Europe’s solar photovoltaics expansion is shifting toward larger systems as residential growth stabilizes and the commercial & industrial (C&I) and utility segments gain momentum, requiring manufacturers, engineering, procurement and construction (EPC) companies, and corporate buyers to adapt portfolios and risk strategies to a maturing landscape, such as a growing focus on hybrid PV-storage models and performance-linked financing.

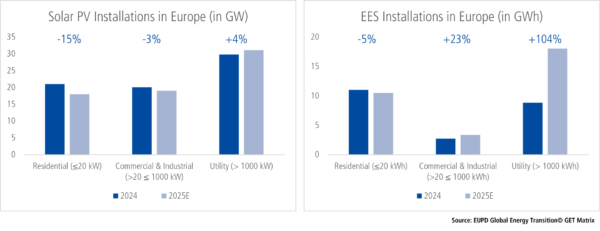

Roughly 68 GW of new PV capacity is expected across the EU-27, UK, Norway and Switzerland in 2025 (Source: EUPD Global Energy Transition GET-Matrix©). Segmental trends diverge as the residential market decline 15%, while the volume of installations in the C&I sector remains steady despite a small decline, and utility installations rise 4%. Electrical Energy Storage (EES) follows the same path, with total installations climbing from 21 GWh (2024) to roughly 31 GWh (2025). Residential storage is set to dip 5%, whereas C&I rises 23% and utility storage nearly doubles.

Drivers of C&I expansion include rising corporate demand for energy independence, maturing environmental, social, governance (ESG) compliance, simplified permitting, and the use of batteries to manage peak demand, hedge against price volatility, and enhance resilience.

Our PV Commercial & Industrial EPCMonitor© 2024/2025 shows that an average of 60% of 131 European EPCs expect a ‘more favourable’ business outlook in the next six months, while in major markets such as France and Germany, the figure exceeds 75%, reflecting solid confidence and opening new opportunities for innovation aligned with ESG goals and long-term value.

ESG commitments and corporate risk protection

Across Europe, businesses are accelerating efforts to reduce energy dependence and advance their ESG compliance. Hundreds of companies have already submitted their ESG reports to us for evaluation under the EUPD ESG Transparency Award© (ESGTA). This evaluation recognizes organizations that integrate forward-looking sustainability concepts into corporate strategy and disclose measurable progress through transparent reporting.

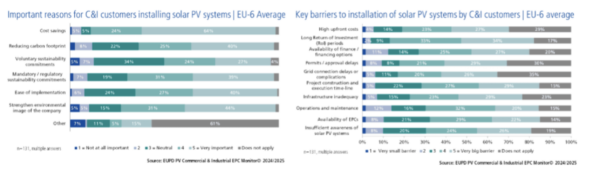

A primary tool for advancing ESG goals while achieving operational savings is the adoption of solar and storage technologies, when sourced and produced responsibly. This trend is reinforced by lower equipment costs, streamlined permitting, and strong policy alignment under the European Green Deal and REPowerEU framework, both of which promote renewable self-consumption and on-site generation. According to our PV C&I EPCMonitor© 2024/2025, 64% of 131 EPCs reported that cost savings are a key driver for C&I customers for adopting solar, followed by 44% citing strengthened environmental image and 40% reducing carbon footprint.

However, renewable adoption also introduces financial exposure, making corporate risk protection measures a central part of technology-selection decisions. 34% of surveyed EPCs identified long return of investments (ROIs) as a major barrier for PV adoption, and 27% cited high upfront costs. Due to this high sensitivity of financial investment, C&I customers place strong emphasis on long-term quality and reliability in their decision-making process. To address this, 53% of surveyed EPCs reportedly offer premium-quality equipment, ensuring durability and reduced operational risk. Furthermore, they report that 56% of their customers are willing to pay a premium, with 46% accepting more than 10% above standard cost, confirming a growing readiness to invest in innovation that transforms ESG ambition into long-term value.

This sends a clear message to brands operating in the C&I segment: innovations that directly address risk protection concerns are viewed as worth a 10% to 20% premium over standard products. In a market where pricing grows increasingly competitive, this offers a decisive advantage for manufacturers able to combine innovation with proven corporate risk protection measures.

What are C&I installers and EPCs asking for?

With the growing prominence of the C&I segment, an increasing number of installers are expanding into this space. According to our InstallerMonitor© 2024/2025, among the surveyed installers across the major European PV & Storage markets, an average of around 58% reported being active in the C&I segment.

Installer and EPC feedback highlights a growing demand for innovation to meet evolving C&I needs. Across major markets, respondents emphasize the importance of longer system lifespans, faster charging performance, and space-efficient designs suited to commercial environments. These priorities point toward a clear market preference for compact, durable and high-performance storage systems that minimize installation complexity and operational downtime.

How brands are responding — and what it takes to stay viable

For brands active in the C&I segment, recognizing the evolving needs of intermediaries and commercial end customers is critical to staying competitive. The segment’s accelerating momentum demands that manufacturers adapt their innovation strategies, market positioning, and partnership models to build sustained visibility and trust.

There are three essential foundations for maintaining brand viability in this fast-developing landscape:

- Access to targeted market insights:

Despite strong C&I growth, Europe remains a mosaic of distinct policies, buyer behaviours, and barriers. Combining these variables through structured market tierisation helps manufacturers identify where to focus and allocate investments. - Trust:

While C&I customers are increasingly committed to renewable adoption, their decision-making process remains complex and risk-sensitive. Beyond technical performance, long-term success in this segment depends on how brands are perceived by key stakeholders such as investors, EPCs, and installers in terms of reliability, sustainability, and innovation. To support these priorities, the EUPD Brand Leadership and Sustainability Rating© (BLSR) framework provides holistic evaluation of manufacturers across brand trust, ESG transparency and financial health—offering a comprehensive view that supports investor confidence, strengthens intermediary trust, and reinforces long-term risk mitigation. - Innovation:

As earlier highlighted, EPC insights confirm that C&I customers increasingly value technologies that ensure long-term reliability and risk protection, reinforcing the strong market demand for innovation that combines performance, modular scalability, and intelligent system integration. To recognize such forward-looking solutions, we introduced the EUPD Top Innovation Awards© (TIA), which highlight technologies endorsed by installers and system integrators for their proven contribution to reliability, scalability, and ease of deployment.

The market is already distinguishing viable innovators

Recent TIA-recognized technologies demonstrate how leading brands are addressing installer and EPC priorities. Solis’ S6-EH3P(80–125)K10-NV-YD-H hybrid C&I inverter integrates PV generation, dual-port storage, seamless on/off-grid control, and intelligent energy management in a compact, scalable design. SolaX Power’s Long-Cycle-Life C&I Smart Energy Storage System adopts an all-in-one design combining battery, PCS, and EMS/BMS for safe, efficient outdoor operation. JA Solar’s ITS Low Carbon solution provides a traceable, low-embedded-carbon module option, achieved through material efficiency and increased recycled content, helping customers measurably reduce upstream Scope 3 emissions. These examples illustrate how leading brands are shaping the next generation of C&I solutions by aligning technical innovation with ESG-focused product strategies that respond directly to the needs voiced by Europe’s installers and EPCs, and their strong performance under the BLSR framework further reflects how sustained innovation builds stakeholder confidence in reliability, sustainability, and long-term viability.

Aligning ESG, innovation and market opportunity

Europe’s accelerating energy transition continues to place the C&I segment at the forefront of growth and innovation. With companies linking ESG goals to financial performance, the demand for premium, low-risk solar and storage solutions has never been stronger—opening a decisive window for brands ready to lead.

In this context, we are convening Europe’s sustainability community at the European Sustainability Week, taking place from November 25–27, 2025, at the Steigenberger Icon Grandhotel & Spa Petersberg, Germany. The ESG-highlight of the week, the EUPD ESG Summit on November 26, will bring together more than 400 C&I businesses actively advancing their ESG strategies and compliance goals. The event provides brands with direct access to Europe’s most ESG-engaged C&I clients. By fostering dialogue between innovators and decision-makers, we aim to strengthen the link between ESG progress, technological leadership, and long-term competitiveness. At the Summit, the next group of top innovation award (TIA) winners and brand leadership and sustainability rating (BLSR) leaders will be announced, recognizing technologies and brands that play a decisive role in C&I customers’ investment decisions and planning.

Now is the moment for manufacturers, EPCs, and corporate buyers to align around innovation, reliability, and ESG purpose, unlocking win-win outcomes that build a more resilient and future-ready energy landscape. This direction also aligns with the EU’s broader industrial agenda under the Net-Zero Industry Act and Carbon Border Adjustment Mechanism (CBAM), both reinforcing ESG-linked competitiveness across the value chain. With Chinese and Indian manufacturers rapidly strengthening their global competitiveness through scale, integration, and premium positioning, acting now is essential for brands to safeguard and expand their market share in Europe’s fast-evolving C&I and ESG-driven solar sector.

About the authors:

Markus A.W. Hoehner is the Founder, President and Chief Executive Officer of Hoehner Research & Consulting Group and EUPD Research. He has been active in top-level research and consulting, focusing on cleantech, renewable energy, and sustainable management for more than three decades. He can be reached at m.hoehner@eupd-research.com.

Daniel Fuchs is the Chief Commercial Officer of the EUPD Group. He brings over 15 years of international experience in sales, marketing, and strategic communications across the global solar and energy storage sectors. Daniel has led more than 500 B2B marketing, communication, and event initiatives worldwide and advises companies on market entry, brand development, and commercial strategy. He can be reached at d.fuchs@eupd-research.com

Varun Mahankali is a Senior Consultant and the Manager of the Top Innovation Awards at EUPD Research. He has over five years of experience in clean tech research and consulting. His expertise spans market intelligence, innovation analysis and consulting within the renewable energy sector. He can be reached at v.mahankali@eupd-research.com.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.