The revenue stack for utility-scale battery storage is evolving in the United Kingdom. Changes to the way Great Britain’s electricity system operator (ESO) National Grid ESO operates – combined with increasing installed capacity – are reshaping the landscape. It’s a market in transition, as the first integrated national grid in the world navigates some of the biggest changes in its 89-year history.

Evidence of that transition can be found in recent capacity-market auction results. In Great Britain, there are two kinds of capacity market auction. The “T-1” procurement exercises award one-year contracts for the following electrical delivery year, and the “T-4” auctions have a multi-year horizon. The auctions help ensure there is enough future grid capacity while at the same time providing project developers with proof of future revenue – the kind that can be instrumental to securing finance. A similar system is in place on the island of Ireland, where Northern Ireland and the Republic of Ireland share an integrated wholesale electricity market.

In February 2023, the success of battery energy storage systems (BESS') in National Grid ESO’s capacity market auctions demonstrated the demand for BESS' as part of Great Britain’s energy mix. The T-1 capacity auction for 2023-2024 awarded contracts to 627 MW of battery storage projects, up from 385 MW awarded in 2022. In the T-4 auction, battery storage was awarded 1.29 GW worth of contracts for 2026-27.

“There is a fundamental need for storage, we’ve seen that with storage winning contracts in the capacity market and we’ll see that with continued volatility in the balancing mechanism,” said George Hilton, a senior analyst at S&P Global Commodity Insights, referring to payments made by the ESO for generators to ramp or reduce output in line with demand. “That is going to drive continued installation, continued growth in the market, and it’s going to mean developers are still building projects.”

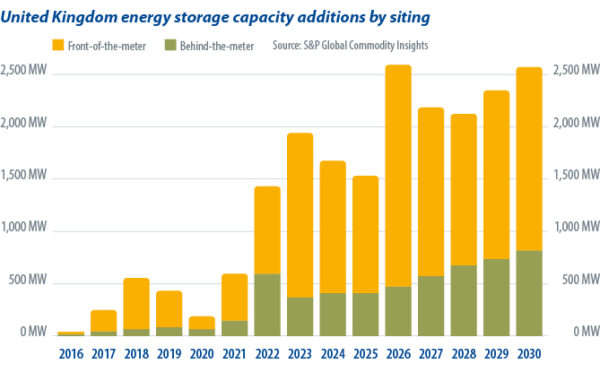

The pipeline for utility-side, “front-of-the-meter” (FTM) battery storage additions has swelled in the United Kingdom, (see chart below) despite annualized revenues for BESS assets tumbling from the highs of 2022. Back then, the battery storage fleet achieved annualized revenue of GBP 156,000 ($197,000)/MW, according to Modo Energy’s GB BESS Index. The United Kingdom-based battery analytics platform’s 2023 market review also revealed annualized battery energy storage revenues fell 65% in 2023, to a total of GBP 53,000/MW. A significant development, but not a surprising one.

Frequency response

Until recently, frequency response services were the main revenue source for Great Britain’s FTM battery fleet. Keeping the electricity grid within 1% of 50 Hz was lucrative for FTM battery assets during the storage market’s infancy. When National Grid ESO launched its dynamic containment (DC) frequency response service, on Sept. 30, 2020, six tenders were received and two battery storage units were accepted in the first round, to provide 90 MW of fast response services over 24 hours. That heralded the start of a DC revenue boom for batteries in Great Britain. When BESS assets were enjoying record revenues in 2022, 63% derived from DC services while 25% of revenue came from the ESO’s monthly firm frequency response (FFR) payments, according to Modo Energy data. Today, things have changed. In January 2024, balancing mechanism (BM) revenues eclipsed frequency response services for the first time on the Modo Energy GB BESS index.

It was almost inevitable – the grid only needs so much frequency response and battery storage capacity additions have led to heightened competition. In today’s market, developers need to approach battery energy storage from a more rational place than before, according to S&P Global’s Hilton.

“You’re not going to have the [return on investment] that you had previously, so it’s attracting, I guess, a different type of investor and a different type of developer, that are more in it for the long term,” said the energy storage analyst.

Juggling act

Long-term investors will undoubtedly hope to raise revenue from the BM, as well as through energy arbitrage – buying and selling back electricity to the grid at optimal tariffs. There is a lot of revenue up for grabs – balancing Great Britain’s electricity grid doesn’t come cheap. National Grid ESO’s most recent Balancing Services Use of System forecast, published in February 2024, predicted the system operator will spend more than GBP 2 billion on balancing the grid in 2024.

Securing revenue from the BM is not as straightforward as simply approaching the ESO with the lowest bid, however. If it was, there is a strong argument that battery storage would already enjoy a greater share of BM revenue. Legacy technology issues are at play. Until recently, staff at National Grid ESO only had access to 15-minute discharge data from Great Britain’s fleet of BM-registered batteries. That put battery storage out of the running for BM trades with a longer dispatch duration. Things are improving. As pv magazine went to press, National Grid ESO was set to extend its 15-minute rule for battery storage, to 30 minutes, from March 1, 2024. The change means battery operators will inform the ESO of the maximum power they can supply for a 30-minute window – opening a new set of revenue opportunities. That is just one way the ESO is tackling the phenomenon referred to as “skipping,” when a battery asset is not selected by the ESO despite being the more cost-efficient option. There are some legitimate reasons why the ESO might not opt for the most cost-efficient generator in the BM, such as geographical demands, but aging rules and procedures have left battery storage at a disadvantage.

Further energy system upgrades are coming. National Grid ESO is in the process of rolling out a new Open Balancing Platform, a program of upgrades which it promises will “revolutionize” the BM. Things kicked off in December 2023, when the ESO added a new tool which enables control-room engineers to send hundreds of instructions to smaller BM-registered units and battery storage units, at the press of a single button. That is a change that will enable battery storage to play a more active role in balancing the network, according to National Grid ESO. By 2027, it is expected the full Open Balancing Platform will have grown to replace both the existing BM and the ESO’s Ancillary Services Dispatch Platform – the system used to procure operational-reserve and contingency resources.

Improved access to BM opportunities could put battery storage on a better footing, in revenue terms. Wendel Hortop, market lead at Modo Energy, highlighted further changes slated for 2024 that should provide even more opportunities for FTM storage.

“On the services side, we’ve got two new markets coming out this year,” said Hortop. “There’s the balancing reserve market, which is due to be launched in March, and the quick reserve towards the end of the year. Essentially, what that would do is just deepen the pool of markets that storage can participate in. I don’t think it’s going to make a drastic difference because of the hyper competitiveness [in the market].”

Future technology

Nick Smailes, head of commercialization at United Kingdom storage research body The Faraday Institution, knows a thing or two about competition. Tasked with working alongside academics and project managers to identify commercial opportunities for battery technology, Smailes said the institute’s analysis suggests 50% of the balancing market might be available to batteries.

“It’s quite bewildering, the number of opportunities and business cases that are out there,” said Smailes, adding that electric vehicle (EV) batteries and fast-charging installations could also play an increasing role in balancing Britain’s grid.

The United Kingdom’s demand for EV battery manufacturing capacity is projected to reach more than 100 GWh per annum in 2030, according to The Faraday Institution. Exactly what the future revenue stack will look like for EV batteries and charging infrastructure remains to be seen, with vehicle-to-grid and vehicle-to-home technology presenting different possibilities.

On the one hand, by the end of the decade there will be significant grid balancing capacity in the garages and service stations of Great Britain. On the other, there are open questions about how participating in energy markets may affect battery degradation.

“There’s a lot more research to do in terms of how vehicle-to-grid protocols could affect battery degradation, because this may utilize and stress batteries in a very different way which also needs new economic considerations, such as stacked revenue models,” said Smailes. “There are research questions for us there.”

Further shake-ups could come if and when sodium ion battery storage becomes commercially viable and that is a research area which the Faraday Institution is heavily involved in. The entity’s Nexgenna project, based at the University of St Andrews, in Scotland, is backed by GBP 15.9 million of funding. The project is tasked with developing the next generation of sodium ion batteries, a field in which Smailes said the United Kingdom could be “very capable.”

“The Faraday Institution has a big sodium program and with companies such as Faradion, who have a significant amount of the world’s [intellectual property] on sodium, so the next generation of batteries could be very interesting and they’re not very far away,” added Smailes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.