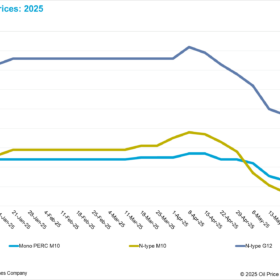

Solar wafer prices decline 22.78% since April peak

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

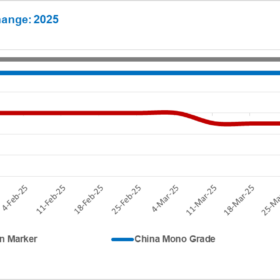

Polysilicon market seeks strategic solutions amid persistent pessimism

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that pessimism in the global polysilicon market has deepened, driven by a persistent oversupply that exceeds buyers’ total monthly purchasing volumes. Several global polysilicon buyers have confirmed maintaining substantial inventories, which has contributed to the current subdued trading activity.

Chinese PV Industry Brief: CATL surges in Hong Kong trading debut

Chinese battery giant CATL surged 12.55% on its Hong Kong trading debut after raising HKD 35.6 billion ($4.6 billion), marking the world’s largest listing in 2025. The offering drew strong demand from strategic and cornerstone investors, boosting CATL’s market capitalization to HKD 1.34 trillion.

Chinese PV Industry Brief: Tongwei, GoodWe post 2024 losses

Tongwei says it recorded a $969 million net loss for fiscal 2024, while GoodWe posted an $85 million loss and Ginlong’s net profit fell 11.3% to $95 million.

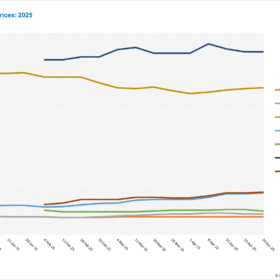

China module prices bearish, U.S. prices rise on tariff policies

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that TOPCon modules from China held steady at between $0.085-0.090/W. It also reveals that Europe prices for TOPCon modules of over 450 W rose by 0.96%, assessed at €0.105/W.

Corning to expand solar wafer manufacturing in Michigan

Corning says it will add 400 jobs and contribute domestically produced wafers to the US solar supply chain with an investment of $1.5 billion.

Chinese PV Industry Brief: Polysilicon, solar module prices continue to slide

Polysilicon prices fell again this week amid weak market activity and elevated inventories, according to industry sources. Downstream wafer, cell, and module prices also continued to slide, with modules now trading as low as CNY 0.68 ($0.09)/W.

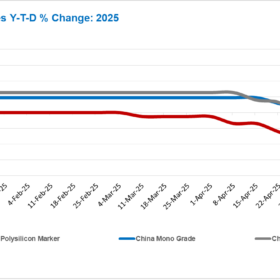

Polysilicon prices decline amid growing short-term market pessimism

In a new weekly update for pv magazine, OPIS, a Dow Jones company, reports that prevailing pessimism in the global polysilicon market continues to intensify, with current conditions still favoring buyers to a certain extent, allowing them to retain a degree of leverage in negotiations.

China identifies major high-purity quartz deposits for PV industry

China has identified two new high-purity quartz deposits as it seeks to localize supply for solar and semiconductor production and reduce dependence on US imports

Chinese PV Industry Brief: Polysilicon output rises, stirring oversupply fears

China’s polysilicon and solar module prices held steady this week amid low trading volumes, but softening producer quotes and rising output across the supply chain signaled mounting oversupply risks.