By 2030, the payback period for heat pumps and rooftop solar could fall by periods of several years, according to a new report by McKinsey & Company.

“Attractiveness of each investment (as measured by the payback period) is likely to increase as EU industries scale and reduce production and installation costs,” said the global management consulting firm .

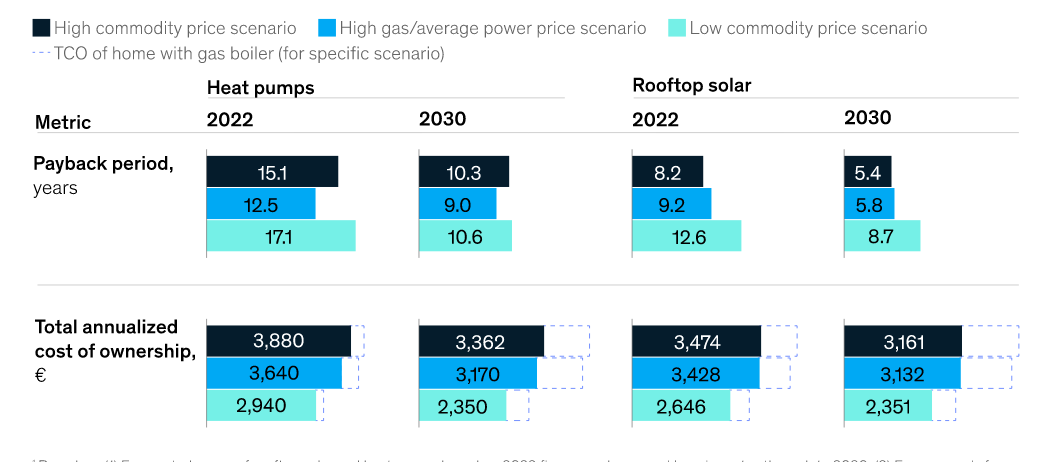

The analysis considers three price scenarios, using a German single-family home as an example. A “high commodity price” scenario, a “high gas but average power price” scenario, and a low-commodity price scenario, where gas prices return to historical averages and power prices reach new lows.

Heat pumps and rooftop solar both have the longest payback periods in the low power price scenario, but it also has the high decreases in payback periods between 2022 and 2030. The payback periods for heat pumps could fall by 38%, from 17.1 years in 2022 to 10.6 years in 2030. The payback period for rooftop solar could fall by 31%, from 12.6 years in 2022 to 8.7 years in 2030.

Heat pumps have the shortest payback periods under the “average power price” scenario. The payback period could decrease by 28% in this time frame, from 12.5 years in 2022 to nine years in 2030. For rooftop solar, average payback periods could fall from 9.2 years in 2022 to 5.8 years in 2030.

Rooftop solar has the shortest payback periods under the “high-power price” scenario. It could fall 34% from 8.2 years in 2022 to 5.4 years in 2030. The payback period for heat pumps could go from 15.1 years in 2022 to 10.3 years in 2030, down 32%.

“These payback periods (and therefore household energy costs) could lower further due to decreasing electricity costs as the power system decarbonizes and decentralizes (reducing costs at peak times),” said McKinsey & Company.

The new study focuses on three initiatives that reportedly have the largest potential to substantially improve the energy efficiency of EU buildings: the ramping up of rooftop solar and heat pump installations, and the improvement of the insulation of buildings.

It finds that the yearly deployment of rooftop solar will need to be around 33 GW to reach the EU’s Fit-for-55 and Repower EU targets, compared with the record rate of 22 GW in 2022 and the 10 GW average of the last four years.

“Heat pump deployment will also need to keep growing at 12.5% a year through to 2030 to reach RePowerEU’s target of 54 million heat pumps by 2030,” the authors say. At the end of 2021, Europe had reportedly installed 15 million heat pumps, with McKinsey estimating an additional 2.5 million installations in 2022.

The consultancy firm suggests five key drivers to help catalyze these changes: upskilling the workforce, setting up appropriate incentive mechanisms, attracting financing and private capital, investing in grid infrastructure, and creating net-zero and circular supply chains.

The forthcoming March edition of pv magazine features an extended article from the McKinsey report authors about the outlook and competitiveness of the European solar production industry.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I don’t think this research is looking in the right direction.

If you look at when heaters (both hot water and space) typically run you’ll see there’s a tendency to run the heaters in the morning (7 to 9 AM) and another window in the evening from 6ish to 8ish. If you look at EV load you’ll see similar peaks associated with charging but they’re swapped – people drive to work and plug in and/or drive home and plug in.

In my power system we’re seeing an increase of peak load of roughly 1% a year due to EVs. By 2030 we’ll have over 1 GW (maybe even 2 GW) of additional EV load at peak. This is an increase of 10 to 20% of peak load just from EV load. Where is this power going to come from? Hmmm?

It’s a trick question because we’re not going to let people charge their EVs whenever they want to. We’re absolutely going to actively manage when people charge their cars and heat their homes. There will be a few hundred hours a year when non-essential EV changing will be aggressively discouraged. All signs point to us using smart rate structures to do this. But why stop at critical peak pricing when there are 8000 other hours in the year that you can influence? The changes well make to how we price electricity will dramatically change the payback periods for heat pumps and rooftop solar. Heat pumps and EVs will benefit tremendously but rooftop solar will likely become uneconomical in most cases. The EU will have to figure out some sort of mandate to keep rooftop PV going at anything close to its current level.

Another likely change we’ll see is a transition away from purely volumetric pricing. Basically, you’ll pay a access fee of 100 Euro/month and dramatically lower unit costs. A German household would go from paying .5 Euro/kWh to something closer to .05 to .1 euro/kWh. The change to the billing structure will make electrifying heating and transportation far more affordable but it would eliminate the possibility of a rooftop PV system paying for itself.

I understand your point and I am curious how things will develop. At the end the market will find the right price. One thing you forget is the costs of grid and taxes. Right now if I would use a dynamic pricing model like tibber, I would pay 13,5 cent for network fee and taxes alone. This can of course become lower, but so will the price of rooftop solar. So you will want to have solar + battery purely to avoid the fees and taxes (if prices of solar+storage are low enought).

We had an 11 kw rooftop array installed in the spring of 2020 at our home north of Toronto, Canada. With $2000 savings per year in hydro costs, the entire system will pay for itself 6 years from now. I was able to purchase a three year old system, so saved almost $9000 on the purchase. If I’d bought new, the payback time would have been 14 years, based on 2020 hydro costs…which have increased.

In the northeastern USA heat pumps cost more to operate than natural gas fired heating due to the high price of electricity and the low price of natural gas. Even a high end heat pump with 2-4X the efficiency of gas (depending on outside temperature) is overall about 50-100% more expensive to run than an old 80% efficiency gas heater due to the 4X higher price of electricity vs. gas. The difference is even greater when the comparison is to a modern 94% efficiency gas heater.

Even if gas price rises the balance is not likely to shift as most electricity there is generated using gas, and with an average generating efficiency of about 40%, a rise in gas price raises the price of electricity as well. The only hope is for solar & wind to increase enough and become inexpensive enough to shift the cost balance. That is not imminent in this large, heavily populated, and not particularly sun drenched region.

It’s really complicated to compare efficiencies of heat pumps vs. gas furnaces.

The first thing to clarify is what is meant by efficiency. Is it the ratio of energy being supplied to a system vs. the heat output of that system? Are we comparing economic efficiency? Or are we using some environmental metric in calculating efficiency?

Add in dynamic market prices, and multiple sources of electricity or even natural gas, and it’s challenging to come up with numbers that everyone agrees to. And certainly these numbers will change as the market and industry changes.

The only heat pump efficiency number that is reliable is their efficiency relative to classic electrical radiant heating systems. Those 3 to 5x numbers are accurate. Just don’t assume they apply when comparing natural gas or other heating systems.

Home automation systems have revolutionized the way we manage our energy consumption. With the potential payback time for heat pumps expected to plunge by 2030, it’s becoming even more enticing for homeowners to invest in these efficient solutions. Imagine integrating smart heat pumps with your home automation setup to optimize comfort and savings simultaneously! The future of energy-efficient homes looks promising, and I can’t wait to see how appliance repair services evolve alongside these innovations.