Researchers from Chalmers University of Technology in Sweden have conducted a comprehensive review of all business models (BMs) that are currently being implemented in the Swedish solar energy market. They have found that there is a deep mismatch between theoretical and empirical solar business models.

“BMs are used in this context to describe and understand the phenomenon of technology diffusion and acceptance, rather than to describe how a specific firm creates and captures value,” the research group said. “We claim that the way these BMs are used and described in the literature does not mirror the logic used empirically by solar firms when designing or communicating around their BMs.”

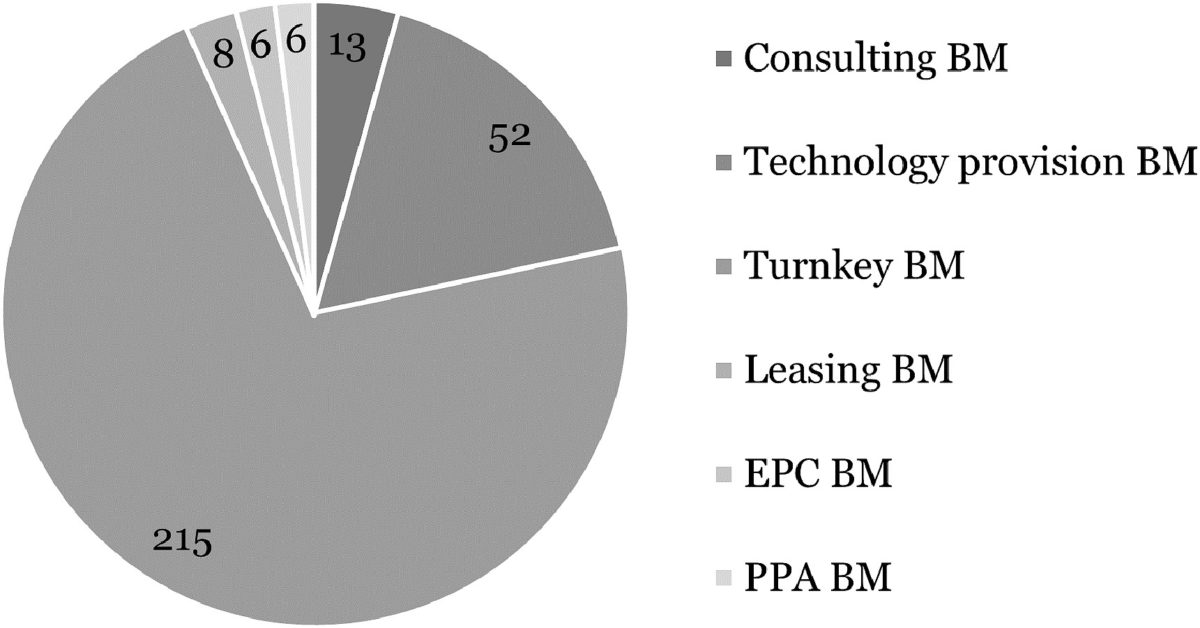

The scientists analyzed the BMs of 241 companies in active sales, project development, and installation of PV systems and identified six main BM types which they defined as Consulting BM, Technology Provision BM, Turnkey BM, Leasing BM, EPC BM, and PPA BM.

“The Turnkey BM is the most recurrent BM on the Swedish solar market, followed by the Technology Provision BM, and the Consulting BM. Leasing-, EPC- and PPA BMs are in contrast somewhat rare among solar firms active on the Swedish market,” they said.

At this point, there are not many companies in the large-scale PV segment or the solar community business, they noted.

“Swedish policy instruments have favored small-scale systems where the person who consumes the solar energy is the same one who buys and owns the system,” said researcher Amanda Bankel. “Hence, it is not surprising that we see many firms offering these solutions and only a few that are aimed at people who do not want, or have the opportunity, to invest in their own system.”

The study also noted the importance of a correlation between public policies and the diffusion of certain business models. They showed that solar companies are currently designing and communicating their BMs with customers in focus, which is a very different approach to that described by past research.

“To exemplify, solar BM literature view farmers, apartment building owners, commercial property owners, and municipalities as one cohesive group of investors that can be targeted using a commercial application BM, whereas solar firm acknowledge the specific needs of these customer segments and design their BMs to offer targeted solutions, such as individual billing for apartments or impartial support during tendering for municipalities,” said the researcher.

The researchers presented their findings in “Solar business models from a firm perspective – an empirical study of the Swedish market,” which was recently published in Energy Policy.

“If Sweden is to achieve its goal of 100% renewable electricity production by 2040, policymakers should ensure that more people have access to solar photovoltaics by promoting different types of solutions,” said Bankel.

Sweden’s operational PV capacity hit 1.59 GW at the end of December, up from 1.09 GW a year earlier, according to provisional figures from the Swedish Energy Agency (Energimyndigheten)

The figures show that 2021 was the country’s best for solar deployment yet, with around 500 MW of new capacity added to the grid. The nation installed 400 MW in 2020, 287 MW in 2019, and 180 MW in 2018. Sweden now boasts around 92,360 PV arrays, with about 26,500 added last year. In 2020, newly deployed installations stood at around 22,000.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.