There is universal consensus that corporate power purchase agreements, a key solution to Europe’s current energy crisis, will accelerate renewables deployment, but uptake is currently stalled due to a perfect storm of policy, permitting, and pricing. This was the clear message on the first day of RE-Source 2022, which brings together corporate offtakers and renewable project developers in Amsterdam this week.

Emergency measures taken at the European level to cap the revenues of electricity generators is putting a break of the signing of corporate PPAs at a time when they are needed more than ever. The European Commission brought together the energy ministers of member countries on Sept. 30, where they agreed on a suggested revenue cap of €180 ($175)/MWh for electricity generators that do not use gas as fuel, in order to protect European electricity consumers.

These “excess revenues” above €180/MWh are to be collected by governments. However, the outcome of the meeting was a recommendation of the revenue cap, among other measures, and European members states have been left to enact their own market interventions.

The European Commission’s head of unit DG ENER, Paula Abreu Marques, noted that “important decisions regarding the energy crisis are being made on an almost daily basis.” The result of the decision of Sept. 30 is that corporate and industrial offtakers and renewable energy project developers and owners are balking at signing new PPAs, while chaos reigns.

“The main issue is that it’s a European regulation, but not a uniform European law,” Dries Acke, policy director of SolarPower Europe, told pv magazine. “The [European] Commission came in with an EU revenue cap. But the members states demanded the flexibility to do other things, go below, above, or [introduce] technology specific [measures]. It is merely a guidance of what the EU would ideally like you [member states] to do, that’s where the uncertainty comes in.”

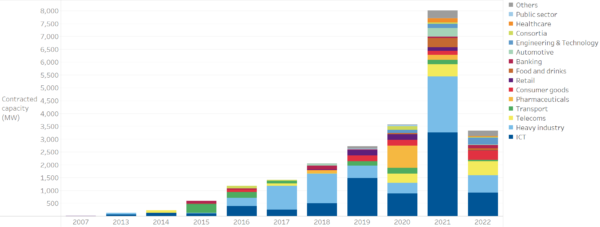

Image: SolarPower Europe

Variation on the EU member state level is already evident. In Belgium, discussions are underway to set a revenue cap of €130/MWh, below the European regulation.

“Members states feel very comfortable to do whatever they want,” said Acke, noting that the uncertainty is having a “chilling” effect on the European PPA market. “If you strike a PPA, and you don’t know exactly what level of revenue you will need to maintain, you are confronted with an uncertainty in your metric that is new.”

At the RE-Source event, corporate offtakers lamented the situation. Google’s global head of data center energy, Amanda Peterson Corio, said that like other companies, the tech giant is still digesting the outcome of the Sept. 30 meeting. She noted that it is unclear how long the market intervention will last.

Popular content

“There were some suggested dates in the Friday guidance,” said Corio, speaking on the first day of RE-Source 2022.

The European Commission has signposted June 30, 2023, as a potential date, but there are fears that the revenue cap will be extended.

“We need a better understanding of the timing, so we know how to price that in,” added Corio, noting that Google has contracted approximately 7 GW of clean energy throughout the world to supply its data centers.

Philipp Pfefferle the director of BASF Renewable Energy, said the intervention should be as short-lived as possible. He noted that the company does not want to see an extension of the suggested end date of June 30, 2023. BASF, the world’s largest chemical company, uses 6 TWh of electricity per year at its facility in Ludwigshafen, Germany – enough to power 2 million European households.

Frustratingly, while the PPA market is largely stalled, there is universal agreement at RE-Source that accelerating renewables adoption is the key solution to the current energy crisis, to address security of supply, cost, and sustainability. However, there is hope that the PPA market will persevere, despite the short-term challenges.

“Price caps may be well intended they can have lots of unintended consequences,” said Macquarie Green Investment Group’s head of core renewables, Edward Northam. “But the foundations of the market are so sound that we are willing to work through that.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.