As with any novel technology, bifacial PV is still held back by a lack of long-term field data to demonstrate its real-world performance under all conditions. Nonetheless, the technology has attracted a lot of market attention in recent years and has started to gain market share.

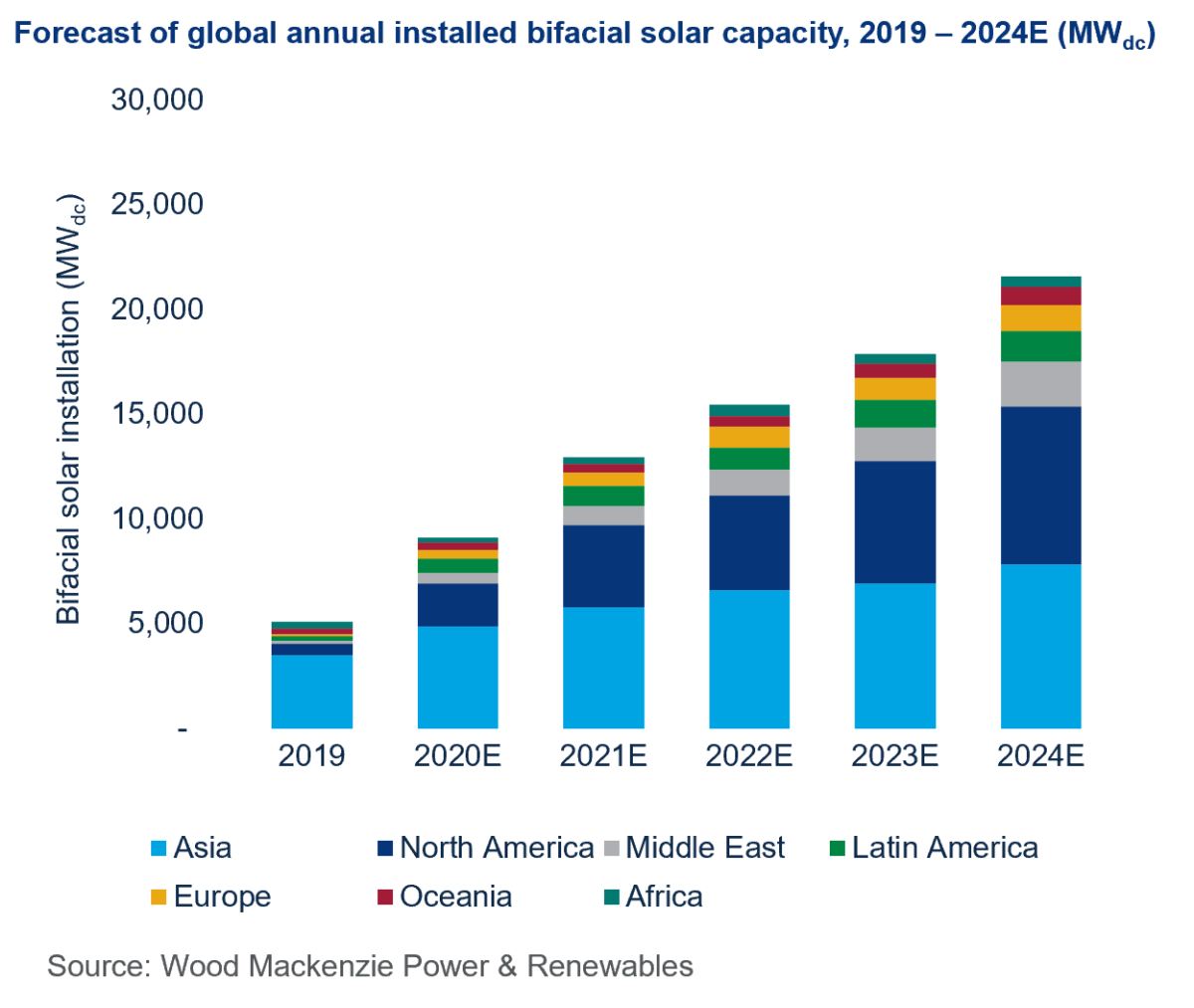

Installed bifacial capacity has grown from only 97 MW in 2016 to more than 2.6 GW last year. According to Wood Mackenzie Power & Renewables’ first report focused on the global bifacial market, that number will more than double by the end of the year, to 5,420 MW, bringing cumulative bifacial capacity to more than 8.2 GW. Between this year and 2024, the size of the bifacial market is poised to increase tenfold, according to the market intelligence company.

While the drivers of bifacial growth differ from region to region, one unifying factor is growing affordability. The WoodMac study found the production cost differential between bifacial mono PERC modules and their single-sided equivalent is now as low as $0.005.

On top of that, WoodMac pointed out it is relatively easy to retool monofacial production facilities to manufacture bifacial modules, ensuring supply certainty to cater to prospective market demand.

Five-year outlook

WoodMac predicts annual bifacial module capacity will exceed 21 GW by 2024, accounting for 17.2% of total installed solar capacity at that point by quadrupling the share it will hold this year.

Not surprisingly, China leads on bifacial thanks to its Top Runner program, which incentivizes new technologies. WoodMac says the Chinese bifacial market will continue to grow but at a slower rate of 20% per year as the country adapts to a subsidy-free solar system.

Significant growth, meanwhile, is expected in the U.S. due to the exemption from Section 201 solar import tariffs that has been made for bifacial products. The 25% tariff applied to most U.S. solar imports – and the States’ modest domestic manufacturing industry – ensures modules in the U.S. cost 40-50% more than in Europe and Australia, WoodMac noted. “Because of the exemption, bifacial solar modules made in Southeast Asian countries will gain significant price advantage, given that they incur no import tariffs of any kind,” the analysts stated.

Switching to bifacial can translate into substantial savings for U.S. developers. A module that cost $0.25-0.35/W under the import tariff would save $0.06-0.09/W if replaced by bifacial. For developers seeing all-in pricing of around $1/W-DC, a system price decrease on that level is significant.

The Middle East, too, is expected to see significant bifacial adoption. According to WoodMac, Oman has a 600 MW bifacial project pipeline and the UAE is also an early adopter, having announced a 320 MW bifacial project in June. Saudi Arabia is expected to follow suit.

In Latin America, state-run, large scale tenders in Brazil, Mexico and Chile will drive growth of the technology. Similar mechanisms will be at work in Egypt and other African nations, predicted WoodMac. Australia leads the pack in Oceania, thanks to bifacial-friendly desert terrain in the center of the country and the high electricity costs which continue to propel solar.

Improving bankability

In Europe, northern nations are expected to continue to see bifacial adoption due to the high latitude. The U.K. and Denmark have more than 150 MW of projects in their pipelines, WoodMac stated, while the fast-growing Southern European market is still lagging behind in bifacial uptake.

However, there is still some way to go to win the trust of investors. With international standards, testing procedures and modeling tools still works in progress, a lack of real-world data and guidelines contributes to uncertainty about the bankability of bifacial modules, the WoodMac study reported.

By developing self-regulation standards the industry is working to improve bankability and WoodMac highlighted the progress made on collecting field data, enhancing bifacial-ready simulation software and developing industry standards and certification.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I think that’s a very Conservative estimate. There is clearly an advantage in bifacial panels in yield per area, and at an additional ex factory cost of around 0.5 cents per watt, even a 1% yield advantage would pay for itself, where in reality, depending how mounted, yield advantage seems generally between 5% to 15% in most cases (occasionally more). I would not be surprised to see 50 to 100 GW of bifacial panel in 2024