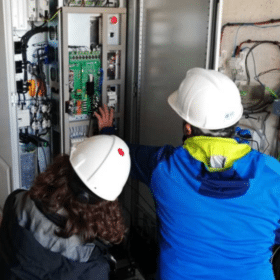

New power electronic device to manage surplus solar power

The device was developed by an international consortium through the EU-funded project Renewable penetration levered by Efficient Low Voltage Distribution grids (RESOLVD). The power electronic technology is claimed to be able to combine different storage technologies in a single electronic-based board interface.

Avancis claims 19.64% efficiency for CIGS module

The German manufacturer said the result was confirmed by the US National Renewable Energy Laboratory. The achieved efficiency is claimed to be a world record for a CIGS panel with an integrated series connection of 30×30 cm.

Silver accounts for 10% of PV module costs

The share of silver in the total cost of PV modules has increased by around 5% in recent months, according to US analyst Matthew Watson. He told pv magazine that silver prices are set to rise, adding that the metal will eventually account for an even larger percentage of overall module costs.

Creating an alternative PV supply chain in the US is no cakewalk

The US Solar Energy Industry Association in late 2020 launched a campaign against forced labor and said it was “strongly encouraging” member companies to adjust their supply chains by June. Here is what will likely happen.

Solar modules prices rose by up to 15% in China, Jinko’s vice president says

According to JinkoSolar vice president Dany Qian, PV panel prices rose significantly since the second quarter of last year due to an increasing shortage of polysilicon, glass, silver, and module frames. She also stated that rushing demand cannot stop prices from rising for at least the next six months or longer, until sufficient capacity ramps up.

GE chooses Australia to launch new line of solar inverters

Just as Australia thought its pioneering days were over, it has become the first country in the world to sell General Electric’s new solar inverters.

Canadian start-up secures US$2.5 million to launch omnidirectional anti-reflective glass

Edgehog secured the funds from Sustainable Development Technology Canada (SDTC). The special glass is hydrophobic and is claimed to be able to reduce the accumulation of dust and residue, thus reducing the need for maintenance.

Solar glassmaker posts another set of bumper figures

Xinyi has accelerated plans to add more furnaces this year and predicts the rebound in solar demand being driven, in part, by the desire of nations for a green recovery from Covid-19 will continue to keep supply tight.

Nerves of steel: European Commission considers extension to import duty

Since summer 2018, a 25% charge has been levied by the EU on steel-product import volumes in excess of historical norms. European manufacturers say there is still a global steelmaking glut and the U.S. is showing no signs of lifting its restrictions.

GCL-Poly continues to ramp production capacity commitments

The poly maker is making significant investment pledges into new production lines in Sichuan and Inner Mongolia.