Dexter Energy, a Netherlands-based developer of solutions for short-term power trading and optimization of solar, wind, and storage assets, is expanding with plans to enter new geographic markets and boost its software platform with battery asset-related trading and by optimizing existing products.

The Amsterdam-based company offers advanced machine learning and optimization software used by utilities, offtakers, and independent power producers (IPPs) to support forecasting and short-term power trading.

The platform uses predictive artificial intelligence (AI), a mix of advanced machine-learning techniques, such as gradient-boosted decision trees, deep neural networks, and probabilistic time-series models, to forecast power output, short-term power prices, and grid imbalances, according to Luuk Veeken, Dexter Energy CEO.

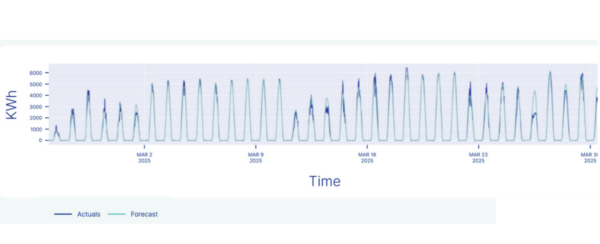

It claims a “high-accuracy” forecasting system. “We know that our power forecast is highly accurate because our customers consistently confirm this. To convince new customers to use our Power Forecast, we need to compete head-to-head in trials with other forecasters each time,” Veeken told pv magazine. “The fact that we have managed to double our forecasted capacity every year for the last five years also stands as proof that we can deliver on our claims.”

Veeken explained that Dexter Energy's products are designed to address asset-backed energy trading needs related to curtailment price cannibalization, negative spot and imbalance prices, along with solar “duck curve” demand patterns and their effect on prices.

“Our products help renewable energy producers navigate this new reality and minimize their balancing costs. Our Power Forecast helps our customers lower their imbalance volume, reducing the risk of open positions in the balancing market and the financial penalties associated with them,” he said.

Curtailment, the name of another Dexter Energy tool, provides signals to customers about when to deliberately reduce over-production when it is financially optimal, for example.

“These models learn from vast streams of weather data, market prices, and real-time SCADA data. All the heavy lifting happens in our secure cloud environment, so there is no proprietary hardware to install. Traders simply pull the signals through a REST API,” said Veeken, referring to a representational state transfer (REST) application programming interface (API) widely used to exchange information securely over the Internet.

Founded in 2017, Dexter Energy announced this month it will invest in further growth, expanding the business across Europe, further develop its existing products, and increase support for battery storage trading. It raised a €23 million ($ 27.04 million) Series C round of venture capital from a group of Dutch and international institutional investors to help reach its goals. The company claims over 80 energy companies as customers, including Sunrock and Pure Energie, both based in the Netherlands, UK-based Centrica Energy and Belgium-based Luminus Energy.

Image: Dexter Energy

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.