From pv magazine 08/2021

To keep solar and wind installations rolling toward the ambitious 2030 targets in place in many regions, large amounts of energy storage will be needed to help balance the intermittent nature of these generation technologies. Consequently, grid operators and energy regulators are beginning to consider more closely how batteries can fit into the wider energy landscape and open up new business models and potential revenue streams, both to encourage further installations and to maximize the value that can be gained from them.

The majority of large-scale batteries developed to date rely on frequency response as a grid service for their primary revenue – charging or discharging over short intervals to keep grid frequency within acceptable operational limits. The bankable revenues from the provision of grid services, paid to the storage unit for its availability to meet frequency regulation needs, allowed early large-scale battery projects to achieve financial close.

However, frequency regulation markets are limited in size and can become saturated in a relatively short period of time. “Immediate use cases [for battery storage] are grid support services,” says Christopher West, who heads the central solar and storage engineering team at Norwegian state owned utility Statkraft. “That’s where most of us have the business model [for large-scale batteries].”

Statkraft operates a vast fleet of hydropower assets, producing some 65 TWh of what it describes as “environmentally friendly” electricity in 2020. It strengthened its position in the solar and battery storage industries in late 2020 with the acquisition of U.K.-based developer Solarcentury.

“We are seeing a trend of batteries reducing reliance on frequency response for their revenue. Though this will continue to be an important part of the revenue stack, prices for frequency response services are falling substantially and we don’t expect it to drive much more growth,” says George Hilton, senior analyst for batteries and energy storage at IHS Markit.

While large-scale battery developments to provide grid services are encouraging, as solar and wind grid penetration continues to increase, there is a growing need to time-shift energy generated by renewables to cover more of the day, something batteries are well placed to do.

“An interesting way that might be replaced is by larger, longer duration solar+storage projects, and we’ve seen a couple of clues that this may be starting to happen,” adds Hilton.

Hilton points to a recent tender in Portugal that favored solar+storage projects, as well as Germany’s innovation tenders – which in May awarded contracts for a total of 258 MW of new solar across 18 projects, all to be developed in combination with batteries – as evidence for the coming trend.

“We are starting to transition into a phase where, instead of energy storage just being used for these niche applications, it will be starting to support bulk energy shifts,” Hilton adds. “And that’s why we see this growing trend of co-location and longer durations.”

Statkraft’s West reports that the company has a pipeline of co-located solar+storage projects, “some of which are under active development.” However, he acknowledges that some of the more concrete business cases for large-scale storage are yet to be realized.

Co-located projects

Regulatory frameworks currently in place appear to be holding back the development of batteries for time-shifting applications. Yet, co-located renewables and storage projects are already becoming more commonplace, as they allow for a smaller, and thus lower cost, grid connection for both the battery and the generation asset.

“When you have grid constraints you can store energy and release it later on,” explains West. “So, where maybe you could only have installed 50 MW [of PV] because you only had a 50 MW grid connection, maybe you could use a battery. And you could still only be injecting 50 MW throughout the day, but you could install a 100 MW PV plant, store that excess and then release that at night – so you can get around grid constraints.”

Despite the attractiveness of this business case, the trend with existing co-located large-scale solar and battery energy storage assets is for them to be operated quite separately.

“There are still challenges in lots of markets in having hybrid trading units,” explains Jon Ferris, head of flexibility and storage at Delta-EE. “To participate in markets, a lot of solar+storage projects are treated separately – individually dispatched on balancing and re-dispatch markets. And they might as well be on separate sites.”

Forecasting matters

For developers and project owners there are clear benefits to the assets being considered together, as in the grid constraint case, the challenge to developing market models for this come from the system operator side. This is particularly true when it comes to forecasting available energy at a certain location on the network.

With a solar project in a particular location, the operator can look at the weather and forecast how much power will be available at that location – or require the asset owner to do so. But if there is also a battery behind that meter, and its state of charge or what the owner is doing in terms of charging or discharging at a certain time is opaque, the system operator has less visibility of how much energy will be available. And when this is combined with the fact that grids are increasingly composed of a larger number of small assets, the picture for operators gets even more complicated.

“It does make forecasting more tricky for the system operators, and there are some challenges that they need to overcome before they can accept the co-location as a traded unit,” says Ferris. “We just need the regulator to push it through, and to leave the system operator with the responsibility of working out how to manage it, rather than saying ‘it’s too difficult, we have to treat them separately.’”

An alternative to direct regulation – changes to wholesale energy pricing throughout the day – could create an opportunity for storage to fulfill this deeper time-shifting role in combination with renewables. For solar, this would require lower prices during the day, rising in the evenings when less generation capacity is available, to create an incentive for projects to store power and discharge it later in the day.

“For a merchant opportunity to emerge you wouldn’t necessarily need more regulation, but you would need more variability in the wholesale tariff throughout the day,” says Hilton. “In that instance we would see solar+storage on a merchant level with longer durations across Europe. But we’re still far away from that.”

Multiple markets

The United Kingdom has been among Europe’s leading markets for battery storage. As an island with weaker interconnections than much of continental Europe, the U.K. saw a greater need for the frequency regulation services offered by batteries than some neighboring countries and is showing signs of extracting more services from them. It was also an earlier mover in deregulating its grid services market – making it available to battery project developers and owners.

Recently, renewables developer Penso Power connected the largest battery seen in Europe to date to the U.K.’s grid – the 100 MW Minety battery project located in southern England. The battery will initially operate into the national grid operator’s “dynamic containment” service for frequency regulation but expects to participate in other markets as well. Shell subsidiary Limejump has worked on optimizing the battery via software to serve these varying functions.

“Batteries can compete in a multitude of markets in the U.K. including ancillary markets, wholesale power markets and the ‘balancing mechanism’,” explains Genna Boyle, head of renewables and flexibility at Limejump. “Initially, the Minety battery has been optimized into National Grid’s new ‘dynamic containment’ product. Limejump has also set the battery up as a balancing mechanism unit should extreme prompt market volatility arise, and it has secured a ‘capacity market’ contract, benefiting from guaranteed payments every month.”

Limejump says that the dynamic deal under which the Minety battery will operate, providing revenue certainty for owner Penso Power, has already encouraged further investment in the U.K.’s large-scale storage sector, and that it is speaking to a number of developers about future projects.

“We expect to see a trend towards larger storage projects following the relaxing of storage planning requirements and the increasing need for batteries to maintain security of supply as we transition towards net zero,” adds Boyle. “Investors are likely to fall into two camps: those requiring a floor price and those willing to take on some merchant risk for better returns.”

In the most optimistic scenario of its latest Future Energy Scenarios report, U.K. utility National Grid says it will need 18 GW of energy storage by 2030, which it expects to break down as 12 GW of batteries, 4 GW pumped hydro and 2 GW of vehicle to grid. And a recent report published by the government’s Department for Business, Energy and Industrial Strategy (BEIS) acknowledges barriers to operating storage alongside renewables assets operating under the country’s contracts for difference (CfD) scheme, and says it will revisit these if necessary – promising to produce clear guidance on co-location requirements to facilitate the addition of energy storage.

“In principle, storage should be able to provide grid services and store power from CfD generators, providing the metering arrangements can distinguish between the two,” the report states.

Further consideration of these arrangements by energy regulators like the U.K.’s BEIS could bring together the currently quite separate revenue streams for solar and storage assets, and this could create space for much more energy storage, both standalone and co-located with renewables, in the U.K. and across Europe. “Frequency regulation and other markets that the storage industry has lent on for growth are quite shallow,” says Hilton. “But this is much deeper, and likely to drive a second wave of growth across Europe.”

Merchant emerges

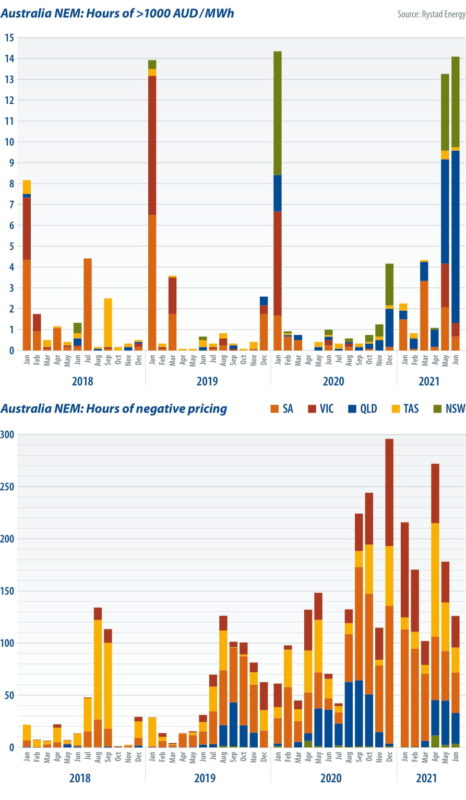

The merchant opportunity for large scale battery storage, arbitrage trading and time-shifting renewable production during periods of excess solar generation, is fast emerging in Australia – another island grid, or rather five weakly interconnected electricity markets. The combination of rapidly expanding both distributed and large-scale renewables is leading to both more frequent occurrences of negative price events and extreme price spikes, on the country’s National Electricity Market.

“There’s a record amount of new variable generation coming into the system and the amount of dispatchable generation has been declining,” observes David Dixon, a senior analyst for Australia renewables research at Rystad Energy. And the trend, Dixon notes, is accelerating with existing aged coal generators retiring and an increasing number struggling to remain viable as renewables continue to drive down wholesale prices. Most notably, the Liddell Power Station, with some 2 GW of generation capacity, is set to go out of service in 2022.

The retirement of coal generators in Australia, their decreasing reliability, and extreme weather events are all conspiring to make high price events in the major state electricity markets far more common (see chart top right). The number of hours in which wholesale prices exceed AUD 1,000/MWh ($740/MWh) increased throughout 2020, with the only dampener to the trend since 2018 being one relatively mild summer, which itself was an anomaly, as global warming accelerates and Australian summers intensify.

“This is where the opportunity lies for batteries,” continues Dixon. “Charging on the negative, so you are getting paid, and then if prices are over AUD 1,000/MWh, then you can make a lot of money very quickly.”

This has been the case for French IPP Neoen’s Hornsdale Power Reserve, located in South Australia and developed in 2017 at 100 MW, only to be expanded to 150 MW in 2020. While benefiting from state government payments for the provision of system strength – a necessity born of weak interstate interconnection and the closure of all coal-fired generation in the state – and revenues from frequency regulation markets.

Neoen is far and away the market leader in Australia of large-scale battery development, and is currently installing the 300 MW Victorian Big Battery (VBB). But it has been joined by renewables developers Lightsource BP and Risen Energy – alongside Australia’s vertically integrated utilities, or “gentailers” that are developing big batteries alongside their existing or retiring fossil fuel assets. Rystad tracks a pipeline of some 37 GW of utility-scale battery storage projects at various stages of development in Australia, with 500 MW likely to be installed in 2021, growing to a 1-2 GW annual market in the near future.

While promising, this rate of large-scale energy storage is still below what the Australian Energy Market Operator (AEMO) envisages as being required under its 2020 Integrated System Plan, in particular its “Step Change Scenario,” as “development is not really keeping up,” says Dixon.

The shortfall, it appears, is the lack of revenue certainty in arbitrage models – particularly for battery assets with an expected lifetime of 10 years. Debt financing is difficult to come by when so much in the market is in flux. “During those peak events is when you make your money and pay these things back very quickly, but it’s very hard to put these in a business case – the spikes are only happening 14 hours a month in the best case,” says Dixon.

The result, and the list of companies willing to take the risk is telling, for developers and equity investors is a requirement to stump up more of their own money. “The reason the very large players in the market are the first movers on these projects is that they can afford to,” says Ben Cerini, a principal consultant with Cornwall Insight. Encouragingly, some innovation around contractual and financial structures is showing promise for co-located energy storage assets.

“There are opportunities to shift generation from co-located solar or utilize otherwise curtailed energy,” continues Cerini. “Some assets are being leased, some have tolling arrangements – it even appears that a swap or option arrangement is the basis for the Maoneng contracts with AGL, they can also be used as a physical hedge against a retail book which allows the owner to spend less on procuring actual hedging instruments.” The AGL deal to which Cerini refers is for 200 MW of storage, across four projects to be installed in 2023. AGL is one of the “gentailers” that occupy much of the competitive landscape in Australia and Maoneng a solar project developer.

For large-scale solar developers, the market, regulatory and financial innovations in leading large-scale battery markets the U.K. and Australia are paving the path for future growth – and for making the addition of storage to a solar project an inevitability. “It’s going to become that a battery is a fundamental piece of a solar farm and the whole LCOE calculation,” says Statkraft’s West. “It’s going to get to a point where we’ll be talking about storage and PV plants in the way now we’re saying about bifacial. It’s just going to be a must have component in a PV plant.”

| Commissioned utility-scale batteries on Australia’s NEM – as of May 21, 2021 | |||

| Region | Site name | Capacity (MW) | Storage (hours) |

| South Australia | Hornsdale Power Reserve Unit 1 | 150 | 1.25 |

| South Australia | Dalrymple BESS | 30 | 0.27 |

| Victoria | Ballarat Energy Storage System | 30 | 1.0 |

| Victoria | Gannawarra Energy Storage System | 25 | 1.97 |

| South Australia | Lake Bonney BESS1 | 25 | 2.08 |

| Source: AEMO | |||

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Talking about energy storage and then only mentioning batteries is very special. Look at the table at the end and pay attention to the times. Half an hour to 2 hours. This is not even daily storage, let alone seasonal. This is why battery people prefer to talk about MW and not MWh.

When it comes to a longer supply, the battery can no longer be used very quickly. This is because the power and capacity of a battery cannot be scaled separately. It is very important to understand this quality. If you add capacity to a classic battery, you always add power and capacity together. Quite different with a redox flow battery or a hydrogen fuel cell. Once the generator power is sufficient, the tanks of the redox flow battery can be enlarged separately, just like with a hydrogen fuel cell.

As a consequence, you can use battery storage for a few hours to maybe a maximum of a day of supply, everything that is above must be covered with other technologies.

Joke: For longer storage times, it is better to use firewood instead of batteries. Batteries have an energy density of around 300 Wh per kg, firewood has 5,000 Wh per kg.

Two additions.

1. Why aren’t we seeing a parallel boom in cheap and potentially abundant off-river pumped hydro storage? It’s doing all right. but nothing spectacular. I speculate that part of this is down to NIMBY opposition and cumbersome regulatory schemes designed for flow hydro, which has much greater impacts on river ecosystems and amenity. But I suspect more of it is simply the long timescales (>5 years), out of kilter with the short timescale of wind and solar development. Pumped hydro needs a stronger lead from governments to fulfill its enormous potential.

2. Trade. Interconnections boost the efficiency and value of storage as well as generating assets. The renewable trade champions today are Norway, Paraguay and Quebec, but others could get into the business: why not Nepal, Oman and even North Korea?

Good Ork For A Green World

Adding to the comments of Mr Wimberley and Mr Sperling, I’m doing a community energy project – 175 households, gas heated. The way forward, as we have modelled it, is a combo of PV & wind plus network connected li-ions to cover “when the sun goes down” plus electrolysers – to absorb large amounts of PV (summer) and to deliver H2 for heat (plus heat and recovered from the electrolysers – remember – they are only 73% efficent). We looked at reflow batts – but the numbers wrt to capex don’t add up. Pretty confident we have a “stand on its own two feet” approach which we are likely to implement in, of all places, the UK.

Spot lithium prices have doubled since December 2020 and look likely to keep on rising as global lithium demand exceeds supply.

https://www.forbes.com/sites/timtreadgold/2021/07/02/lithium-price-tipped-to-rise-after-warning-of-perpetual-deficit/

Beside, there are mining-caused social and environmental problems everywhere in the World where lithium is mined. Not to mention the mining and refining of cobalt, nickel and phosphates.

If I am wrong, I would be genuinely grateful to be told.

As regards a lower cost, safer (non flammable), battery process that can operate efficiently without HVAC, take a look at https://EOSE.com

Stackable Integrated Battery’s most popular products in Europe in 2022

URL: https://www.essvalley.com/stackable-integrated-battery