From pv magazine 06/23

One of the most eye-catching aspects of the EU’s Green Deal Industrial Plan (GDIP), presented in February, is the European Commission’s Temporary Crisis and Transition Framework (TCTF) for state aid rules. Under the proposal, member states can, for a limited period, provide projects with a fixed percentage of investment cost, in principle, without breaching competition laws. The “grace period” for boosting national subsidies applies to aid granted before 2026.

The move is not without controversy, however, as many fear it will benefit the wealthier member states. Margrethe Vestager, the EU commissioner responsible for competition, acknowledged this when presenting the proposal. She noted, for example, that Germany and France together account for 80% of the state aid approved thus far under the temporary EU state aid framework adopted in 2020.

CRMA and NZIA

The EU is worried that the Inflation Reduction Act (IRA), adopted by US President Joe Biden last year, will make it much harder for the green technology industry in Europe to compete on an equal footing and will drive companies to relocate to the United States. The IRA effectively grants tax credits, grants, and loan guarantees to clean energy projects and is seen as a relatively simple set of rules compared with the “jungle” of directives and regulations at EU level.

The EU also has a weak hand on taxation, which is largely seen as a national competence, and cannot match the IRA per se. Relaxed state aid rules, however, would allow member states to increasingly support national projects and give their green industries, including solar manufacturing and battery storage, a necessary boost to help accelerate the energy transition.

The effects of the state aid exemptions could last much longer than the end-of-2025 cut-off date.

“What the TCTF says is that the aid must be granted by the end of 2025,” says Benedicte Andries, assistant vice president at ratings agency Moody’s. “This means the payment commitment must be made before the end of 2025, while the actual pay-out of the money can happen after the cut-off date.”

An extension of the state aid exemption regime cannot be ruled out either. To this end, Andries says one key aspect to watch out for is how considerable the impact of the IRA will be. This is something that could become clearer toward the end of 2024, she says. Another issue concerning the relaxed state aid rules is how big the distortive effect will be within the single market and whether there will be the political will to remedy distortive effects by providing more European finance for those member states with insufficient fiscal space.

“Measures might be extended if a review of the state aid measures concludes that the functioning of the single market is not being harmed by the measures allowed under the TCTF, for example,” Andries adds, “or when it is deemed that such measures need to be extended to safeguard the competitive position of the EU in terms of net-zero technologies in light of global industrial plans.”

Potential beneficiaries

Temporarily relaxing EU state aid rules could also help European companies compete against Chinese producers, for example in solar module manufacturing.

“It will definitely help support solar panels, since the European producers were basically swiped out of the market by the Chinese,” says Louise van Schaik, head of unit for the EU and global affairs at the Clingendael thinktank. “There are new plans to produce advanced PV tech in Europe and to ensure [panels] can be recycled at the end of [their] lifetime. A boost in national subsidies will help get these projects off the ground.”

The beneficiaries of relaxed state aid rules include manufacturers of strategic equipment. This includes solar modules; batteries; heat pumps; electrolyzers for hydrogen production; wind turbines; and carbon capture, usage, and storage technologies; as well as related key components.

The extent to which companies will benefit from relaxed state aid rules will depend on their location and size, however. In a recent report, Moody’s said most large, internationally diversified cleantech companies with significant operational capacity both in and outside of the EU will likely benefit the most.

“These companies will be able to choose from subsidies offered under different investment plans in Europe and abroad,” the report stated. “Because these companies have the operational flexibility, they will be able to allocate and shift their investments in the countries where they operate. This will depend on where they can maximize return on capital, meet local demand in their respective markets, and strengthen their supply chains.”

Sarah Brown, Europe program lead at climate thinktank Ember, says state aid is one option for increasing investment in renewables. It is important, she points out, that this funding comes with clearly defined obligations on how and where it is allocated.

“Ideally, direct or indirect subsidies should not be the key instruments for funding,” says Brown. “EU policy and actions must also focus on creating an environment where investors and developers feel there is adequate market certainty.”

Red tape

Permitting and bureaucracy at national level is a major issue for developers of clean energy and the European Commission is trying to address this issue by pressing through new regulations.

Under the Net-Zero Industry Act (NZIA), which is also part of the GDIP, the commission has floated the idea of a “one-stop-shop” for permitting, in order to simplify and accelerate procedures. Under the proposal, three months after the NZIA enters into force, each member state will have to appoint one national authority to which any developers of cleantech projects can send applications electronically.

This responsible national authority is then to provide the applicant with all information on the procedures to follow and communicate all permitting decisions and set up procedures to resolve and communicate the outcome of disputes. The Net-Zero Europe Platform – chaired by a commission delegate plus member state representatives – will review progress, share best practice between member states, and steer individual nation approaches to make everything run as smoothly as possible.

Andries questions how this will be implemented in practice. He says it is unclear how effective and efficient it could end up being.

“With the Net Zero Industry Act, they are trying but I guess a lot of the red tape and ‘not-in-my-back-yard’ behavior is caused by national and local policies,” says Clingendael’s Van Schaik. “But the EC [European Commission] seems to make it possible for specific projects to be fast tracked and I guess this means less environmental permits and less citizen consultations.”

The NZIA is not the only piece of legislation addressing obstacles to permitting. Kristian Ruby, secretary-general of Brussels-based industry association Eurelectric, notes that the third iteration of the Renewable Energy Directive (RED III), provisionally agreed by the EU institutions in April, has put in place a new permitting framework. He says it is expected to significantly speed up permit granting, while respecting environmental legislation.

“Of utmost importance is the fact that the new framework gives member states the mandate to carry out sound spatial planning,” says Ruby. “That means combining nature, energy, and grid planning and involving all the relevant stakeholders. Maintaining the current positive momentum on renewables permitting in Europe will depend, to a great extent, on member states’ planning.”

Ruby adds that, for the first time, EU legislation under the revised RED is also very prescriptive on what permitting consists of; it provides clarity on the expected scope of documentation to be submitted and specific deadlines for the competent authorities to greenlight or reject a project proposal, with a maximum 2.5 years, or 3.5 years for offshore wind. It also grants the principle of “positive silence” for intermediary steps of the permitting process, meaning an application process can advance if the regulatory authorities have not acted within a given timeframe.

Ember’s Brown notes that permitting issues are not only related to regulation but also to the capacity of approvals agencies. “They need enough skilled workers and resources to speed up existing processes and cope with the increase in applications,” she says. “So, while new policies to cut permitting times under RED, REPowerEU and the GDIP are very welcome, there needs to be financial support available to address the barriers to faster permitting on the ground, and conditions must be put in place to ensure the efficient and effective allocation of these funds at the national level.”

Brown says the one-stop shop represents an opportunity to make the process more streamlined and to coordinate resourcing and upskilling, if appropriately supported and developed.

“Any speeding up of the permitting process must also avoid any decline in environmental-impact standards and scrutiny. So any central one-stop shop must ensure consultation about, and consideration of, local impacts and connotations,” she adds.

Market reforms

The European Commission proposed reforms to electricity market design in March, in a bid to reduce the influence gas prices have on power costs in wholesale markets. The proposal supports the uptake of power purchase agreements (PPAs) – long-term contracts between electricity consumers and producers of renewable power. The draft reforms also back two-way contracts for difference (CfDs) between power generators and the state, which are linked to a pre-defined “strike price.” CfDs are designed to shield generators from low market prices and at the same time prevent “excessive revenues” when market prices are high.

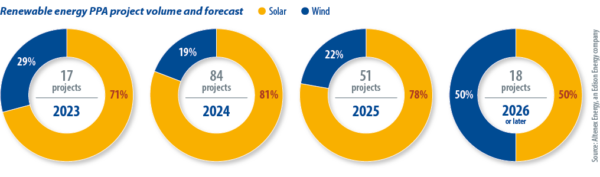

The uptake in PPAs had increased in recent years, albeit from low base levels, but growth stagnated in 2022, to around 6.6 GW of new contracted generation capacity, compared with 8 GW the previous year, according to data from RE-Source, the European Platform for Corporate Renewable Energy Sourcing. Total contracted capacity in Europe by the end of 2022 was around 26 GW, led by Spain, the Nordic countries, the UK, and Germany.

On the buy side of PPAs, corporations want to secure stable and predictable electricity prices under long-term contracts that also guarantee that the electricity is produced from renewable sources. On the sell side, electricity producers are looking to lock in supply for several years ahead in order to shore up financing and make a convincing business case for new projects.

One of the barriers to PPA growth, however, is counterparty risk. To this end, the commission’s draft electricity market design stipulates that member states shall ensure that instruments such as guarantee schemes are in place to reduce the financial risk associated with off-taker payment defaults.

Nevertheless, the proposal is very soft compared to what some Southern European countries had hoped for, which was separate markets for fossil-based and renewable power generation.

“It appears that the EC has chosen the right areas to focus on and it is a sensible approach to avoid fundamentally changing the spot market element of the existing energy market design,” says Brown, from London-based Ember.

Speaking at a Eurelectric conference in Brussels in the spring, Leonhard Birnbaum, chief executive of electric utility E.ON, acknowledged that market intervention by regulators and states could have taken a much more radical turn had it not been for the fact that energy prices have traded downwards in recent months.

“We have also to be fair, open, and honest and say we have been lucky,” Birnbaum said. “Because if the price crisis we have seen since August last year would have prevailed for another two months, the political pressure would have been impossible to withstand and then today we would have been looking at a completely different market.”

Birnbaum says the power sector is not only about climate action. “It is also about security of supply and affordability. I think the moment security of supply is endangered, it takes over as the most important target,” he adds. “We saw that last year.”

The timeline for steering electricity market reform through the EU Parliament and Council of Ministers appears ambitious. A number of compromises will have to be found in order to get the reforms adopted before EU elections in June 2024.

pv magazine put that question to Birnbaum at a press conference in Brussels in late March. “It depends how much they follow the advice ‘if in doubt, leave it out,’” he answered. “If they focus on a few topics I think there is a real likelihood that … it can be closed this year.” The commission, he added, “will be looking very hard at which battlefields to actually play up on and which not.”

Negotiations in the EU Parliament and council about the NZIA, electricity market reform, and the Critical Raw Materials Act are only just beginning, however a number of other key legislative instruments have already been adopted. They include reform of the EU’s Emissions Trading System (EU ETS) and the related Carbon Border Adjustment Mechanism which will see a tightening of the supply of carbon allowances to the market.

Under the new rules, the 2030 target for CO2 emission reduction in sectors covered by the EU ETS – which includes power plants, heavy industry, and aviation – will be increased to 62% from 2005 levels, compared with 43% previously. Free allowances to industry will gradually be phased out and will completely disappear by 2034.

Many analysts believe the outlook for carbon prices is bullish; that will make it more expensive to emit CO2, also for fossil-based power generation. Zero-carbon power generators are potential winners in this scenario. That, coupled with a 42.5% renewables target in electricity generation, by 2030 – which has yet to be formally adopted – bodes well for the solar industry as things stand.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

9 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.