Tesla results: solar down, batteries up

Elon Musk’s EV and energy company is becoming increasingly irrelevant in the rooftop solar market, but battery sales are booming.

China Power clean energy unit to de-list from Hong Kong exchange

The business will come under the control of its Chinese state-owned parent power company after a shareholder vote agreed the move earlier this month.

No respite for REC Silicon as shutdown dominates Q2 figures

The Norwegian polysilicon supplier – which has most of its manufacturing operations on U.S. soil – cannot give any estimate on when its solar material production lines will return, and has been left entirely dependent on the semiconductor products made by its Montana facility.

Greece returns to growth

After a few years of stagnation, Greece’s PV industry is back with a plan to tender 430 MW in 2019 and to develop hybrid PV and wind projects.

Nuclear: A poor investment strategy for clean energy

Study claims that investment in a new 1GW nuclear power plant leads to average losses of approximately 4.8 billion euros. It further argues that the technology’s dangerous radioactivity emissions and proliferation risks do not qualify it as a ‘clean’ energy solution to be considered for addressing climate change. Yet still, governments are incorporating the technology into clean energy plans around the world.

More big PV Down Under, as South Australia’s wind and solar pipeline swells to 10 GW

With the approval for a 176 MW solar farm and 66 MW battery storage facility near Murray Bridge, South Australia’s utility-scale wind and solar pipeline has reached some 10 GW.

New-look auctions fire up Brazil

Next up in pv magazine‘s unsung solar markets series is Brazil, where a new series of auctions for solar has provided much needed clarity to the sector, at least up until 2021.

Myanmar issues tender for rooftop PV

The nation is targeting an unspecified capacity of solar PV systems to be installed on households and public facilities across several of its regions. The successful projects will be jointly financed by the World Bank and the government of Myanmar.

Putting China’s electricity market reforms on the spot

A report by the U.S.-based Rocky Mountain Institute has modeled scenarios for the deregulation of electricity markets in China. The report finds the implementation of a spot market would drive increased integration of renewables and provide significant reductions in costs and emissions.

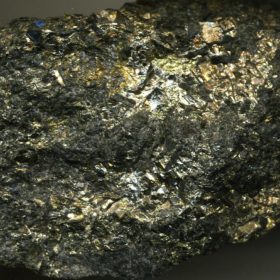

‘Investment in nickel production needs to happen now’

Rather than helping electric vehicle take-up by driving down costs to parity with traditional engines, the low price of nickel at the moment is deterring investors and could cause a supply shortage that holds back electromobility in a few years’ time.