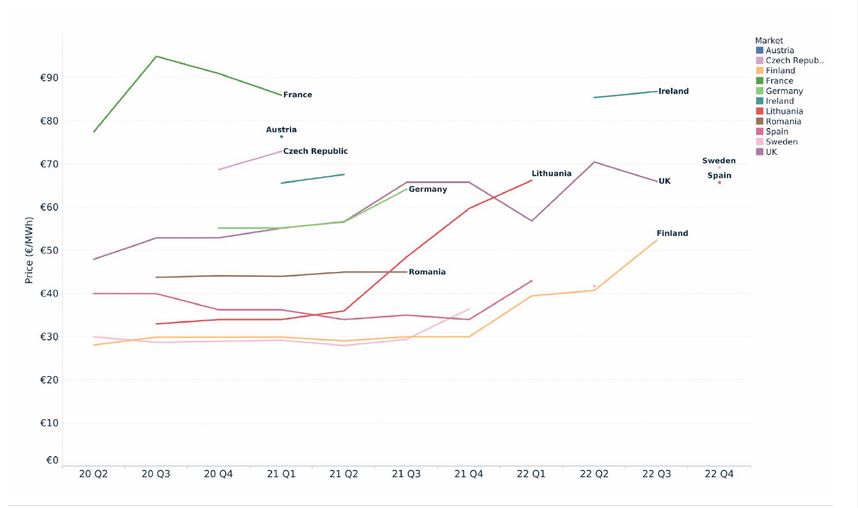

High development costs and a volatile regulatory environment contributed to an 11.4% increase in solar PPA prices in Europe in the fourth quarter, according to a new report by LevelTen Energy.

Prices rose by 30% in the United Kingdom and by 20% in Italy, said LevelTen Energy.

“It is likely that public auctions have contributed to the sharp rise in prices in the UK,” said Frederico Carita, developer services senior manager at LevelTen Energy. “More capacity going to government auctions means less is available for corporate buyers, leading to higher PPA prices.”

The prices of solar PPAs reached €76.84/MWh, up 60% year on year. Spain has remained in the range of €45/MWh, making it the second-cheapest country above Finland, which reached €40/MWh.

Despite rising prices, buyer demand continued to grow in 2022, said LevelTen Energy. It analyzed 125 PPA price offers for 94 projects in 16 countries. All of its figures are based on the prices developers are offering for PPA contracts, rather than transacted PPA prices.

“PPA prices continue to rise in Europe due to inflation, supply chain constraints, rising interest rates and, of course, regulatory uncertainty,” said Plácido Ostos, energy analyst for Europe at LevelTen Energy. “Spain continues to stand out from the rest due to fundamental factors such as robust solar resources and relatively high land availability, so it is not surprising that it remains a very strong PPA market.”

In emerging European markets, the supply of solar energy also grew.

“PPA buyers looking to avoid hyper-competitive markets should consider markets like Greece and Hungary, which together produced an impressive 21% of the Q4 volume,” said Carita.

Despite strong demand, regulatory uncertainty contributed to a shortage of PPAs, according to the report.

pv magazine print edition

“From price caps on renewable generators to capping gas prices, policymakers are increasingly relying on imposed measures to keep wholesale prices artificially low, often at the expense of generators,” said Kristian Lande, LevelTen Energy's senior director. “For the renewables sector, these measures pose a serious risk of hurting investor appetite, which is the last thing the continent needs as it works to accelerate its transition to clean energy.”

The report showed that the availability of wind PPA contracts fell as developers applied for siting and construction permits for projects. In 2022, wind investments fell by 47%, according to WindEurope.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.