Dutch construction company invests in 300 MW solar module factory

The factory is under development in Eindhoven by Dutch start-up Solarge, and is scheduled to begin manufacturing activities in March.

SDN opens heterojunction module factory in South Korea

Planned to be located in Gwangju, in southwestern Korea, the new factory is expected to reach a capacity of 385 MW and to produce 550 W panels.

Ecuador announces renewables auctions, plans to allocate 1 GW

Ecuador plans to launch a 500 MW procurement exercise in November.

Guggenheim Solar Index: PV supply chain shake-up

Solar stocks have underperformed in the broader market in August, writes Jesse Pichel of ROTH Capital Partners. Project delays could be on the horizon as more module imports are held up at customs, and the supply chain will start to see impacts as suppliers look for options to source polysilicon outside of China.

Price increases hit US solar as trade uncertainties with China cloud growth goals

Price increases, supply chain disruptions, and a series of trade risks are threatening the U.S.’s ability to decarbonize the grid, warned SEIA president and CEO Abigail Ross Hopper.

The Hydrogen Stream: work begins on Chile’s first green hydrogen project and French energy giants target decarbonized hydrogen

TotalEnergies wants to decarbonize hydrogen production in Normandy with the support of Air Liquide and, in Chile, an international consortium has begun construction of the country’s first green hydrogen facility. Elsewhere, the Indian government has invited U.S. companies to bid for green hydrogen and electrolyzer contracts.

Chinese PV Industry Brief: Rising wafer prices and a big tracker order

AntaiSolar has secured a 400 MW contract from Ningxia Jiayang Energy and Longi has raised the prices of all its wafers. Elsewhere, GCL New Energy has announced the sale of another 198 MW of project capacity.

Pakistan’s looming water crisis could be eased by a solar-led energy system

With renewable energy generation said to consume up to 95% less water than fossil-fuel fired power plants, solar could lead the way to a less stressed existence in mid century, according to researchers from Finland’s LUT.

China holds the key to cancelling half the world’s new coal project plans

With pressure mounting on the world’s governments to turn their back on the fossil fuel, China and peers in South East Asia, Europe and South Asia could help deliver a coal-free future at the COP26 climate summit planned in Glasgow in November.

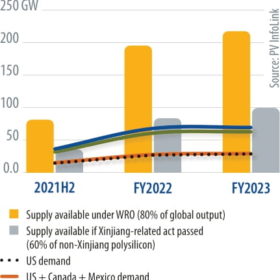

Polysilicon amid international trade disputes

Polysilicon capacity is unable to catch up with rapid capacity expansion in the mid and downstream segments, writes Corrine Lin, chief analyst for PV InfoLink. New polysilicon capacity requires big capex investment and a lead time of more than two years to complete construction and reach full operation. With unbalanced capacity between the upstream and downstream segments, polysilicon prices have been rising since the second half of 2020, with prices for mono-grade polysilicon surpassing CNY 200/kg ($27.40) in June 2021, up more than 250% year on year.