From pv magazine Spain

Each quarter, Seattle-based renewable energy trading company LevelTen Energy reports the prices that wind and solar project developers have offered for the power purchase agreements (PPAs) available on the LevelTen Marketplace.

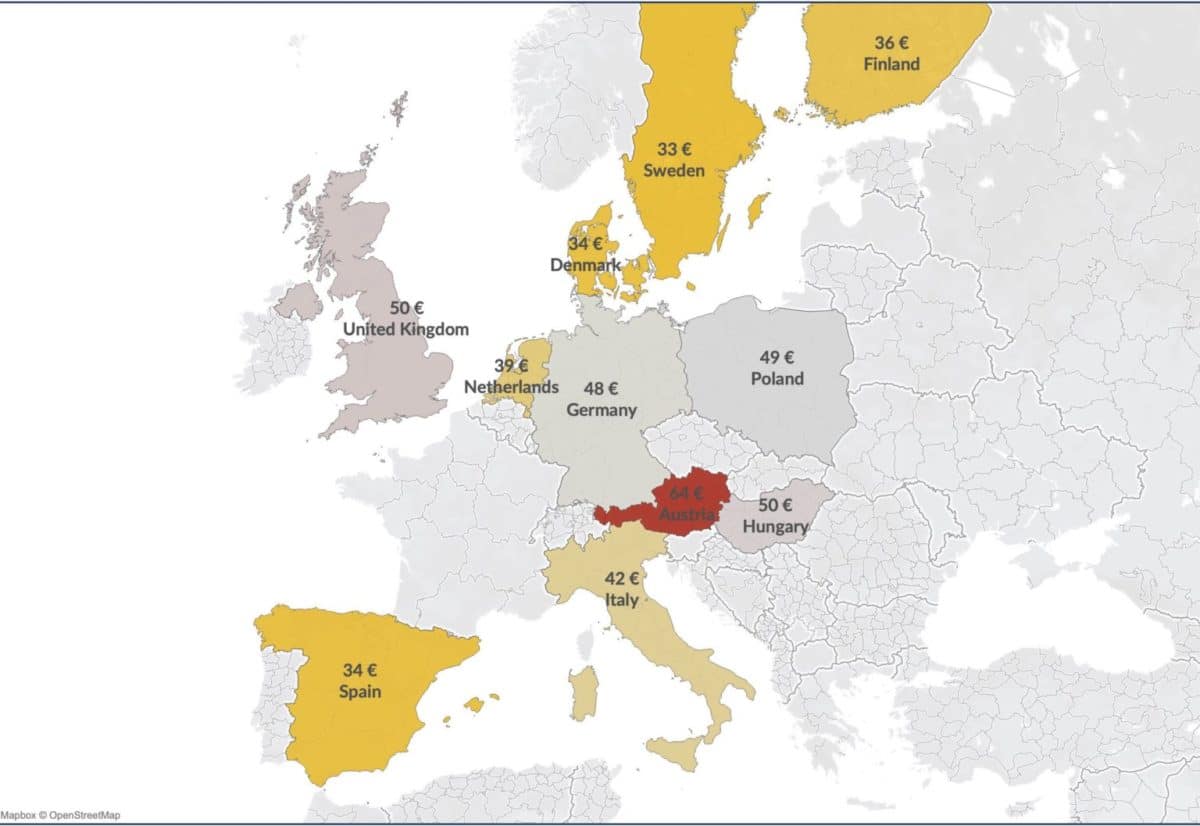

In the first quarter of 2021, the company analyzed data for 355 power purchase agreements from 138 renewable energy projects in 16 European countries and noted that the result had been largely characterized by the stability of PPA prices.

The biggest changes occurred in France, where prices fell by 5.5% compared to the previous quarter, while in Spain, they fell by 2.6% compared to the fourth quarter of 2020: from €35 / MWh in the fourth quarter of 2020 to €34 / MWh in the first quarter of 2021. In Germany, prices fell slightly by just 1%.

In the period from January to March, Italy continued to be the market with the highest percentage of offers from project developers in the LevelTen Marketplace, accounting for 31.3% of the total, while Spain continued to be the second biggest market with a 24.8% share. The United Kingdom became the third-largest market in Europe, and Germany was again the fourth market.

In Europe, the average duration of wind PPAs was 11.7 years, and that of solar ones, 11.9 years.

Among the current trends, the LevelTen points out that the European energy giants are turning green, as are the oil companies, and mentions the participation of Total in the Spanish auction in association with Ignis; the signing of a PPA between Shell and Solaria; Eni‘s entry into the Spanish photovoltaic market by acquiring 160 MW in three X-Elio facilities; and the signing of the PPA between Repsol and Microsoft.

The demand for PPAs continues to increase in Spain. According to the European platform RE-Source, “of the almost 4 GW of PPAs signed in 12 countries last year, Spain was responsible for more than 1.3 GW, around a third of the total announced”. German consultancy Aurora Energy Research indicates that the demand for PPAs in Spain will be about 31 TWh per year in 2030.

“Before the announcement of the auction, one of the main risks for the Spanish PPA market was that the excess supply would lead to very low prices of the agreements,” stated Aurora. “However, as the projects participating in the auction cannot sign bilateral contracts, the supply of projects built to sign corporate PPAs is reduced.” According to the company, with at least 19.5 GW auctioned and therefore withdrawn from the PPA market, the renewable energy supply for the PPA market is closer to 29 TWh, which is quite balanced with demand.

While the auction helps fund large projects, PPAs will play a particularly important role for smaller developers, or those simply looking to diversify their purchasing portfolio.

The Spanish market for PPAs will continue to be an important source of financing for many renewable energy developers, according to LevelTen Energy. Rising CO2 and gas prices and a greater appetite for green energy will drive demand for PPAs. “Similarly, diversification of risk and strategies will lead many developers to seek private PPA contracts as a way to finance debt,” it added. “Therefore, it is probable that the coexistence of government auctions with a fluid PPA market will continue in the immediate future in the Spanish market.”

“It is possible that, as the Spanish solar industry continues to boom and competition intensifies both for auction awards and PPA purchase agreements, Spain is on its way to becoming the European market with the lowest prices of solar PPAs,” said Flemming Sørensen, vice president for Europe at LevelTen Energy.

“I don't think the recent auction prices will set a new short-term benchmark for PPA prices in Spain,” he explained. “However, it is clear that Spain remains an attractive and competitive market with a huge solar development portfolio, so I would expect PPA prices to continue to decline slightly in the future.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.