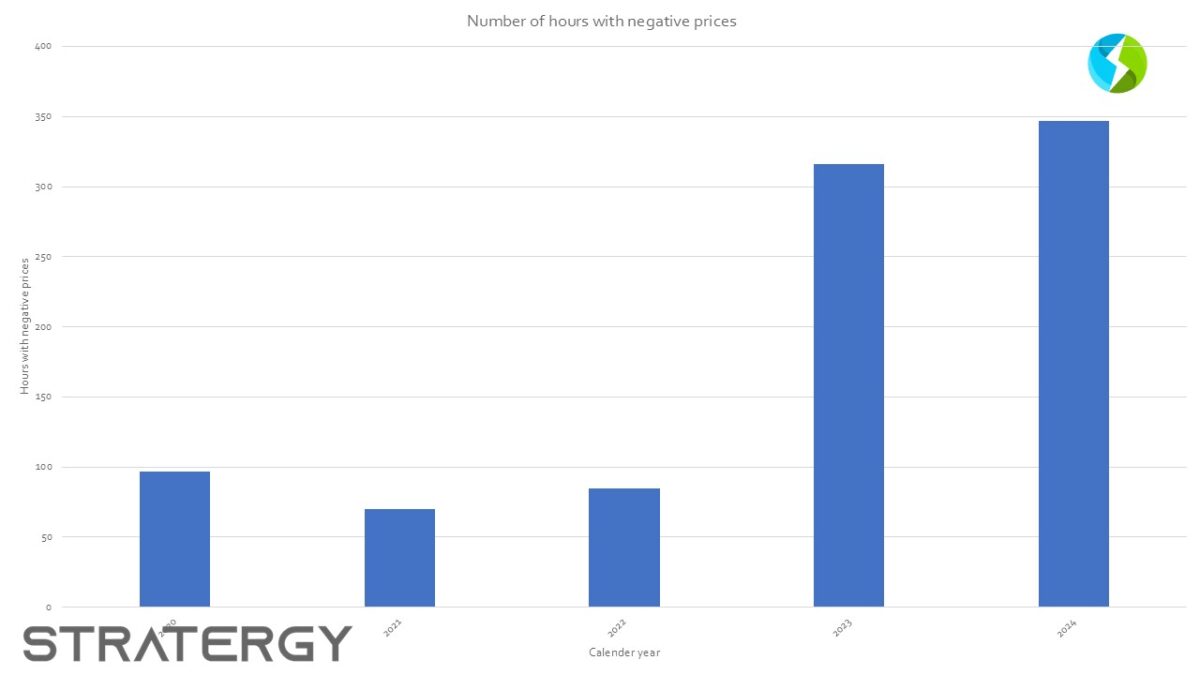

The Netherlands' EPEX SPOT Day-ahead market registered 347 hours of negative prices between Jan. 1 and Aug. 14, according to figures from Dutch consultancy Stratergy. In 2023, the total number of hours of negative prices reached 316 for the full year.

“It is expected that this year, the total will fall between 450 and 550 hours, depending on the further development of gas prices,” analyst Jan Willem Zwang told pv magazine. “There is a clear correlation between the expected solar and wind energy for the following day and the negative hourly prices in the day-ahead market. Negative prices are most common during the day in the summer months, especially on weekends, holidays, and during vacation periods when expected consumption is lower. Additionally, it is evident that slightly stronger winds during the nights and colder months directly contribute to negative hourly prices.

Zwang said the growth in solar and wind capacity is expected to significantly increase the number of hours with negative prices in the coming years. He predicts a substantial rise in negative price hours as renewable energy capacity expands.

“In 2025, we will likely see between 550 and 750 hours,” he added, noting that these outcomes depend on the development of gas prices and the bidding strategies of renewable energy producers. “In 2026, between 800 and 1,200 hours. For 2027, 2028, and 2029, projections range between 1,000 and 1,500 hours.”

Producers are expected to increasingly avoid selling on a day-ahead basis when prices are negative, especially with the new SDE++ scheme. Zwang added that congestion and capacity-limiting contracts could lead to fewer and less severe negative day-ahead prices, even though more hours with negative prices have been observed this year.

“For example, last year July had 65 hours with negative prices at an average price of – €51.67 ($56.75)/MWh, while this year 81 hours with negative prices were recorded at an average price of – €22.76/MWh,” he said.

In 2020, the average negative price was –€9.57/MWh, but in the following two years it was -€14.82/MWh and -€34.61/MWh, respectively. In 2023, it was -€26.06/MWh and so far this year it has been €22.26/MWh.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.