Make an abrupt change, and there will be abrupt consequences. It’s commonsense. That’s why it is no surprise that, on the back of China’s recent announcement to put the immediate brakes on its PV industry charge, overcapacity looms, prices are set to free fall, and 2018 global demand is on track to decline.

In the latest analysis released, Taiwan-based TrendForce estimates that negative growth will be recorded this year – around 5-8% – to fall to 92 to 95 GW. This compares to the 98 to 99 GW that were installed in 2017.

This forecast is more bleak than both IHS Markit’s – which revised its expectations down from 113 GW to 105 GW – and SolarPower Europe’s, which expects to see 102 rather than 107 GW this year.

In China, meanwhile, TrendForce says installations will drop 40%, to 31.6 GW. There is expected to be an installation rush ahead of the June 30 deadline, where those plants connected to the grid will still receive the 2017 FIT. “But only ongoing projects, which are in the stock-up and development phases, will be able to grid-connect in time successfully,” said the analysts.

Demand in Q3 is set to be “considerably slashed” on the back of the new regulations, although a rebound is anticipated in Q4, due to the Top Runner program, which has not yet been affected by the changes, and poverty alleviation projects.

Under the Top Runner program, a quota of 32 GW has been allocated between 2017 and 2020. TrendForce said this may not be completely implemented, but that the government will attempt to execute as much as possible since it “attaches great importance to the program”.

Next year – 2019 – is expected to bring with it not just global installs of over 100 GW as new markets are attracted by the falling module prices, but also an increase in unsubsidized projects in China. Indeed, the Taiwanese analysts believe the central government will encourage its local counterparts to support the industry based on their policies.

“This will improve the problem of insufficient subsidy and make the companies more competitive in the market,” said TrendForce.

It added, “As the bids for Top Runner Program have lower prices for FiT rates and modules, grid-parity may be realized earlier than expected. Coupled with electricity trading and trade of green energy certificate, more unsubsidized projects are expected to appear in 2019.”

Regarding distributed generation (DG) projects, TrendForce expects the 10 GW quota to be used up soon, consequently the June 30 deadline will not create much demand.

However, the “detailed regulation” for these types of systems is expected to “significantly affect demand” between the second half of this year and 2020. “Provinces with greater penitential to develop DG systems will be more favorable,” it said.

Confirming predictions last year that installs in China will veer away from utility-scale, which until now has been the dominant sector, Q1 2018 saw a massive increase in DG: of the 9.65 GW of PV installed, 7.68 GW comprised DG systems, reported China’s National Energy Administration (NEA) in April.

Weakening protectionism

In addition to creating an oversupply situation, and lowering PV module prices, China’s latest decision will also serve to push domestic suppliers to enter other, overseas markets. This will have the knock-on effect of lowering global average selling prices (ASPs) and, thus, weakening the tariffs imposed under the Section 201 trade case.

“The tariff listed in Section 201 will be reduced to 25% in 2019. At that time, the imported modules will have lower prices than those traded in the U.S. market even with the 25% tariff, which will make the imported modules more competitive in the U.S. market,” said the analysts.

History repeating itself?

2011 was a devastating year for the global solar PV industry (it was also the year that China first unveiled a FIT, and the year the first trade wars began, in the U.S.).

FIT uncertainty spread across Europe, particularly in Italy, the Czech Republic, Germany, France and Slovakia, which, in addition to the impact of the Spanish market crash, spurred freefalling module prices – around 22% in Europe and Japan, and 30% in China.

This did not, however, trigger the expected higher demand, due to (i) higher project financing; and (ii) buyers waiting for further price drops.

Last week, Bloomberg New Energy Finance said it expects to see a 34% decline in multicrystalline solar module prices in China, which would be roughly equivalent to the fall in module prices in 2016 and 2011. As China is the largest solar market, this drop will, of course, spread out, and affect other markets.

![]()

Polysilicon prices for multi are expected to be most significantly affected, having fallen from around to 125 RMB/kg (around US$19.5) in April, to an estimated 105 RMB in June. They are set to fall further to 95 RMB by the end of this year, and to around 87 RMB by next June.

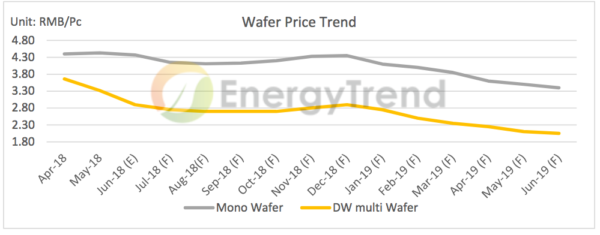

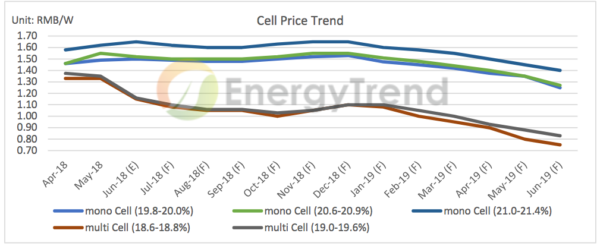

For multi wafers, prices are set to drop from just under 3.80 RMB in April, to just under 2.30 RMB (around US$0.36) next June, and for modules between 270-275W, from 2.50 RMB to around 1.60 RMB (around US$0.25).

Image: TrendForce

As happened last year, when China blew the socks off the global PV industry with its unanticipated high levels of new installations, it will be interesting to see what the rest of the year brings.

Abrupt changes do not lay down the foundations for a sustainable strategy and predictable path forward, but one can only hope that some lessons were learned from 2011.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I do not think so, things changed in Chinese market, they will not over produced anymore, due to their cash flow tight up with Chinese new economic strategy.

If those analysis gave this kind of image, and system deal price keep sharping dropped, it is interesting what will happen.

Has anybody considered putting solar tiles on wind generators the large propelers and the tower structures as surely this could be win win .Just a thought.