Swiss consultancy Pexapark has reported that in March, 23 new PPAs were signed in Europe with a combined capacity of approximately 2.5 GW. This is the highest figure ever recorded by Pexapark in a single month, and represents a 14% increase compared to February. Although March had seven fewer deals than February, the number of deals is still higher than any other month in 2022.

In the first quarter of 2023, developers announced almost 70 PPAs for a total of 6 GW.

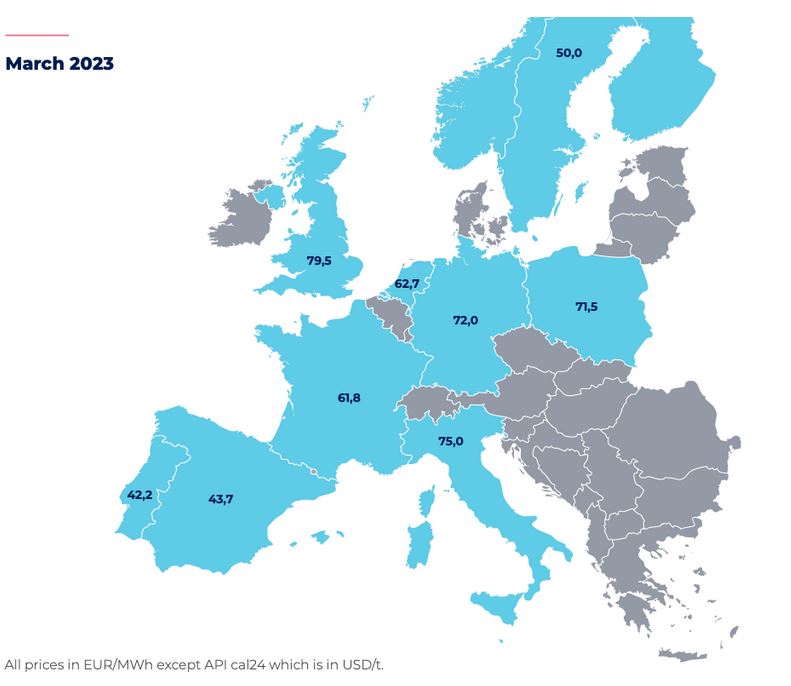

According to Pexapark, the Pexa Euro Composite saw a 0.5% increase in prices compared to the previous month. Spain and Portugal maintained their position with the lowest prices in Europe. Meanwhile, the Polish index recorded the largest increase, surging by 28.9% compared to the previous month. In contrast, the Nordic countries experienced the steepest decline with a 11.5% drop month on month.

Energy reform

Popular content

On March 14, the European Commission finally published its proposal to reform the design of the EU electricity market. The report authors of Pexapark, a Swiss consultancy, expressed their excitement after analyzing how some of the proposed reforms will impact the Power Purchase Agreement (PPA) market on the continent. However, the authors noted that the final legislation is not expected before 2025. Nonetheless, the authors believe that the European Commission's new electricity market design reform proposal has the potential to usher in the Golden Age of PPAs.

Currently, between 100 and 150 transactions take place annually, generating between 10 and 20 GW of new capacity. Pexapark projects that the measures included in the reform could generate over 1,000 TWh of corporate demand. This corporate demand will increase in parallel with GDP and general electrification efforts, resulting in hundreds of additional PPAs to support new renewable capacity.

Pexapark emphasizes that Europe's conversion into a “much larger and more vibrant” PPA market is underpinned by measures that allow for new and increased investment in renewable capacity. Additionally, the proposed credit support mechanisms will unlock the demand for PPAs. “Based on our experience, credit has become a key obstacle to holding more PPAs,” the authors explain. The Commission proposes that projects that have already committed part of their generation to a PPA allocate another part of the production to buyers who have difficulties accessing the PPA market, such as small and medium-sized companies.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.