From pv magazine 07/2021

Following a successful constitutional challenge over insufficient action on climate change, Germany’s governing parties have beefed up their climate protection plan in recent weeks. The country is now committed to climate-neutrality by 2045, instead of 2050. The bar has been raised for the 2030 climate target, as well, as greenhouse gases will be cut by 65%, rather than the originally proposed 55%. Nevertheless, climate experts warn that even these targets are not sufficient to limit global warming to 1.5 C. In order to achieve the goals of the Paris Climate Agreement, at least 200 GW of installed capacity will be needed by 2030, from 55 GW today. This means an annual increase in PV of at least 15 GW in Germany alone – a far cry from the 2 GW to 3 GW annually added in recent years.

But how are such increases to be achieved with the legal hurdles and red tape still in place? And in what way should the “market” drive expansion when medium- and large-scale renewables plants are becoming more expensive and uneconomical due to rising prices?

But how are such increases to be achieved with the legal hurdles and red tape still in place? And in what way should the “market” drive expansion when medium- and large-scale renewables plants are becoming more expensive and uneconomical due to rising prices?

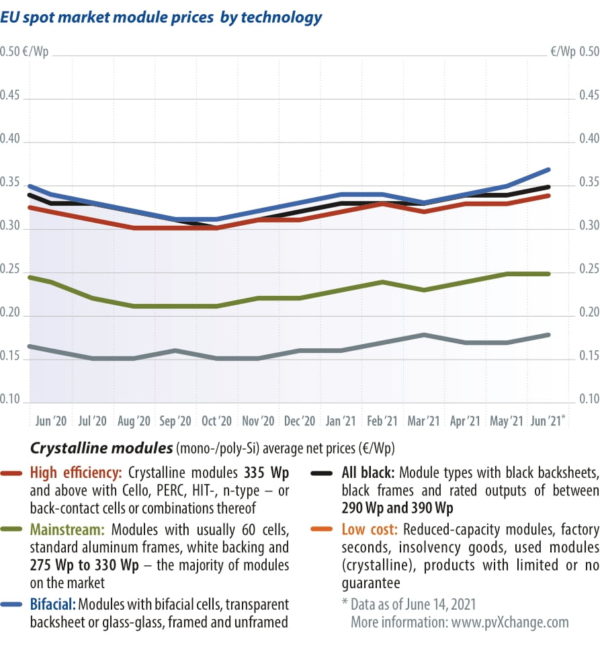

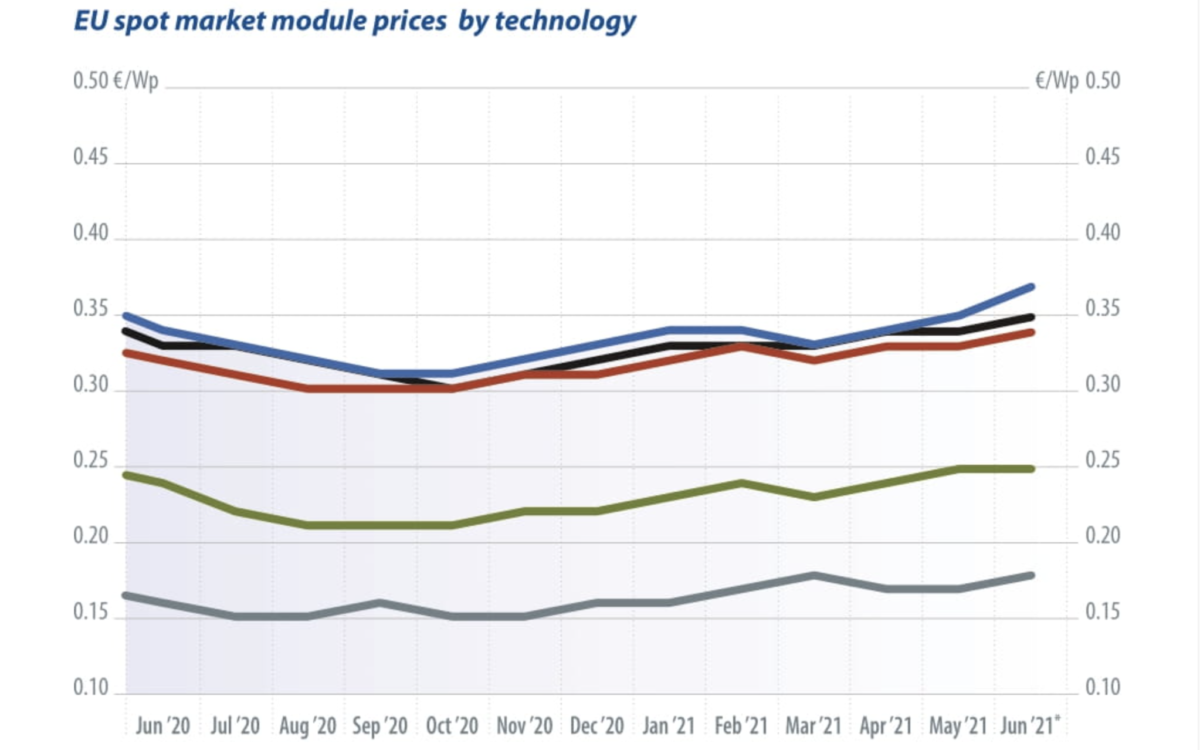

In June, almost all of the values in the pvXchange price index rose again by around €0.01 per watt-peak, and bifacial modules even saw a jump of €0.02. This means the prices of some module types are now 20% higher than at the beginning of the fourth quarter of 2020, when module prices dropped to a historic low. With currently rising raw material and transport prices, all forms of energy generation are becoming more expensive, but wind and PV especially so. While the procurement costs for inverters and storage are still largely stagnant, the prices for solar panels are skyrocketing, as are those for substructures and installation materials. This is due, among other things, to soaring polysilicon prices. Since the beginning of 2021, the cost of polysilicon has already tripled. Thanks to a lack of capacity and the fallout of a recent accident at a polysilicon factory in Xinjang, the bottleneck is only expected to worsen, further driving up prices.

Rising copper and steel prices are also causing problems. The purchasing terms for solar cables are being adjusted upwards almost monthly due to their high copper content, and a similar trend can be seen in mounting systems. Moreover, horrendous delivery costs for goods globally are negatively impacting component prices – international freight prices have multiplied by seven or eight times in the last year. This is not expected to change in the near future. For shipping prices to come down, the economy outside China would first have to pick up again and container congestion in Asian ports clear.

Some analysts are already correcting their forecasts for global PV expansion this year since many planned projects are stalled. Some see a revival of multicrystalline modules sparked by the persistently high cost of pure silicon, and for mono-PERC cells. But cells are no longer the decisive factor in the module and if all other production costs are constant, there will be no decisive price advantages here. I do not see any new availability in the multi sector yet. The only major module manufacturer still consistently using multicrystalline technology is Canadian Solar. Otherwise, one can only find old stock, mostly modules below 300 W.

Popular content

At present solar panels are cheaper on the international spot market than directly from manufacturers, which mainly draw on surpluses and returns from unrealized projects. Some of the product prices were negotiated well before the price increases of the last few months, meaning small to medium-sized plants can still be built as expected. Many a large project will probably have to be put on hold until the situation eases. It remains to be seen whether the Chinese market will perform as predicted in view of the high prices, and it generally gobbles up a large share of the modules it produces in the second half of the year. After all, Chinese project developers are not as dependent on affordable overseas shipment to Europe. If these expectations are not met, we can hope for an easing by as early as the fourth quarter. But we will not return to the historically low module prices of 2020 any time soon.

The PV market needs good ideas in order to stimulate the construction of medium- to large-scale solar plants in the near future. The rapid removal of market barriers by lawmakers is one possible and sensible measure, but larger tender volumes are also needed, especially for smaller players.

About the author

Martin Schachinger has been active in renewable energy for more than 20 years. In 2004, he founded the online trading platform pvXchange.com, where wholesalers, installers, and service companies can purchase standard components, solar modules, and inverters that are no longer manufactured but still urgently needed to repair defective PV systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.