European developers signed 30 power purchase agreements (PPA) in October for a total contracted capacity of around 2.06 GW, according to the latest analysis from Swiss renewables research firm Pexapark

The result is the highest monthly volume reported in 2025, last exceeded by figures from December 2024. It is also a significant improvement on September’s result, when developers signed 19 PPAs for 630 MW.

Pexapark says October’s result was driven by corporate offtakers, with companies including French railway operator SNCF, Apple and Amazon announcing multiple deals.

SNCF was the most active offtaker, signing seven PPAs for approximately 235 MW of solar in France. Apple was just behind, signing six PPAs for October’s largest total contracted volume by a single offtaker, reaching 619 MW of solar and onshore wind deals across multiple countries.

The largest single deal of the month was a 235 MW solar PPA in Great Britain between Metlen Energy & Metals PLC and Engie SA. The agreement covers six solar projects currently under construction that are expected to reach close within the first half of next year.

October also saw five announced battery energy storage system (BESS) optimization deals for a total of 317 MW/657 MWh, Pexapark added. The largest was a 202 MW/404 MWh standalone system in Romania, owned by Swedish operator Repono, for Romania’s first publicly announced BESS optimization deal.

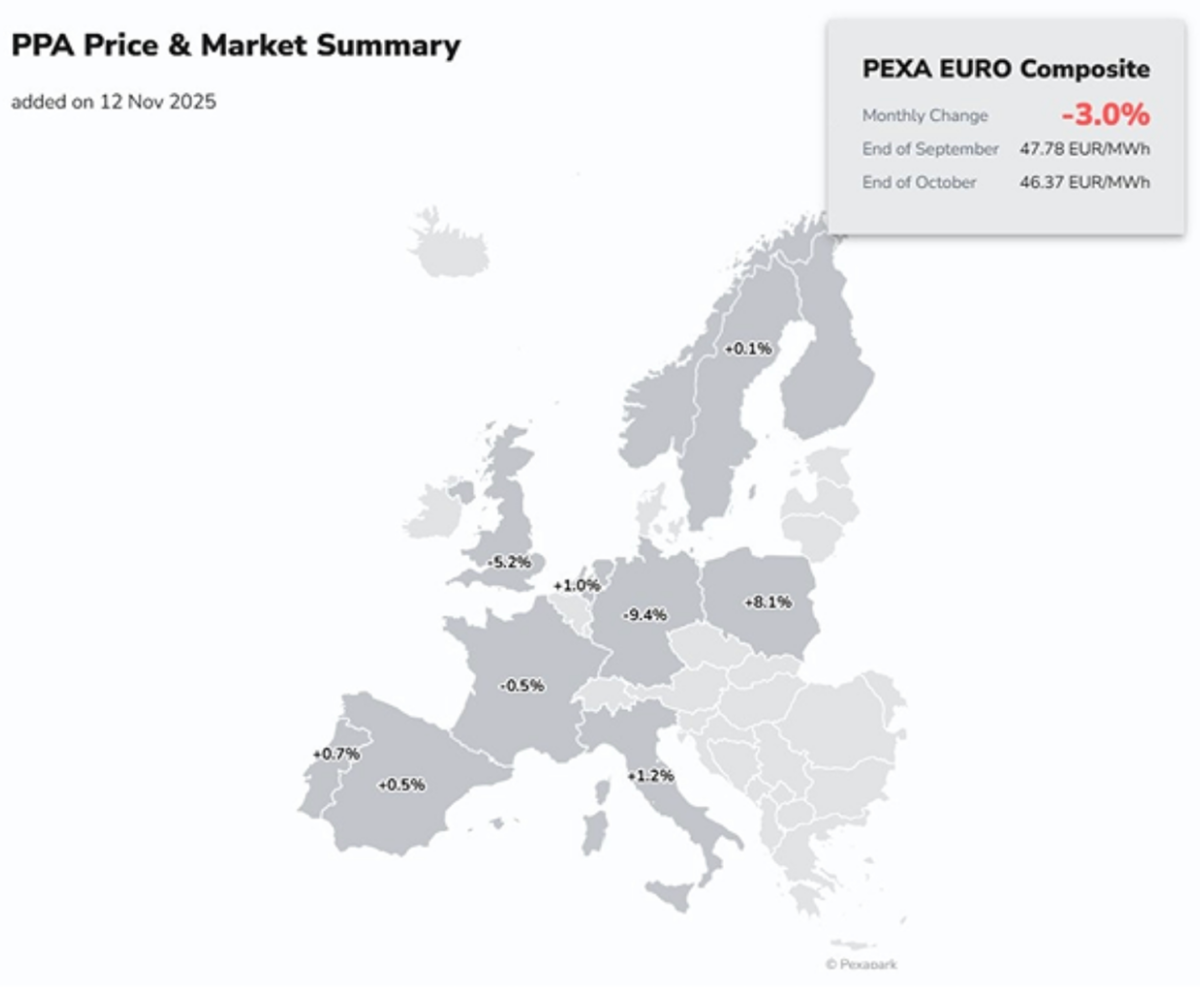

Pexapark’s latest analysis tracked PPA prices were closed at €46.40 ($53.74)/MWh in October, a 3% month-on-month decrease. The analysts say this is the third downward adjustment this year and stems from continued reductions in capture assumptions for solar PV and offshore wind under Pay-as-Produced structures.

The largest drop was recorded in Germany, where PPA prices were down 9.4% month-on-month, which Pexpark says reflects further alignment with market consensus among buyers. PPA prices were also down in Great Britain and France, by 5.2% and 0.5% respectively.

In contrast, Pexapark noted PPA prices increased in the Spanish, Portuguese, Dutch and Italian markets by 0.5%, 0.7%, 1.0% and 1.2% respectively. Poland saw the largest monthly rise in PPA prices, increasing by 8.1%, which Pexapark attributes to “a calibration that incorporated an updated seasonality pattern and a slightly higher solar forward capture curve”.

Earlier this month, analysis from Pexapark indicated that the general downturn in the number of PPAs signed across Europe this year was due to a lack of pricing consensus between buyers and sellers. The research firm’s transactable price range model, which identifies the range in which PPA deals can realistically occur, found little harmony between the highest buyer bids and lowest seller offers in Germany, Great Britain, France, Spain, Portugal and the Nordic region during the third quarter of this year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.