In an Advanced Energy Materials perspective paper, researchers from Dresden University of Technology and InfinityPV, a Danish provider of thin film manufacturing equipment, discussed trends in scientific research and commercial development of organic PV (OPV) and perovskite solar cell (PSC) technologies.

The paper “Lost in Transition? Perspective on Research versus Commercialization of Organic and Perovskite Solar Cells,” discusses the high level of academic activity based on a bibliometric study of more than 28,000 scientific outputs and the more limited corresponding commercial activity. It has suggestions about how to bridge “the research-to-market gap” based on the findings.

The perspective paper noted that researchers are pushing power conversion efficiencies to 20% and 27%, for organic solar cells (OSC) and perovskite solar cells, in the analysis of research results and trends by country, collaboration activity, authorship trends, citation impact, patenting activity, industrial footprint, and government support.

The analysis of a dataset of over 100 companies going back 25 years highlighted the need for greater transparency on financial performance, PV stability and other performance metrics. “The key findings suggest that while lab-scale performance is advancing, a lack of market trust inhibits industrial advancement,” said the researchers.

The industry is small and it is hard to find financial transparency, according to the researchers. “The most surprising fact is that very few, just about 13%, of the many companies we identified publish real financial data, which means that it is impossible to see what the actual market development is,” corresponding author and CEO of InfinityPV, Frederik C. Krebs told pv magazine.

The researchers noted that German OSC panel manufacturer Heliatek and Chinese perovskite solar cell manufacturers Renshine Solar and GCL Optoelectronics have all acquired IEC 61215 and IEC 61730 certifications as a sign of the technology maturing, but they also said that it will take many more companies to do so to indicate market maturity.

The researchers said that the number of OSC companies is stable, while the number of perovskite solar companies is still growing. OSC companies “thrive in Europe” but are few in number in Asia, adding that China dominates PSC in terms of research output and company formation.

It was suggested that the technical readiness level (TRL) does not automatically translate into industrial scaling. The TRL metric was contrasted with the National Renewable Energy Laboratory (NREL) metric, technology performance level (TPL), which is seen as “more suitable” for renewable energy technologies.

The researchers further noted that the new technical bankability level (TBL) metric from Det Norske Veritas (DNV), which was launched in February, could provide more relevant risk criteria. But it is still early days for TBL adoption, as Krebs noted that he has not seen it being used yet amongst emerging PV developers.

Another recommendation was to promote more open and shared pilot lines. “Recently, many new initiatives to establish truly collaborative labs that offer shared R&D infrastructure have been announced. I hope to see a maturation that properly blends academia and industry with less red tape,” said Krebs.

Further suggestions included greater standardization and certification efforts, plus better cross-sector collaboration between industry, startups, and research teams.

The researchers said it helps to see emerging PV within the “broader energy transition landscape,” noting that perovskite technologies “hold strong potential for large-scale commercialization,” particularly the perovskite-silicon tandem combination due to higher efficiencies already demonstrated at the module level, along with increasing involvement of established silicon PV manufacturers.

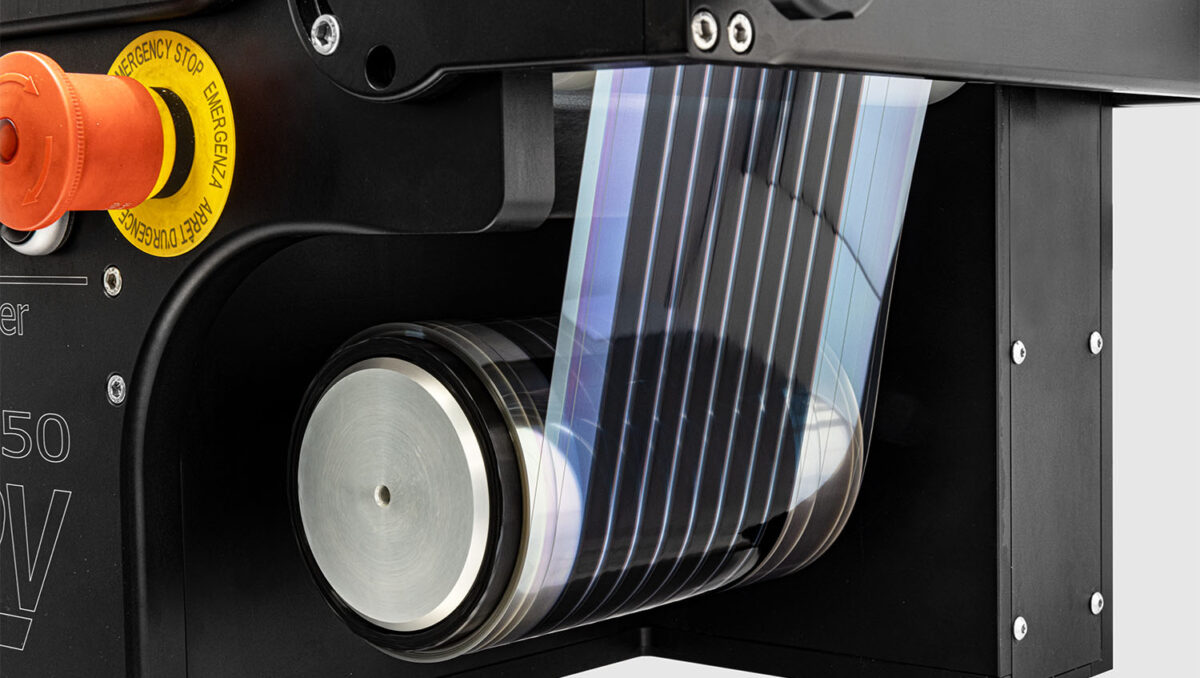

As for OSC, whose benefits include source material abundance and a non-toxic stack, it is applicable in building-integrated photovoltaics (BIPV), agrivoltaics, Internet of Things (IoT) devices, and indoor photovoltaics. “Although these are often classified as niche applications, they are not negligible in importance,” said the researchers.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.