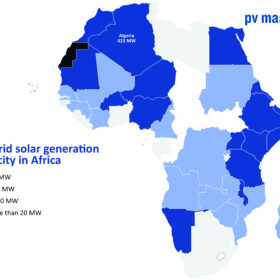

Africa’s winners and losers in the bid to go solar

While East Africa – and Kenya is particular – has made great strides in the provision of off-grid solar systems, Central Africa is a long way behind, according to a new report from IRENA and the African Development Bank. In terms of investment, the study’s authors wrote, much, much more will be required to achieve universal electricity access this decade.

RenewSys expands solar encapsulant capacity to 3 GW, aims for 11 GW

Solar manufacturer RenewSys has expanded its encapsulant capacity to 3GW with the addition of a new line at its facility in Bengaluru, India. The company aims to eventually expand its encapsulant capacity to 11 GW.

Oman inaugurates 500MW Ibri 2 solar field

Some 1.5 million bifacial panels make up the power plant in Ad-Dhahirah governorate which was constructed in just 13 months by ACWA Power, the Gulf Investment Corporation and Kuwaiti developer Alternative Energy Projects Co.

Quantum dot layer pushes perovskite solar cell efficiency up to 25.7%

Researchers in Switzerland have replaced the electron transport layers in perovskite solar cells with a thin layer of quantum dots. On an area of 0.08cm2, they achieved a record efficiency of 25.7% and high operational stability.

India’s solar module manufacturing capacity on track to soar 400% in four years

Ratings agency Crisil estimates India will have 38-43GW of annual solar module manufacturing capacity by the end of March 2025. Production capacity will be driven by strong domestic demand, favorable government policy, raised module conversion efficiency, and price competitiveness, according to the ratings agency.

European Commission advisory body slams plan to label gas and nuclear ‘sustainable’

The Platform on Sustainable Finance was unstinting in its criticism of a suggestion made by the EU executive on New Year’s Day, that the divisive energy sources be considered eligible for support in the bloc.

Shanghai Electric sounds death knell for CIGS manufacturing project backed by $197m of public money

With five public entities having committed RMB1.25 billion into a project to produce copper, indium, gallium, selenide solar modules five years ago, the joint venture has been abandoned at an estimated impairment cost of RMB1.42 billion.

Philippines utility Meralco launches 850MW renewables tender

Through the procurement exercise, the power utility is seeking proposals to deploy around 600MW of capacity that will have to start providing power in February 2026, and another 250MW to begin commercial operations in February 2027.

US zero-carbon future would require 6TWh of energy storage

US researchers suggest that by 2050, when 94% of electricity comes from renewable sources, approximately 930GW of energy storage power and six and a half hours of capacity will be needed to fully cover demand for electricity in the United States.

The weekend read: Dreaming of a MENA integrated electricity grid

The spark of renewables in the MENA region has increased the need for new interconnectors. Big projects with high capacities are being planned across borders to raise electricity exchanges across the region, reviving the dream of a MENA integrated electricity grid.