Backing from institutional investors for renewable energy generation capacity is likely to rise $210 billion over the next five years, with utility-scale PV capturing a 43% slice, according to a new report from Octopus Investments.

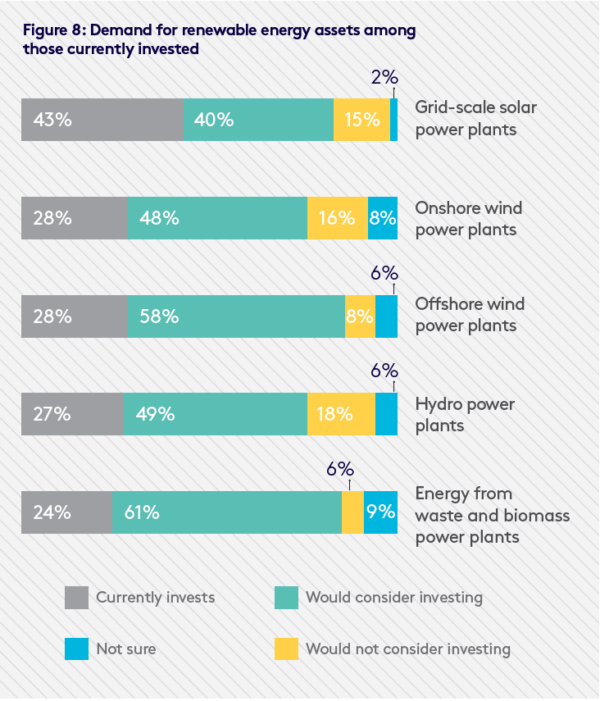

Respondents to The green investor: why institutional investing holds the key to a renewable energy future, cited solar as of interest more often than was the case for rival renewable technologies. The number of respondents that would not consider investing in grid-scale solar was the smallest recorded.

For the purposes of the report, Octopus surveyed investors with and without renewable energy holdings, and with a total asset volume of $6.8 trillion. More than two-thirds of the institutions surveyed held renewable energy investments, with the remaining 33% not doing so. Respondents included pension and multi-manager funds, insurance companies, strategic investors, high net-worth families offices, private banks, endowment funds, foundations, and sovereign wealth funds.

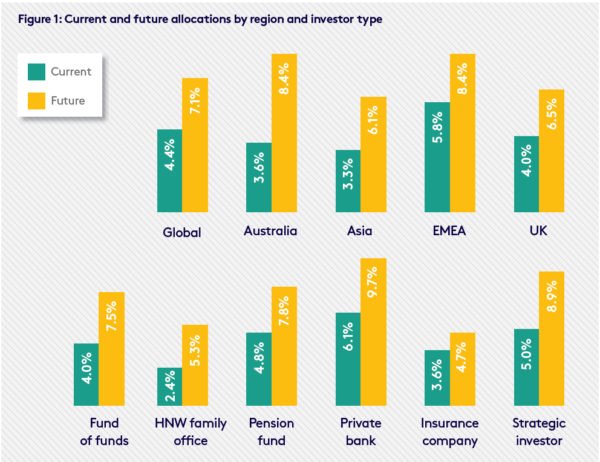

Over the next five years, 45% of respondents said they would increase their investment in renewable energy by 10%. Backing for renewables accounted for 4.4% of the total asset volume of the surveyed institutions and if they were to realize their growth plan in that asset class, renewable energy investment would account for 7.1% of the total asset volume in five years’ time – a $210 billion increase.

According to the report, market volatility across all sectors is working to renewables’ benefit, as institutional investors seek to diversify portfolios. Around 66% of the respondents said spreading their investments into multiple asset classes, including renewables, was a key motivation. Almost half – 48% – said the primary driver for their investment decision had been predictable cashflows from renewables infrastructure. On top of that, environmental, social and governance credentials (ESG) were listed by 57% of respondents as a key driver for investment decisions.

Compliance is pushing investments

ESG compliance was a strong motivation among respondents in the EMEA region, with 95% of respondents citing it as a significant factor. Nearly half of the surveyed investors said a decision to opt for renewables investment was also a response to investor demand to align with global trends. The report claimed such pressure on investors is likely to increase over time as “greener” millennials hold investors to account.

Respondents from Europe – especially the U.K. – were particularly active in investing in renewable energy projects. Around 5.8% of the total asset volume of surveyed investors from Europe, the Middle East and Africa was allocated to renewables. Over the next five years, that volume is set to grow to 8.4% of the asset volume. By contrast, surveyed investors from Asia reported just 3.3% of their assets as being in renewables, with the report’s authors projecting that figure will rise to 6.1% over the same period.

The authors, however, cited the International Renewable Energy Agency’s claim $1.7 trillion of investment into renewable energy is needed between 2015 and 2030 to mitigate climate change effectively. That is a figure well short of what Octopus Investments has extrapolated in its latest findings.

Job not done yet

“Institutional investors are waking up to the investment opportunity that comes with securing a renewable future,” said Matt Setchell, co-head of energy investments at Octopus. “There is much to celebrate in the report. However, while institutional investors’ contributions are on the increase, there remains a long way to go to plug the funding gap. We cannot afford to view increased allocations as ‘job done’. More needs to be done to unblock investment to help tackle climate change. Acting now is not an option; it is a necessity.”

In that vein, the report also investigated the key barriers to unlocking more investment. The biggest inhibiting factor, cited by 56% of the surveyed investors, was energy price uncertainty. Some 41% of respondents raised concerns over liquidity and 35% said a lack of skills in the field of renewable energy investment and asset management was a major constraint.

“Our report identifies the key barriers that need to be overcome to enable institutional capital to support a renewables future,” said Setchell. “Clarity on policy from government, flexible investment opportunities to suit investor needs, and skilled managers who are able to identify and offset risks will be crucial to unlocking further institutional investment into the sector.”

Some 52% of the respondents said more policy support would unlock additional investment into the sector. Nearly half of the respondents added, better-pooled investment vehicles would encourage them to dive deeper into the investment opportunities that exist. And 42% of the investors surveyed said building better in-house expertise would help.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.