Pexapark records slight increase in European PPA prices for August

Power purchase agreement (PPA) prices increased by 1.4% on average in Europe in August, according to Pexapark. It says that only nine deals with a combined capacity of 193 MW were closed.

Albania approves first unsubsidized large-scale solar projects

The Albanian government said last week that unspecified developers have agreed to build two 20 MW solar projects in the nation’s Korça region. The authorities also said that renewables operators will now have to pay fees for grid imbalances.

Bangladeshi fabrics maker invests in 100 MW solar plant

The solar park will sell power to the Bangladesh Power Development Board at a price of $0.1195/kWh under a 20-year power purchase agreement.

India installed 1.2GW of unsubsidized solar in 2021

India surpassed 5GW of cumulative, “open-access” solar capacity in December.

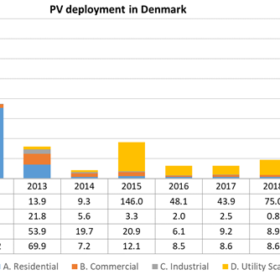

Unsubsidized utility scale solar changing shape of Danish PV market

In a short interview with pv magazine, Flemming Vejby Kristensen, from the Danish PV association Solcelleforening, explained the surprising performance achieved by Denmark’s PV market in 2021, in which around 667.6MW of PV capacity was deployed. Around 94% of this growth is coming from large scale unsubsidized solar projects and the segment’s main driver has been the willingness of big corporations to buy green electricity under bilateral PPAs.

Latest Polish renewables auction shows momentum of unsubsidized solar

Recent analysis from German consultancy Enervis has shown that only 40% of the electricity to be generated by solar capacity in Poland’s latest auction for utility scale renewables will be sold under the exercise’s contracts for difference regime, and that the remaining share will be sold under bilateral power purchase agreements or to the spot market.

Netherlands’ first unsubsidized solar park

The 16 MW project is under development by Swedish-based utility Vattenfall. Construction is scheduled to start in 2024.

Growing interest for utility scale solar in Czechia

Several utility scale solar projects are being developed in Czechia, with investors hoping to secure subsidies from a recently launched rebate scheme that covers up to 50% of the costs. Securing a PPA to sell power, however, may be more difficult, as the current market conditions do not offer many opportunities for long-term deals.

Anumar switches on southern Germany’s largest solar park

The 120 MW solar plant will sell power under two long-term PPAs for the electricity to be generated by 90 MW of its capacity.

Rising gas, electricity prices create new opportunities for short-term PPAs in Europe

Higher gas and electricity prices could open up new opportunities for short-term power purchase agreements in the Italian and European renewable energy markets, according to Stefano Cavriani, the founder and director of EGO Energy, an Italian company that specializes in PPA hedging. In a chat with pv magazine, he explained that electricity prices should not increase more, but they may stabilize at current levels, or slightly below the €100/MWh threshold.