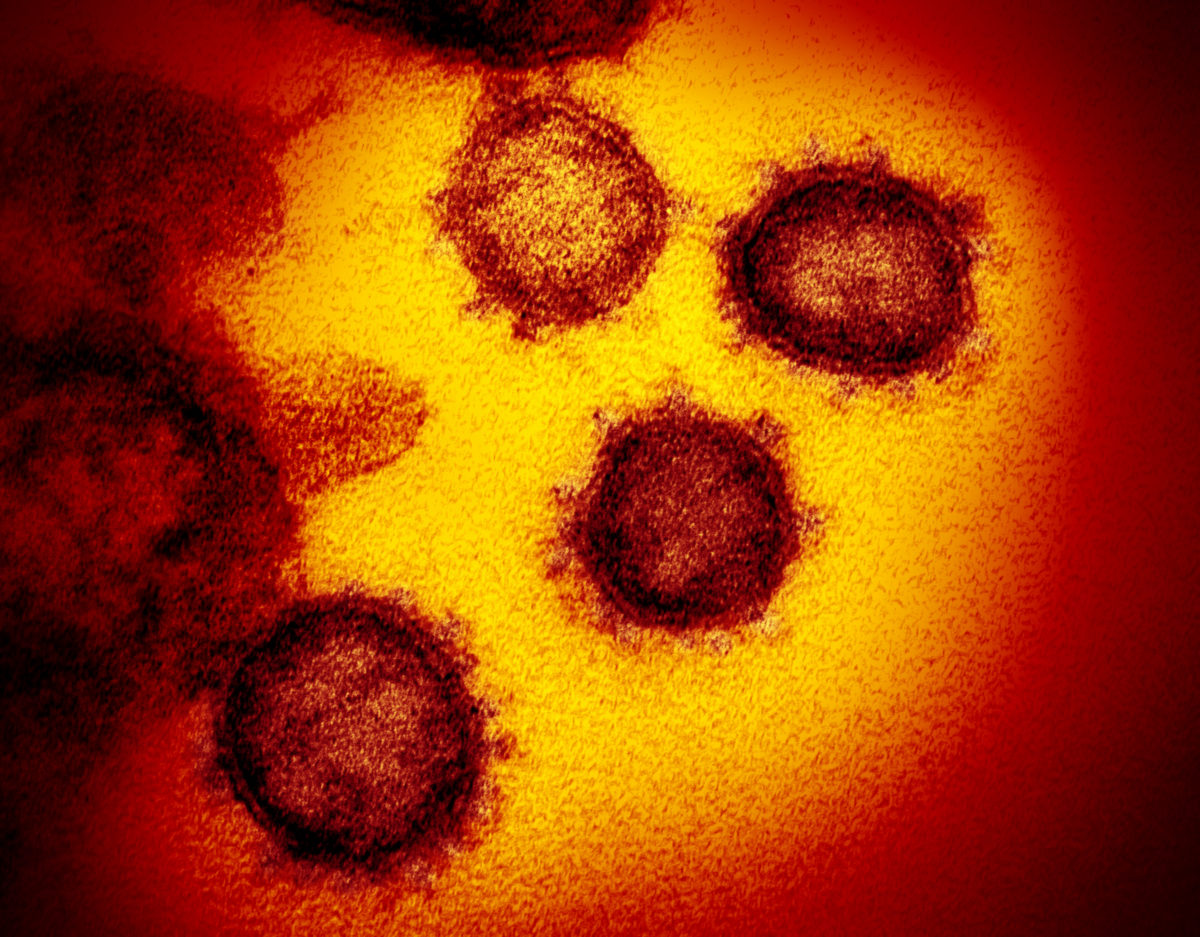

“Capacity utilization across the supply chain rose to 80% in March, gradually stabilizing the supply of modules,” says PV InfoLink Chief Analyst Corrine Lin. “However, the continued spread of coronavirus threatens an economic crisis and the impacts are rippling through the manufacturing sector and out to global demand in March through April.”

PV InfoLink reports that China’s National Energy Administration (NEA) has postponed submission deadlines for projects under China’s auction system until mid-June, and is considering an extension to grid-connection deadlines as well. These currently stand at March 31, June 30 and December 31. According to PV InfoLink, the NEA may extend each of these by another quarter.

“Against this backdrop, the anticipated demand won’t pick up the slack until Q2-Q3 in China, and whether demand will rise depends on China’s decision on the Dec. 31 deadline extension,” says Lin. “For now, Chinese demand is predicted to fall slightly lower than 40 GW this year.”

Spot price

In spot price analysis for the week, the Taiwan-based analyst states that one of two tier-one polysilicon manufacturers has returned to operating at full capacity, with the other ramping up and expected to return to a normal utilization rate shortly.

The analysts report little change in wafer or cell prices, but note that while module manufacturers have largely resumed operations (except in Malaysia, where restrictions on businesses remain in place), the effects of Covid-19 on end markets such as the United States and Europe are only now beginning to show.

“So far, there is no marked change in the volume of foreign orders placed for modules. However, Europe and other regions where the virus is highly prevalent are expected to see projects being postponed,” the analysts state. “This will make it even more uncertain how foreign module demand is faring. The pandemic will extend its tentacles from the supply side to the demand side during March–April.”

So far, PV InfoLink has not altered its expectations for global PV demand in 2020, forecasting 134.3 GW of new installations worldwide for the year. “Knock-on effects on overseas demand will begin to emerge,” says Lin. “But to what extent the demand level is affected depends on when the outbreak could be contained.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.