-

Cultural barriers easing…

Even in a city as large and global as Tokyo, Japan’s monoculture is evident in everything from food to music, film and fashion. The ‘Japanese way’ of doing things informs most daily interactions, with even the ubiquity of the English language relegated to also-ran status. This makes doing business in Japan more challenging than in nearly all other developed economies. And, allied to domestic excellence across most industries, it can prove a dauntingly impenetrable prospect for foreign companies. The solar industry has first-hand experience of this, but as the market matures the opportunities for international companies to prove their value are increasing.

Although the residential solar and storage markets remain difficult to penetrate, at the commercial and industrial (C&I) as well as utility-scale, the landscape has shifted. Japan’s Ministry of Economy, Trade and Investment (METI) has confirmed a further FIT cut in April, and with solar subsidies suddenly less lucrative, developers and businesses are looking for ways to lower costs. Here, Chinese module and inverter suppliers in particular are sniffing a wealth of opportunities.

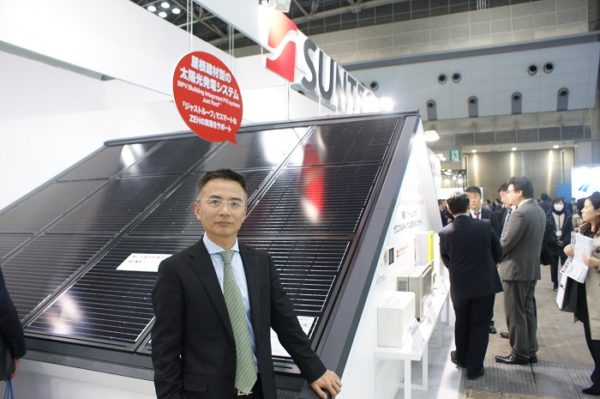

“Competing against Japanese branding has long been a challenge for us,” Trina Solar Japan president Ye Chen told pv magazine. “But we see more and more foreign suppliers in the Japanese market, and that is altering the landscape. We are looking at downstream opportunities such as utility-scale development, as well as high efficiency products and increased quality control to work more closely with customers. Energy is becoming more decentralized in Japan, and this way of thinking is new to the country, which highlights to us that a change is in the air.”

-

…and foreign companies understand the market better

Japan has been the world’s third-largest solar market for the past few years, so it is by no means completely insular, nor hostile to overseas companies. But as the sector has matured, so too have foreign firms’ approach to the nuances of doing business in Japan. Many of the world’s largest solar PV brands have only recently ramped up their efforts to go big in Japan… and it would appear that 2017 could prove to be pivotal in ushering in more overseas influence on its solar landscape.

“Given the high labor costs and high land prices of Japan, we have made a concerted effort to offer customized solutions to the market,” said JinkoSolar VP global sales and marketing Gener Miao. “To achieve this we have invested in a local warehouse, local support and logistics, and expanded the local team to be able to offer the kind of expertise the Japanese market wants. Only by providing more local service can we break into the Japanese market fully.” Miao revealed that JinkoSolar has expanded its Japanese staff from 20 to 40 in the past few months, and has also opened a new office in downtown Tokyo’s exclusive Ginza district.

This approach is echoed by that taken by SolarEdge, which last week increased its Japanese sales and logistics presence significantly. “For years we found it tough in Japan because, simply, we could not get JET [Japan Electrical Safety & Environment Technology] certification for our inverters,” Lior Handelsman, SolarEdge’s VP of marketing and product strategy, admitted to pv magazine. “This year is different, and we are getting good responses for our full solutions for the commercial space.” SolarEdge does not yet have JET certification for the residential space, but Handelsman said that the firm’s growing Japanese team has helped to facilitate growth. “We have more than doubled our team in Japan, including additions in the technical specifications space, so that we are able to converse, in Japanese, more directly with the industry. Japan is a conservative market so growth takes time, but there is no reason why we can’t become a leader in the inverter space.”

Sungrow’s SVP for the PV & storage division David Zhao stressed that Japan has always been a challenging market to operate in, but the Chinese firm’s successes in other international markets has laid the groundwork for better recognition in the country. “Brand name recognition is very important in Japan,” Zhao said. “We shipped 11 GW of inverters globally in 2016, and that has a big impact on perception, particularly given that we can be very competitive with Japanese suppliers on cost.”

-

Residential sector poised to drive the market by 2020

METI’s outlines for Zero Energy Homes (ZEH) are being taken very seriously by homebuilders in Japan. The targets for 2020 and 2030 are strong push factors for the adoption of solar PV, with all new homes to be built between now and these two dates likely to have solar installed as a minimum, with the wider remit to have all new homes zero-energy by that later date.

“This is a big driver for residential solar,” said IHS Markit solar research manager Cormac Gilligan. “The sales channel currently is dominated by the likes of Panasonic and Sharp, which sell these home kits comprising panels, inverters and storage. This is something of a closed market given there are only a handful of homebuilding companies, and the preference remains strongly in favour of Japanese brands.”

However, given the decreasing FIT, homeowners are becoming more sensitive to costs – and this is somewhere in which foreign suppliers, particularly in the module and inverter space, have been able to make gains. “As the FIT has decreased it has helped foreign companies because Japanese solar companies have been unable to lower costs at quite the same rate as that seen by foreign suppliers.” Companies such as SMA and Delta, for example, have had a good year in Japan, and both Huawei and Sungrow can expect to increase their market share at the expense of Japanese inverter suppliers in 2017, Gilligan added.

-

Megasolar sector has three strong years ahead of it

The general consensus on the show floor at the PV Expo was that the impending shift away from large-scale growth and towards rooftop installations in the Japanese solar market will happen gradually. Things take time to develop in Japan. The country is naturally cautious and favors long-term planning over short-term gains or knee-jerk decisions.

But this mindset has not always been favorable to the large-scale sector. A problem the industry has faced for a long while was developers securing high FIT tariffs and then sitting on their projects as they waited for systems and installation costs to fall. METI has now said that, by April 1, all unbuilt projects with a FIT scheme in place must have made concrete actions towards development, or risk losing the subsidy. This has caused a rush of movement in the large-scale sector, some observers have noted. “Everybody has been rushing into the megasolar sector because of the attractive FITs,” Conergy Japan MD Hideyuki Otaka told pv magazine. “But because of the government policy changes and the reduced FIT, interest will wane. But for now, for the next four-to-five years, actual business will remain strong. There will be lots of construction activity at least for the next two years.”

JinkoSolar’s Gener Miao added that even with the lower FIT (which will fall to around $0.17-$0.18/kWh for large scale projects in April), given the one-to-two year build out times of these large-scale projects, the lower subsidy rates will prove attractive by 2018-19 because PV system costs will continue to fall.

-

Japan is fertile ground for battery and inverter innovation

With the ongoing and impending changes in this mature solar market, innovation is never far from the surface. In the rooftop sectors, the lower FITs and falling PV module costs are creating a perfect storm for storage – and this is turning the heads of leading suppliers. “We can’t compete at this stage in the residential storage market given the strong branding of local suppliers such as NEC, Panasonic and Hitachi,” said Trina Solar’s Chen. “But we are looking closely at the home storage market in Japan, and will soon begin promoting our home system packages comprising modules, inverters and storage systems.”

On the inverter front, SMA’s MD for Japan Takeshi Imazu believes that the large-scale solar sector will evolve from 70% centrally controlled to a 50/50 split between string and central by 2020. “The decentralized solar landscape is evolving because of land space and availability constraints,” Imazu said. “More and more ground-mounted plants are being built in remote and mountainous regions. And that presents problems for central inverters. Having said that, central inverter-controlled large-scale plants are still the preference in Japan, which is why we have introduced our 2.5 MW containerized inverter to the market.”

Sungrow’s Zhao added that many developers who had sat on generous FITs are optimal plots of land are leaning towards adding central inverters given that Capex costs tend to be lower. “As prices for modules and inverters have dropped since they secured their FIT rate, the demand to finish these projects using central inverters is growing.”

Germany’s Kaco New Energy, meanwhile, has introduced its 20 kVa and 50 kVa string inverters to the Japanese market, and sees these products as ideally suited for both utility and commercial scale projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is a great article, that I really enjoyed reading. Thanks for sharing.