Rethink Energy expects several gigawatts of perovskite PV generation capacity to be built in 2026, in what will be just the start of a rise to prominence. Clear advantages are expected for the technology in every market segment.

The first movers will be the handful of companies leading the field today, at least five of which – Microquanta, UtmoLight, GCL System Integration, Caelux, and Oxford PV – have commissioned 100 MW pilot production lines. By 2026, every mainstream silicon manufacturer will have committed to perovskite products.

Rethink believes multiple companies are already capable of making perovskite solar panels that would be competitive today. These companies also have a second generation of perovskite cells in the laboratory. Within three years, next-gen products will be scaled up to full size panels and viable for mass production.

Second-generation perovskites will be superior to current mainstream options and will outcompete silicon PV on rooftops, with consequences for building-integrated photovoltaics (BIPV). Outcompeting thin-film solar, perovskites will make BIPV a relevant business.

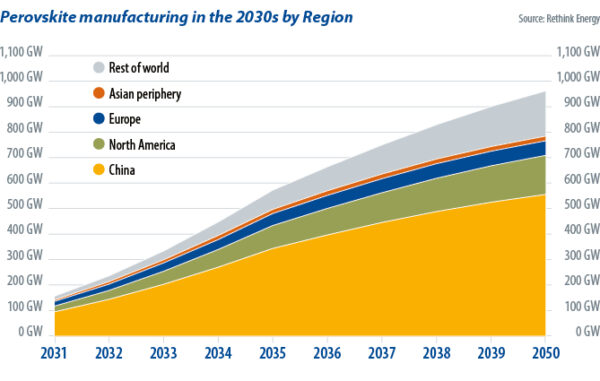

The perovskite cells currently being scaled are good enough to enable startups to compete with the $100 billion mainstream industry, which will soon have to adopt perovskites. Rethink Energy expects perovskites will completely take over solar during the 2030s, regardless of whether the industry reaches 1 TW or 2 TW in scale.

Big investments

These expectations are supported by the commissioning of multiple production lines in the past 12 months, with many more in progress. Another positive development is the expansion of production capacity by manufacturing equipment companies supplying the laser scribing and other kit needed for production lines.

The strongest proof that perovskite commercialization is just around the corner is that the first major investments are being made by mainstream companies. Qcells, in South Korea, has invested in a $100 million perovskite pilot line. In the United States, First Solar has acquired Swedish perovskite startup Evolar AB for $32 million, with an additional $42 million contingent on the business hitting R&D targets. The world’s biggest silicon solar manufacturer, Longi, is continually reporting ever-higher perovskite-heterojunction tandem cell efficiency results.

Each month brings several new companies into perovskites, whether startups completing a round of series A financing, companies entering the solar industry via semiconductor manufacturing, or silicon giants getting ahead of the curve. Since Rethink Energy’s report was written, these companies have been joined by Sekisui Chemical, a Japanese plastics company promising to sell perovskites in 2025.

Most of the startups, especially those in China, will focus their efforts on thin-film product and this will take BIPV from its current, negligible scale to a large percentage of all distributed solar installations. These thin-film products will initially be perovskite single-junction devices but, over time, more and more will switch to tandem technology in combination with potentially every other thin film.

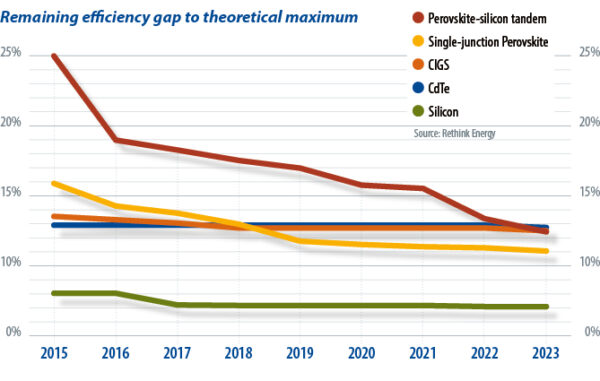

The tunability of perovskite absorption spectra is a major advantage of the technology over other thin films. This factor means perovskites can be combined with every other PV semiconductor, including other perovskites. Where single-junction silicon has a theoretical efficiency limit of 29.4%, a perovskite-perovskite tandem could reach 43% – there is already one Chinese startup pursuing this route. As more junctions are added, the technical potential grows: the theoretical limit for a triple-junction perovskite is 50%.

Much of the technology’s potential will be unlocked in the next decade, continuing the rollercoaster of record-setting results that perovskites have been on ever since they emerged from dye-sensitized solar in 2009. They are now drawing level with existing options and will soon surpass them.

While most startups pursue thin film, the first and biggest perovskite companies in the west are already pursuing tandem devices. When the mainstream manufacturers enter the fray, they will also do so via tandem devices. In First Solar’s case, this will be with perovskite-cadmium telluride, while others will find entry through silicon heterojunction-perovskite. Rethink Energy expects that these tandems will first dominate the rooftop segment by the mid-2030s, then the entire solar industry by 2040.

Single-junction perovskites may find a niche as a cost-effective repowering option and perovskites have inherent advantages in every conceivable segment – electric vehicle roofs, satellites, indoor devices – and in every case, there will be a dedicated sub-type of perovskites.

Rethink Energy’s forecast is a minimum case on two levels. Firstly, perovskites will be so disproportionately cost-effective that once the tipping point is reached, they will be adopted at least as swiftly as we have forecast, and possibly much more rapidly. Secondly, perovskites’ superior performance and price have the potential to enable immense additional solar demand, including futuristic green hydrogen complexes, among other things, on a scale that silicon alone cannot enable.

China will dominate the field of perovskite manufacturing and installation but this will only be because it is the biggest market, with the biggest solar industry. Perovskites will not be anything like as Chinese-dominated as silicon PV has been. Perovskites will play a part in European and United States efforts to reclaim a share of global solar manufacturing while India, which is still switching from multicrystalline to monocrystalline passivated-emitter rear contact solar, will be slower to adapt.

About the author: Andries Wantenaar joined Rethink Energy after studying at the University of Keele, where he obtained a math degree.

About the author: Andries Wantenaar joined Rethink Energy after studying at the University of Keele, where he obtained a math degree.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.