Module manufacturer Trina Solar has agreed to buy 70,000 MT of polysilicon from China South Glass Group (SGG) from 2023 to 2026. The purchase price will be negotiated on a monthly basis.

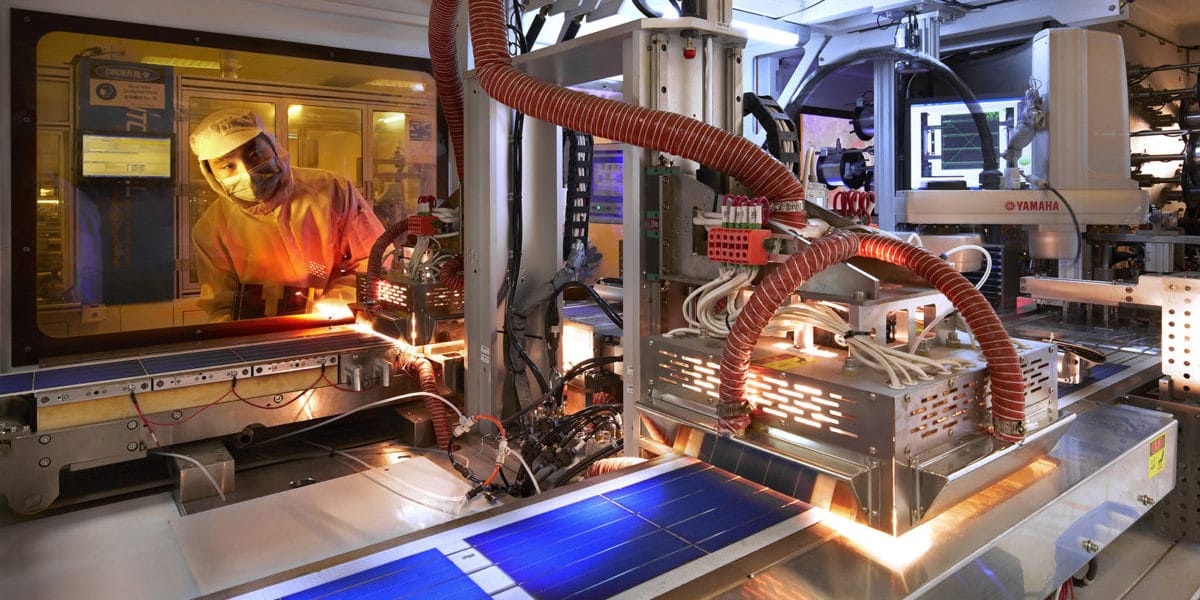

A consortium formed by Golden Solar (Hong Kong) Solar Material Company Limited, Giastar Group, and New Hosun Group has unveiled a plan to build a 10 GW heterojunction (HTJ) solar module factory in the Sichuan Province. The three companies want to invest CNY7 billion (around $1 billion) in the new facility.

Module maker Risen Energy is seeking to raise CNY5 billion through a private placement of shares. The company said the net proceeds will be partly invested in its project to build a 5 GW heterojunction module factory.

Highways business Shandong Hi-Speed this week agreed to work with the renewable and clean heat business it controls – Shandong Hi-Speed New Energy Group – to roll out clean power sites across its roads network and service stations. The renewables unit this week announced it generated 289 GWh of solar power in July, and 267 GWh in August for an eight-month total of 2.03 TWh to the end of August.

Polysilicon company GCL Technology has signed up for another 25,000 tons of coal from Suzhou GCL Energy Technology Co Ltd, at a maximum price of CNY 27.8 million ($3.97 million). The poly maker had already agreed to spend up to CNY 48.2 million on 43,230 tons from the same supplier under three agreements signed since June 4, 2022.

Popular content

State-owned manufacturer Luoyang Glass last week paid Dutch-owned float glass maker TG Donghai CNY 422 million for its TG Fujian Photovoltaic Glass Co Ltd unit. TG Fujian also assembles systems for electric vehicles and makes batteries. Luoyang also started work last week on the CNY 2.3 billion first phase of a solar cell glass production fab whose two 1,200-ton-per-day lines will be able to manufacture 137 million m2 of cell glass per year upon completion. This week, the company started production at a separate PV cell fab in Hefei which Luoyang said features “the first intelligent warehouse in the industry.” The manufacturer also fired up a carbon capture and utilization system in Hefei it says will produce 50,000 tons of carbon dioxide annually.

A solar project company and a clean power business accounted for CNY5.7 million of the CNY 12.8 million solar developer Kong Sun Holding put aside for bad debts related to its financial services arm during the first half. Publishing its six-month figures last week, Kong Sun said both unnamed companies were still operating normally and legal recovery of the overdue loans, of CNY 2.8 million and CNY 2.9 million, respectively, was being considered. Kong Sun, which retains 14 solar plants with 390 MW of generation capacity reported a first-half loss of CNY 89.5 million, down from CNY 153 million in the same period of last year. Sales of its solar projects meant the CNY 564 million of revenue Kong Sun posted in January to June last year fell to CNY 285 million this time, with the first-half numbers not helped by CNY 10.8 million of “solar plant rectification expenses.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.