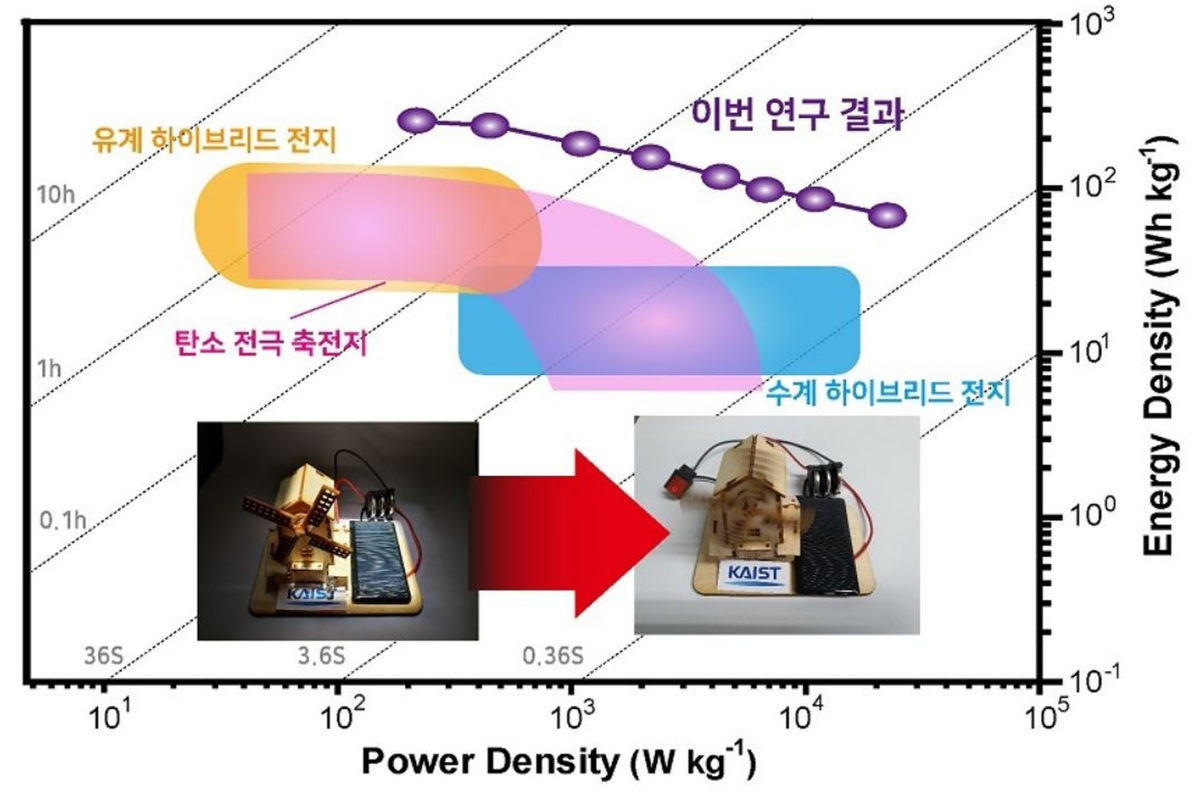

A research team at the Korea Advanced Institute of Science and Technology (KAIST) has developed a high-energy density, ultrafast rechargeable hybrid lithium-ion battery that can be used in smart electronic devices and EVs. “The hybrid lithium-ion battery, which has a high energy density (285 Wh/kg) and can be rapidly charged with a high-power density (22,600 W/kg), is overcoming the limitations of the current energy storage system,” Professor Jung-Goo Kang of the Department of Materials Science and Engineering said. “It will be a breakthrough.” The research team synthesized a porous carbon hollow structure with a large surface area by changing the orientation of the polymer resin from linear to twisted. When the twisted resin was carbonized, more micropores were formed, and a carbon structure with a surface area 12 times larger than that of the conventional linear resin was created. The carbon structure created through this process was used as a capacitor-type cathode material. In addition, the anode was made using a germanium-embedded hollow carbon nanosphere material to reduce degradation and maximize the dispersion of lithium ions. The researchers found that the hybrid lithium-ion battery using those special electrodes had an energy density comparable to that of conventional lithium-ion batteries and the power density characteristics of a capacitor, affording recharge within a minute.

In the meantime, an extreme fast charging battery tech developed by Israeli start-up StoreDot got one step closer to commercial viability with an investment from Volvo Cars Tech Fund, the Swedish carmaker's venture capital arm. With the amount of the strategic investment undisclosed, Volvo Cars has become the latest major automotive manufacturer and a vote of confidence in StoreDot's advanced technologies, following the likes of Daimler, BP Ventures, Ola Electric, Samsung, TDK, EVE and VinFast. According to the Geely-owned Swedish company, the investment gives it “the opportunity to collaborate closely with StoreDot on exciting new battery technology, as it aims to become a pure electric car company by 2030”. The first established car maker to commit to all-out electrification, the company is aiming for half of its global volume to consist of pure electric cars, Volvo is aiming for half of its global volume to consist of pure electric cars by 2025. As previously announced, the Israeli start-up is on track to begin mass producing its ‘100in5' silicon-dominant anode extreme fast charging (XFC) lithium-ion cells as early as 2024, achieving 100 miles of charge in just five minutes. For StoreDot, the financial shot into the arm as part of StoreDot's Series D investment round means that it will be able to bring its batteries to the market quicker and boost ongoing R&D into solid-state technologies. According to its strategic technology roadmap unveiled last month, StoreDot gears to deliver three generations of its battery technology – described as 100in5, 100in3, and 100in2 of miles per minute of charging – by 2024, 2028 and 2030. StoreDot claims that it is already at the “advanced stages of developing ground-breaking semi-solid-state technologies” which it believes will further improve its batteries by 40% over the next four years. Its third-generation achievement is expected to come on the back of a post-lithium technology that is to offer an energy density of more than 550 Wh/kg.

With slow charging times one of the major deterrents to EV adoption, Korea-based Hyundai is partnering with retail giant Lotte Group and KB Asset Management to accelerate the establishment of a super-fast charging infrastructure in Korea. Their plan is to set up a special purpose company through which they will lease EV superfast chargers of up to 200 kW to local charging companies. Their goal is to enable 5,000 units in major cities across the country by 2025. With its E-pit, a high-speed EV charging brand, Hyundai is leading the development of the domestic EV charging infrastructure ecosystem. In this week’s statement, the Korean carmaker reported it is now operating E-pit charging stations at twelve highway locations and six urban hubs. Through the new partnership, the company wants to add “major downtown business sites,” such as their national sales and service centers and offices, to its high-speed EV charging network. Lotte Group will also provide its retail facilities such as department stores and shopping malls in major cities as locations to install the new EV chargers.

According to the report Powering Small-Format Electric Vehicles with Minigrids, scaling electric mobility to a growing solar minigrid industry in Nigeria may be transformative for people living without access to transportation, and profitable for both minigrid and EV operators. The report by RMI, Factor[e] Ventures and the UK-charity Shell Foundation finds that in rural communities where solar minigrids are a better option than extending the grid, integrating EVs may stack the benefits of clean, affordable transport on top of those from reliable electricity access. The study also shows that renewable energy minigrids in rural Nigeria can power two- and three-wheeled EVs for the same cost as fossil-fueled alternatives. Finally, the study showed that at the costs, rental revenues and vehicle utilization observed in the Nigeria pilot, investments in leased electric two-wheelers are expected to pay back within a 10-year vehicle life.

Popular content

For the world’s leading EV manufacturer, Tesla, the first quarter of the year was yet another opportunity to post record profits despite supply chain issues exacerbated by the Russian invasion of Ukraine and the production stop at its Shanghai Gigafactory. It generated a total of $18.76 billion in sales, of which $16.86 billion came from the automotive division. By comparison, in Q1 2021 revenue stood at $10.39 billion, and in the final quarter of 2021, it grew to $17.72 billion. From January to March, Tesla delivered record-breaking 310,048 electric cars worldwide. Due to the production halt of six days in Shanghai, corresponding to some 12,000 cars that could have been built during that time, production in Q1 fell to 305,407 vehicles. While it is looking to ramp up production in all gigafactories, Tesla says it is making “significant efforts” to advance its own cell manufacturing, raw material sourcing and supplier diversification.

Other industry players have felt the pinch to a greater degree. French carmaker Renault reported lower first-quarter revenues due to the war in Ukraine and a semiconductor shortage, which was partially offset by higher prices and rising EV sales. Renault’s revenue fell by 2.7% from a year earlier to 9.748 billion euros ($10.6 billion), and sales were down by more than 17% versus the first quarter of 2021 to 552,000 vehicles, the lowest quarterly sales since the global financial crisis in 2009. The bright spot in its Q1 report are sales of fully electric and hybrid vehicles that were up 13% and accounted for 36% of total sales.

In the Netherlands, solar car start-up Lightyear is partnering with The Sharing Group to integrate its vehicles into their car-sharing platform MyWheels. Under the deal, the solar car maker will supply 5,000 Lightyear Two vehicles to the platform by 2025. In addition, Lightyear One will also be offered via MyWheels as early as 2023, but it has not been specified how many of these vehicles will be available on the platform. Lightyear One is the company's first model that will only be produced in a limited quantity. It will go into production next summer, and first customer deliveries will begin by the end of the year. Lightyear Two will be the mass-market model of the technology manufacturer and will go to market in 2024/2025 with a starting price of €30,000. According to Lightyear CEO Lex Hoefsloot, the future of mobility is not only about the vehicle itself, but also about how we use it. “Car sharing services are an example of how the market is evolving to find new, more sustainable ways to keep people mobile without owning a car,” Hoefsloot says. The company said that vehicles like the Lightyear One and Two generate power themselves and have less moving parts than other cars so their maintenance and operation costs will be comparatively low.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

To recharge a typical 60kWh battery in one minute would require a 3.6MW charger. That’s 15,000 amperes at 240V. A normal wall socket is 10A. It’s roughly equivalent to the feed to 150-200 suburban houses.

I wonder what rate these batteries can discharge at because it could potentially use the same Tech on site for storage if it has a high discharge rate. That way it would be quick charge up to a certain point until the on-site storage battery gets use up and then maybe it switches back to something a lot more regular. The charge points could have information estimating how quickly you could charge off of them on on their website so you would know before you get there what the status of a charger is. Maybe it takes half a day to prepare a charger for a car to be able to use it at the maximum discharge rate but the onsite battery could be holding like 1.5 cars of full charge when it’s full and only let the cars fill up to 80% full with their quick charge mode.