Researchers from Chalmers University of Technology and PV advisory firm Becquerel Sweden AB have investigated the impact of direct subsidies on the deployment of solar in Sweden. They have urged policymakers to adapt future programs to different investor characteristics.

The group analyzed all the incentives for rooftop PV between 2009 to 2021, based on an analysis of 79,336 applications for PV capital support that the government awarded.

“For the study, the dependent variable was the willingness to invest in solar,” explained the scientists. “The seven independent variables (IVs), one research variable, and six control variables included in the study were the subsidy level, the PV module price, the serial number of the month, the electricity day-ahead spot price, the interest rate, the state of the economy, and energy tax on self-consumed electricity.”

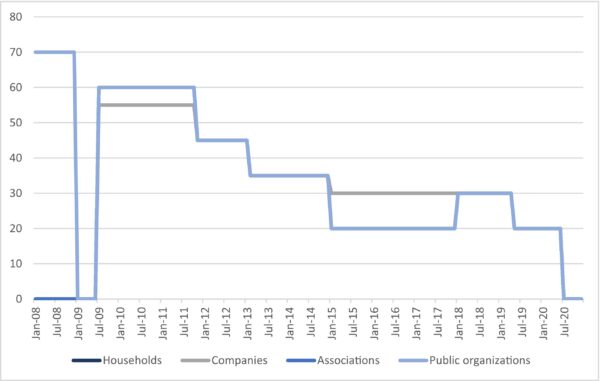

The group said that the maximum capital subsidy in 2009 was set at up to 55% for large companies and 60% for all other groups, In 2021, it reached up to 10% for companies and up to 20% for all other entities. At its peak in 2019, the annual budget for PV subsidies stood at about SEK 1.2 billion ($110 million).

The academics separated the data into four investor groups: households, companies, associations, and public organizations. They analyzed them with quasi-Poisson regression, which is used when modeling an overdispersed count variable, and four different robustness tests to assess whether the results remained consistent across different approaches.

“Our results reveal that there were important disparities among the four different groups, which suggests that different factors of market dynamics may impact renewable electricity technology (RET) investor groups differently,” the researchers said. “In particular, only households had a significantly positive relationship between the subsidy level and the willingness to invest. A similar effect was observed for private companies, although, the robustness of this relationship may be questioned due to potential instability.”

Explaining the lack of influence on public organizations and associations, the scientists proposed that they are more sensitive to policy risk. Among policy risks, they said, are the limited budget of the Swedish subsidy program, the long waiting time for subsidies, and the frequent changes in the level of the subsidies.

“The results emphasize the need for research to better inform policymakers about investor groups' potential preferences,” concluded the academics. “We suggest that in order to capture the nuances among different investor groups, this should not only focus on extreme or oppositive groups, e.g., companies versus households, or revenue-driven versus saving-driven actors, but also for other subgroups, such as households, companies, associations and public organizations.”

The scientists presented their findings in the study “The impact of solar PV subsidies on investment over time – the case of Sweden,” published in Energy Economics.

Image: Chalmers University of Technology, Energy Economics, CC BY 4.0 DEED

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.