From ESS News

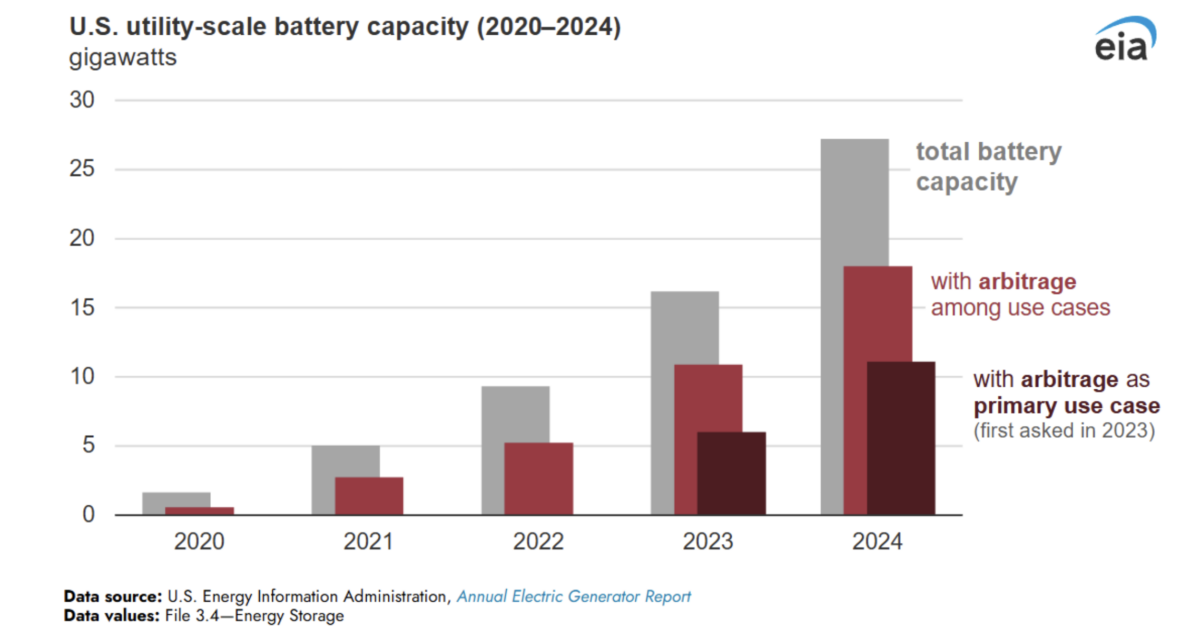

The latest data from the US Energy Information Administration (EIA) confirms that arbitrage – the practice of buying electricity when prices are low and selling it when prices are high – remains the dominant use case for utility-scale battery energy storage systems in the United States.

In 2024, operators reported that 66% of all utility-scale battery capacity included arbitrage among its applications, while 41% of total capacity was used primarily for arbitrage.

The next most common application was frequency regulation, which was the primary use for 24% of battery capacity. Frequency regulation plays a critical role in maintaining the grid’s stability by keeping it operating at a steady 60 cycles per second.

To continue, please visit our ESS News website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.