From pv magazine USA

One year ago this week, the IRA was signed into law, marking the largest climate and energy spending package in US history. Inside the massive energy, climate, and tax bill is $600 billion in spending, $370 billion of which is dedicated to supporting renewable energy buildout and climate resilience.

The IRA mandates a nationwide reduction of carbon emissions by roughly 40% in 2030. It also targeted a return to domestic manufacturing in the United States, bringing jobs and supply chains back onshore. About $60 billion within IRA is directed toward US manufacturing.

One year later, more than $100 billion in private investment has been announced, leading to the establishment of 51 new facilities or significant expansions, according to the Solar Energy Industries Association (SEIA).

“The unprecedented surge in demand for American-made clean energy is a clear sign that the clean energy incentives enacted last year by Congress are working,” said SEIA President and CEO Abigail Ross Hopper.

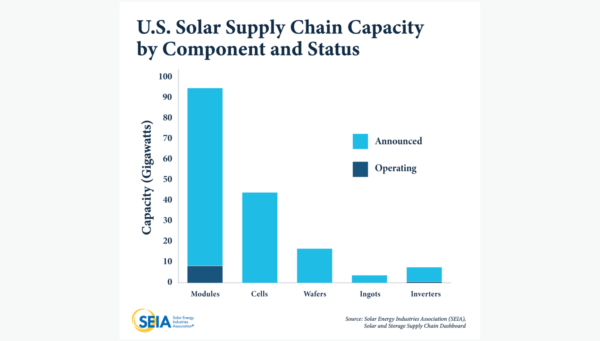

SEIA said that more than 155 GW of solar supply chain capacity expansions have already been announced, leading to an estimated $20 billion investment in US communities. The production additions include:

- 85 GW of solar module capacity

- 43 GW of solar cells

- 20 GW of silicon ingots and wafers

- 7 GW of inverter capacity

By 2026, it is forecast that the US market will have over 17 times its current capacity across modules, cells, wafers, ingots, and inverters once these facilities reach operations. More than 20,000 US jobs are expected to be created by these facilities, and the US solar manufacturing workforce is set to triple to more than 100,000 positions over the next decade.

In addition, more than 65 GWh of energy storage manufacturing capacity has been announced across 14 new or expanded facilities. Since the IRA was passed, over 3 GW of large-scale energy storage projects have been deployed, and an estimated 100,000 customers have installed a residential solar system paired with battery storage.

“We’ve often dealt with the buy side, through continued tax credits for projects. That really helps installers and developers and end-users,” said George Hershman, SEIA board director and SOLV Energy chief executive officer. “But we really never dealt with how we are going to get product, the supply side. I think the IRA did a great job with supporting the supply side to ensure we build the manufacturing supply chain in the US that we all want to be able to deploy.”

There have been attempts to overturn the IRA or strip core provisions, but Hershman said that early and continued success will neutralize any attempts to throw out the landmark industrial policy.

“We want to win the win,” he said. “We all want to be in a position where we can cut ribbons and put shovels in the ground and say the IRA brought this project to your community. A lot of these projects are in Red counties and Red districts. It’s much harder to fight against a bill that’s bringing jobs and property tax revenues to your district.”

SEIA says that the US solar industry will generate more than $565 billion in private sector investment over the next decade. By 2033, cumulative solar capacity will reach 668 GW, enough to power every home east of the Mississippi River. This is also equivalent to offsetting 459 million metric tons of carbon emissions each year, representing about one-third of all power sector emissions based on 2021 levels.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.