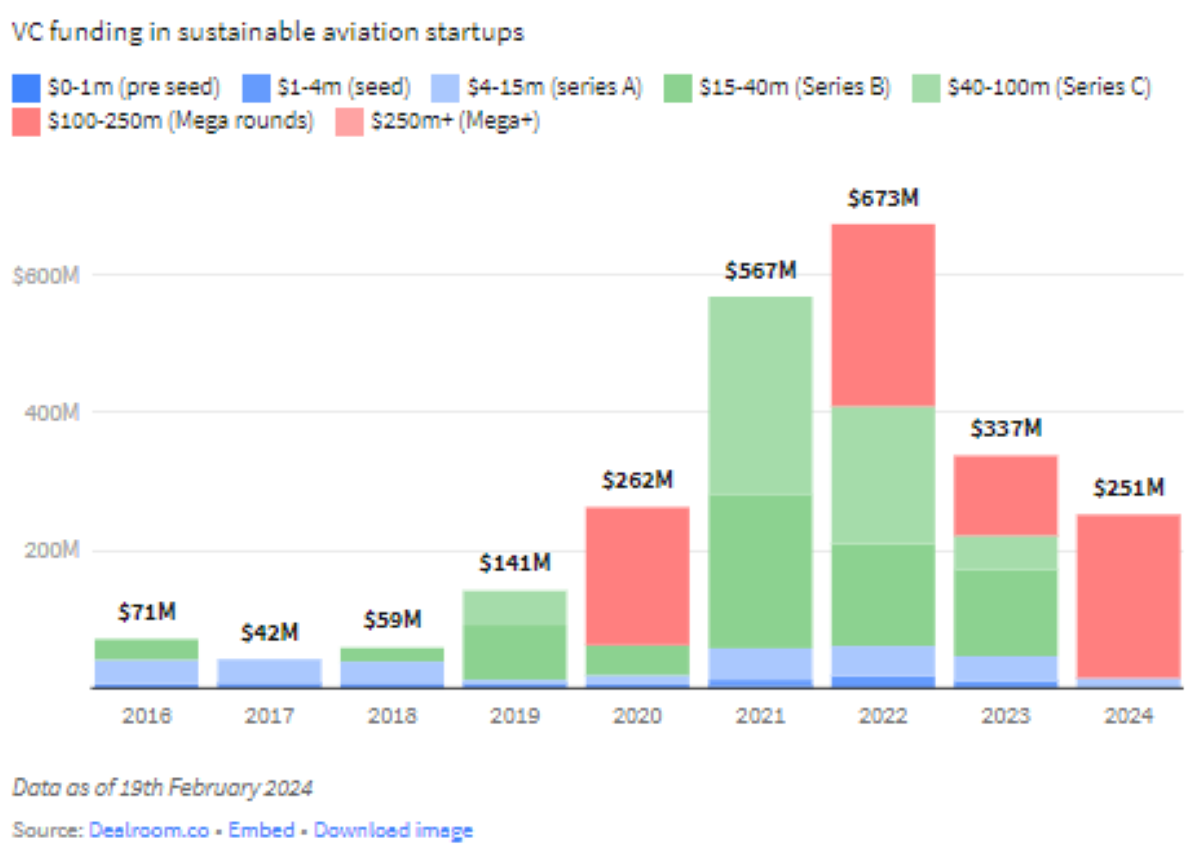

Since 2016, there has been $2.4 billion worth of venture capital flowing to companies developing technologies to decarbonize aviation, according to Dealroom.co, a Netherlands-based provider of global data and intelligence on startups and tech ecosystems.

The segment had a strong start in 2024, noted Dealroom.co senior analyst Lorenzo Chiavarini.

“Aviation is one of the segments where we still don’t have a clear winning technology path to decarbonization to reach 2050 net-zero targets,” he told pv magazine. “In my assessment, it could be a threat or opportunity, either we don’t hit the targets, or we hit the targets thanks to huge investments and technological advances. A third option is we hit the targets thanks to massive social change. That is, flying becomes something we only do if there is no other alternative. So, if we want people to fly, and limit climate disruption and biodiversity collapse, we need to get serious about decarbonizing aviation now.”

Based on Dealroom.co data, a total of $2.4 billion was invested in the so-called sustainable aviation since 2016. “Under sustainable aviation, we include things like electric aircraft, aircraft batteries, and hydrogen aircraft; sustainable aviation fuels such as e-fuels and biofuels, as well as new aircraft models, airships, and software solutions for contrail avoidance,” he explained.

The startups that attracted most of the funding are developing electric aircraft, hydrogen aircraft, e-fuels and biofuels. Biofuel is the most mature of these segments while electric, hydrogen and e-fuels are emerging.

“Funding peaked in 2022 at almost $700 million before dropping 50% to $337 million in 2023,” Chiavarini said. “Interestingly, early-stage investments stayed nearly constant from 2021 to 2023, more than double the level of any previous year. It enabled a strong early-stage startup scene that needs to prove it can scale in the next few years. Also notable, Europe seems to have gained a share of innovation by both the amount invested and the number of rounds.”

Venture capital across all sectors decreased 38% from 2022 to 2023, totaling less than half of the 2021 peak, even considering the hype about artificial intelligence startups. “Sustainable aviation is not exactly mirroring the broader market, as it is such an emerging segment, especially the technologies for electric and hydrogen aircraft and e-fuels,” Chiavarini stated.

Popular content

The surge in new investments, however, has to be taken with caution. “We are very early in 2024,” said Chiavarini. “It was mainly driven by two very large rounds, namely Swedish startup Heart Aerospace, which makes hybrid-electric regional aircraft, and Ineratec, a German company that aims to use CO2 and green hydrogen as feedstock for synthetic fuels and synthetic chemicals. I would add that it is common to announce rounds in January that were in reality closed at the end of the previous year. In any event, we are seeing both late-stage and early-stage activity, which is a good sign.

According to Dealroom.co, over 400 investors have made at least one bet on sustainable aviation startups. The most active based on the number of deals is Breakthrough Energy Ventures, a fund backed by Microsoft founder Bill Gates, with 8 investments from Series A to Series C, including Heart Aerospace, ZeroAvia, U.S.-based hydrogen aircraft developer, and Viridos, U.S.-based developer of microalgae biofuel.

JetBlue Technology Ventures, the corporate venture arm of the US-based JetBlue Airways, is the most active corporate investor with 6 seed and series A stage investments, including Universal Hydrogen, a U.S. provider of end-to-end hydrogen flight solutions, and Electric Power Systems, a U.S. developer of batteries for electric aircraft.

In addition to the sustainable aviation activity, Dealroom.co tracked $5.6 billion invested in electric vertical takeoff and landing (eVTOL) and electric Urban Air Mobility (UAM) startups since 2016. Most eVTOLs do not contribute to the decarbonization of the aviation industry due to a predominant focus on just a few passengers, typically 2 to 8 passengers, and limited flight range, typically less than 300 km.

“They are more about enabling new mobility models in urban and semi-urban areas, with use cases such as fast trips to the airport from urban centers,” Chiavarini said.

“They are comparable to the use cases of helicopters and short-distance private jets today, and they cater to a wealthy customer base. A few eVTOLs focus on longer ranges and more passenger seats, so could contribute to decarbonizations, such as France-based Voltaero and US-based XTI Aircraft.”

The hope is that they will still contribute positively to the development of aviation by pushing forward the use of emerging technologies and making regulators more comfortable with certifying electric aircraft. “But on their own, they are not solving any sustainability problems in aviation,” Chiavarini concluded.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.