Total and Marubeni win Qatar’s 800 MW solar tender

The resulting project will sell power to Qatar General Electricity and Water Corp under a 25-year power supply deal. French oil and gas giant Total and Japanese conglomerate Marubeni will hold a combined 40% stake in the power plant, which will be built near Doha, the Qatari capital.

The weekend read: Your guide to market growth in 2020

Some 15 countries are likely to be able to lay claim to the status of being members of solar’s “gigawatt club” in 2019, according to conservative projections from BloombergNEF. Nonetheless, PV suppliers, developers and service providers are always on the lookout for new pockets of growth. To kick off 2020, pv magazine’s global team of correspondents and editors have highlighted 10 “fast-growing” solar markets to evaluate where the opportunities, and potential risks, lie.

Portugal pushes back solar auction to March

The minister of environment and energy transition has told parliament two auctions for large scale solar will be held this year, with a new procurement round now planned. The minister revealed energy storage may play a part in the capacity tenders.

SolarPower Europe repeats call for solar strategy as part of European Commission’s €1tn Green Deal

Lobby group CEO Walburga Hemetsberger says the plans announced by commission president Ursula von der Leyen this week should place the European solar industry front and center.

BlackRock vows to exit coal as part of new climate-focused investment strategy

The U.S. asset management fund’s plan to cut future investment in coal is reportedly part of a climate-focused initiative to establish sustainability at the center of its business approach. The announcement comes weeks after the investor closed $1 billion of a record $2.5 billion fund focused on PV, wind and energy storage projects.

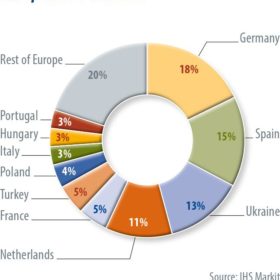

A new era of sustained growth

After several years of weak solar demand growth in Europe, compared to the historical highs of 2011, installations are expected to surge by 88% to reach a new installation record of 23 GW in 2019, writes Cormac Gilligan, research manager at IHS Markit. A range of favorable macro conditions have coalesced this year to reignite the market.

US government expects 24 GW of new solar this year

A Department of Energy agency expects 17.4 GW (DC) of utility scale solar power generation capacity plus 6.6 GW of small scale PV will be installed in 2020. That volume would be 60% higher than the record, set in 2016.

European Commission announces €1tn Green Deal ambition

President Ursula von der Leyen has outlined plans to fund her Green Deal with a mix of EU, member state and private sector contributions. Now it is over to individual nations and the European Parliament.

Desert solar farms can improve tortoise habitat

With openings in the fence and improved growth of plants vital for tortoise survival, solar farms in Nevada can provide better habitat than the surrounding desert. First Solar has found similar habitat gains in California.

Hard times for thin-film PV module makers as Crystalsol and Calyxo file for insolvency

Calyxo, a German cadmium telluride solar module manufacturer, has filed for insolvency for the second time, despite the recent emergence of new prospective investors. Meanwhile, Crystalsol – an Austrian flexible solar panel maker – has also initiated insolvency proceedings, due to losses of roughly €7 million.